As global markets navigate the complexities of policy shifts under the new Trump administration, investors are witnessing significant volatility across sectors, particularly influenced by regulatory expectations and geopolitical developments. With U.S. stocks experiencing fluctuations due to these uncertainties, dividend stocks offer a potential avenue for stability and income in an unpredictable economic landscape. In such times, a good dividend stock is typically characterized by consistent earnings, strong cash flow, and a history of reliable payouts—qualities that can provide investors with both resilience and returns amidst market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Telecom (SEHK:728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited, along with its subsidiaries, offers wireline and mobile telecommunications services mainly in the People’s Republic of China and has a market cap of HK$623.35 billion.

Operations: China Telecom Corporation Limited generates revenue through its wireline and mobile telecommunications services, primarily within the People’s Republic of China.

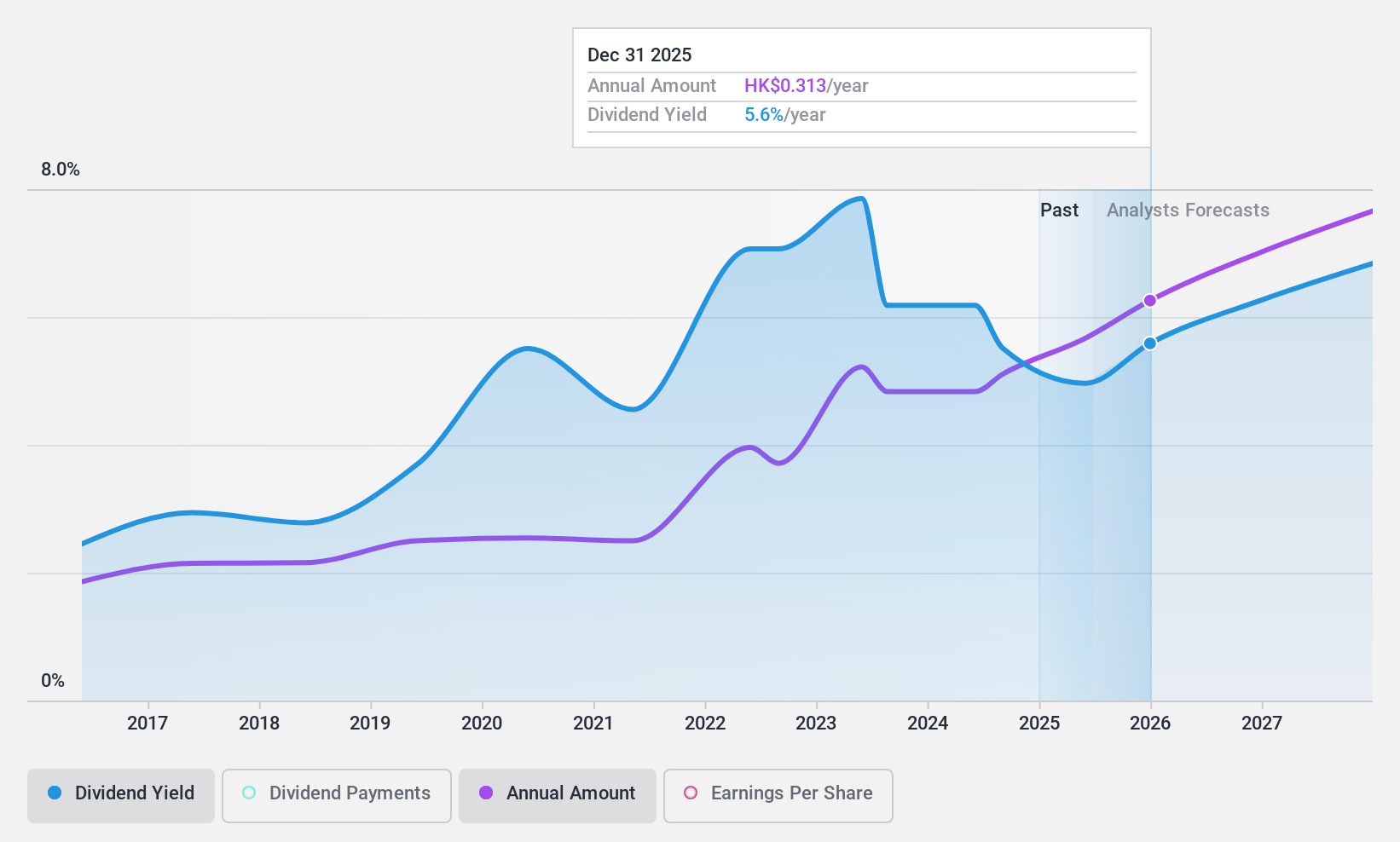

Dividend Yield: 6.2%

China Telecom's recent earnings report shows a steady increase in net income and sales, supporting its dividend payments. The company's payout ratio of 25.5% indicates dividends are well-covered by earnings, while the cash payout ratio of 66.6% suggests reasonable coverage by cash flows. However, its dividend history has been volatile over the past decade, and its current yield is below top-tier levels in Hong Kong. Despite this volatility, dividends have grown over ten years.

- Click to explore a detailed breakdown of our findings in China Telecom's dividend report.

- Upon reviewing our latest valuation report, China Telecom's share price might be too pessimistic.

Sumitomo Mitsui Financial Group (TSE:8316)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Mitsui Financial Group, Inc., along with its subsidiaries, offers a range of services including banking, leasing, securities, and consumer finance across Japan and various international regions such as the Americas and Asia; it has a market cap of ¥14.23 trillion.

Operations: Sumitomo Mitsui Financial Group, Inc. generates revenue through its diverse operations in banking, leasing, securities, and consumer finance services across multiple regions including Japan, the Americas, Europe, the Middle East, Asia, and Oceania.

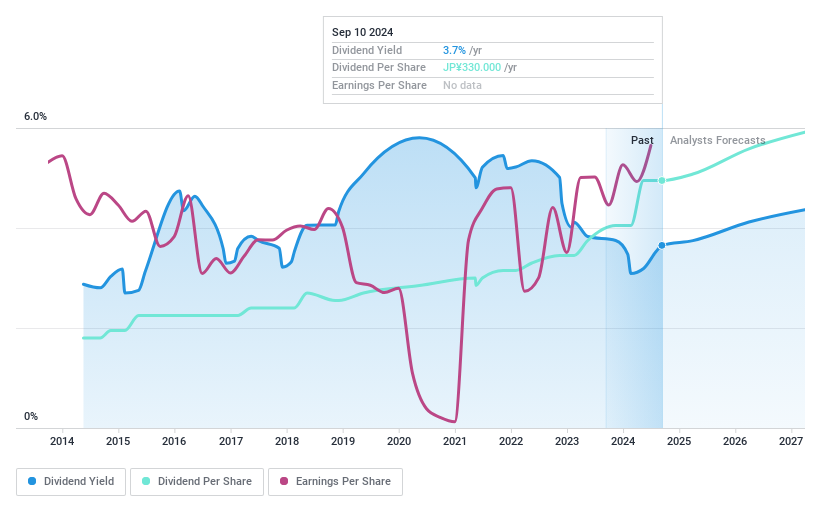

Dividend Yield: 3.3%

Sumitomo Mitsui Financial Group's dividend yield of 3.3% is reliable and stable over the past decade, though below Japan's top quartile payers. The recent share buyback program aims to enhance shareholder returns and capital efficiency. Earnings have grown significantly, with a low payout ratio of 38.7%, indicating dividends are well-covered by earnings. However, there's insufficient data on future coverage by cash flows or sustainability beyond three years.

- Delve into the full analysis dividend report here for a deeper understanding of Sumitomo Mitsui Financial Group.

- Our valuation report unveils the possibility Sumitomo Mitsui Financial Group's shares may be trading at a discount.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG offers car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market cap of €531.28 million.

Operations: WashTec AG's revenue segments include €87.58 million from North America, with a segment adjustment of €390.43 million.

Dividend Yield: 5.5%

WashTec's dividend yield of 5.54% ranks in the top quartile of German payers, yet its sustainability is questionable due to a high payout ratio of 103.4%, indicating dividends are not covered by earnings. Although cash flows cover payments with a reasonable cash payout ratio, the company's financial position is strained by high debt levels. Recent earnings show slight growth, but past dividend volatility and unreliability pose concerns for long-term investors seeking stable income.

- Unlock comprehensive insights into our analysis of WashTec stock in this dividend report.

- According our valuation report, there's an indication that WashTec's share price might be on the cheaper side.

Make It Happen

- Access the full spectrum of 1951 Top Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WashTec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:WSU

WashTec

Provides solutions for car wash in Germany, Europe, North America, and the Asia Pacific.

Solid track record with adequate balance sheet and pays a dividend.