- Germany

- /

- Medical Equipment

- /

- XTRA:AFX

How Should Investors Feel About Carl Zeiss Meditec's (ETR:AFX) CEO Remuneration?

This article will reflect on the compensation paid to Ludwin Monz who has served as CEO of Carl Zeiss Meditec AG (ETR:AFX) since 2010. This analysis will also assess whether Carl Zeiss Meditec pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Carl Zeiss Meditec

How Does Total Compensation For Ludwin Monz Compare With Other Companies In The Industry?

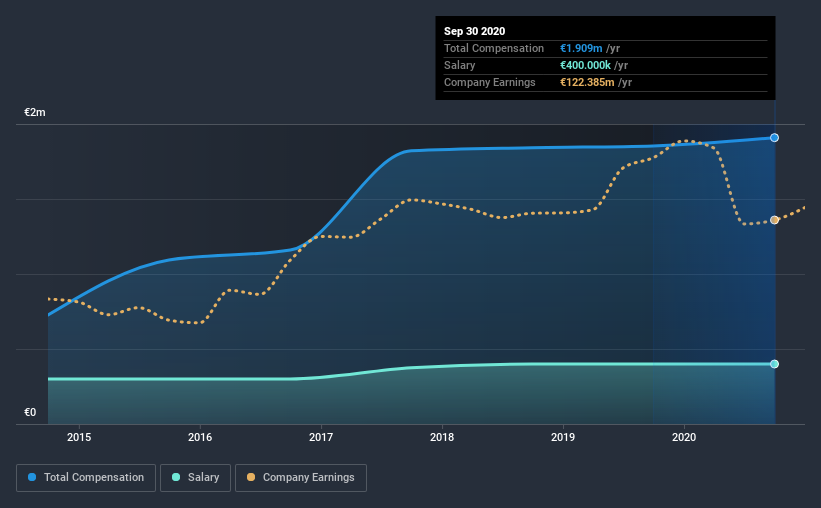

Our data indicates that Carl Zeiss Meditec AG has a market capitalization of €12b, and total annual CEO compensation was reported as €1.9m for the year to September 2020. That's mostly flat as compared to the prior year's compensation. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €400k.

For comparison, other companies in the industry with market capitalizations above €6.6b, reported a median total CEO compensation of €2.5m. This suggests that Carl Zeiss Meditec remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €400k | €400k | 21% |

| Other | €1.5m | €1.5m | 79% |

| Total Compensation | €1.9m | €1.9m | 100% |

On an industry level, around 28% of total compensation represents salary and 72% is other remuneration. Carl Zeiss Meditec sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Carl Zeiss Meditec AG's Growth

Carl Zeiss Meditec AG has reduced its earnings per share by 1.2% a year over the last three years. It saw its revenue drop 11% over the last year.

The lack of EPS growth is certainly unimpressive. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Carl Zeiss Meditec AG Been A Good Investment?

Most shareholders would probably be pleased with Carl Zeiss Meditec AG for providing a total return of 177% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Carl Zeiss Meditec AG is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Some investors may take issue with this, especially considering shrinking EPS for the past three years. On the flip side, shareholder returns have been strong over the same time, which is certainly a positive sign. We're not saying CEO compensation is too generous, but shareholders will probably want to see an increase in EPS before agreeing the business should pay any more.

Whatever your view on compensation, you might want to check if insiders are buying or selling Carl Zeiss Meditec shares (free trial).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Carl Zeiss Meditec or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:AFX

Carl Zeiss Meditec

Operates as a medical technology company in Germany, rest of Europe, North America, and Asia.

Excellent balance sheet established dividend payer.