- Germany

- /

- Healthcare Services

- /

- XTRA:M12

M1 Kliniken AG's (ETR:M12) P/E Is Still On The Mark Following 32% Share Price Bounce

M1 Kliniken AG (ETR:M12) shares have continued their recent momentum with a 32% gain in the last month alone. Looking further back, the 21% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

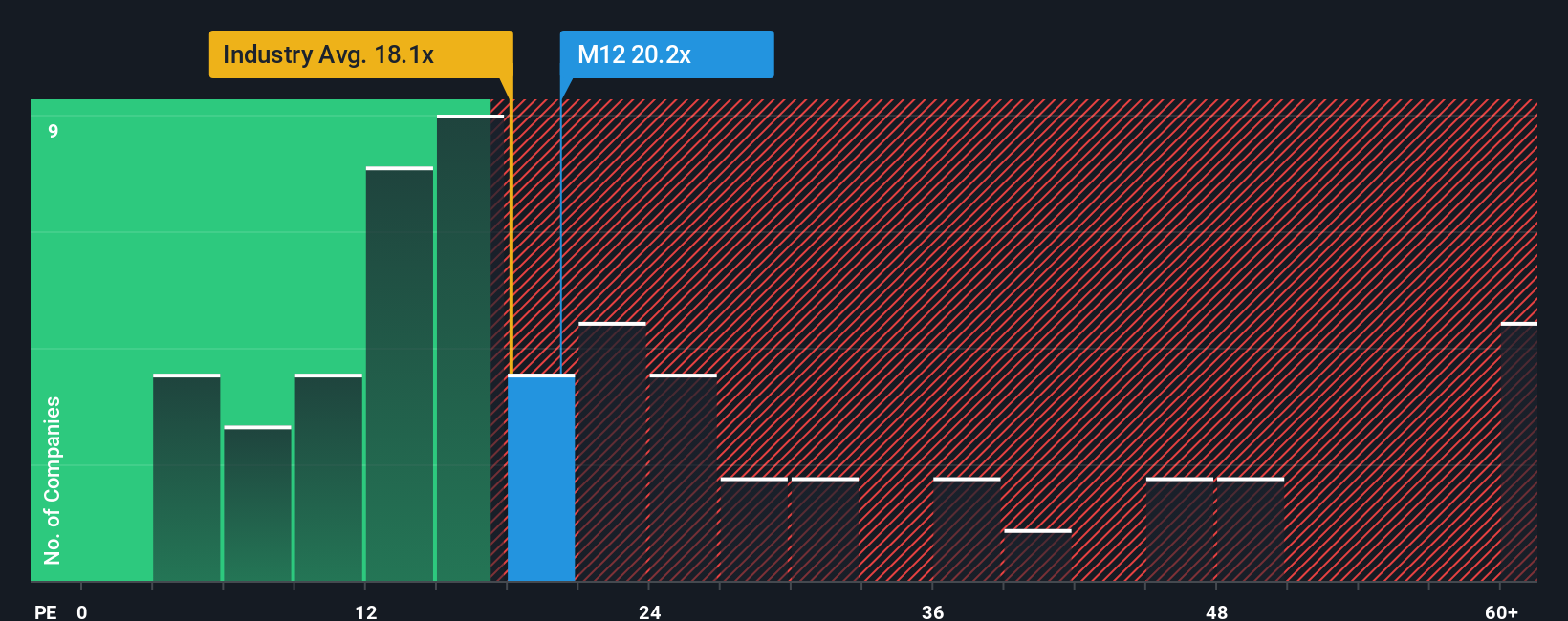

Since its price has surged higher, given around half the companies in Germany have price-to-earnings ratios (or "P/E's") below 18x, you may consider M1 Kliniken as a stock to potentially avoid with its 20.2x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

M1 Kliniken's earnings growth of late has been pretty similar to most other companies. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for M1 Kliniken

Does Growth Match The High P/E?

M1 Kliniken's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.5% last year. Pleasingly, EPS has also lifted 174% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 20% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 17% per annum, which is noticeably less attractive.

In light of this, it's understandable that M1 Kliniken's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From M1 Kliniken's P/E?

The large bounce in M1 Kliniken's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that M1 Kliniken maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with M1 Kliniken.

If these risks are making you reconsider your opinion on M1 Kliniken, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M12

M1 Kliniken

Provides aesthetic medicine and plastic surgery services in Germany, Austria, the Netherlands, Switzerland, the United Kingdom, Croatia, Hungary, Bulgaria, Romania, and Australia.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026