- Germany

- /

- Medical Equipment

- /

- XTRA:AFX

How Investors Are Reacting To Carl Zeiss Meditec (XTRA:AFX) Winning CE Mark For AI OCT Tool

Reviewed by Simply Wall St

- ZEISS Medical Technology announced in August 2025 that it had received CE mark approval for CIRRUS PathFinder, an artificial intelligence-powered clinical support tool designed to enhance OCT interpretation and workflow efficiency for clinicians.

- This development highlights ZEISS's commitment to integrating deep learning algorithms into its medical imaging products, aiming to advance both practice efficiency and quality of patient care.

- We'll explore how the CE mark approval for the AI-driven CIRRUS PathFinder could influence Carl Zeiss Meditec's growth prospects and competitive positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Carl Zeiss Meditec Investment Narrative Recap

To invest in Carl Zeiss Meditec, you need confidence in the company's ability to translate innovation in medical imaging and AI into consistent growth, despite recent pressures on earnings and margins. The CE mark approval for CIRRUS PathFinder underscores a push towards higher-value solutions, but in the near term, its impact on sales and profitability may not be immediately material, while revenue catalysts remain positive, the biggest risk continues to be margin pressure from an unfavorable product mix and regional pricing challenges.

Among recent announcements, the NMPA approval of CLARUS 700 in China is especially relevant, as it builds out ZEISS's presence and portfolio in a challenging but essential growth market. This supports one of the key catalysts for the company, strengthening the product pipeline and international reach, but also highlights how success in China is central to mitigating ongoing risks in profitability and sales momentum.

In contrast, investors should still be aware that persistent margin pressures and pricing headwinds in China...

Read the full narrative on Carl Zeiss Meditec (it's free!)

Carl Zeiss Meditec's outlook anticipates €2.6 billion in revenue and €266.9 million in earnings by 2028. This is based on analysts’ expectations of a 6.3% annual revenue growth rate and an increase in earnings of €116.8 million from the current €150.1 million.

Uncover how Carl Zeiss Meditec's forecasts yield a €53.61 fair value, a 25% upside to its current price.

Exploring Other Perspectives

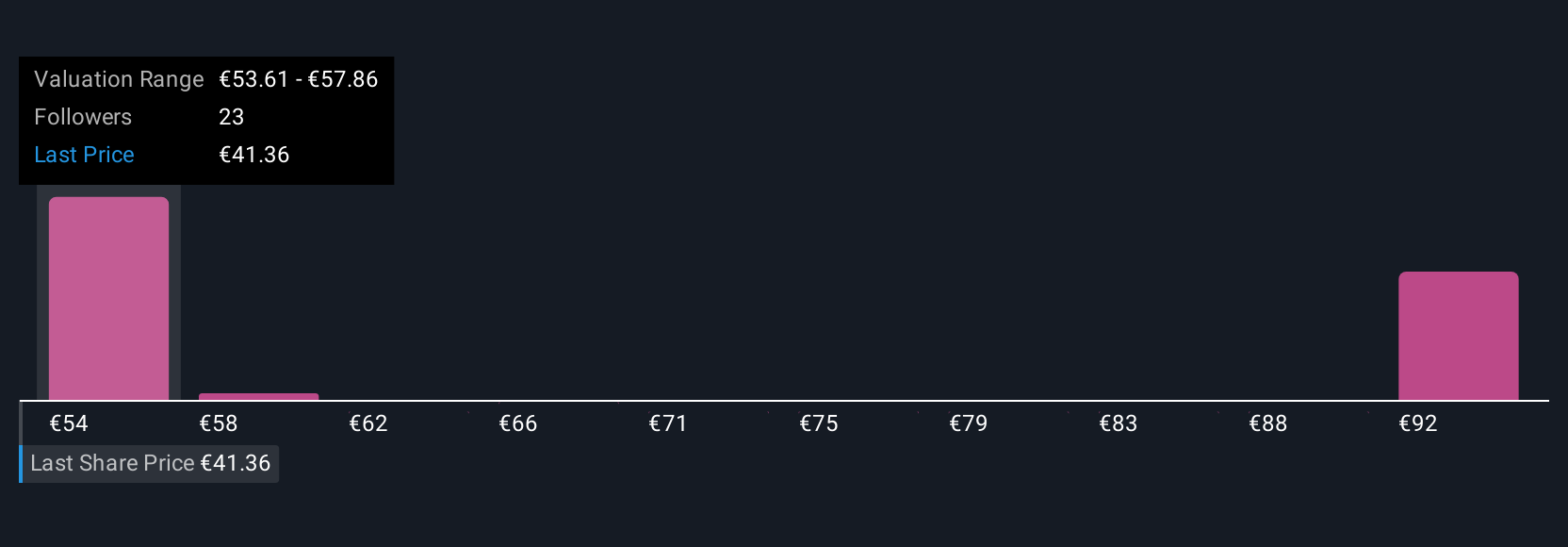

Seven members of the Simply Wall St Community estimate fair value between €53.61 and €94.41, showing a wide spread of individual outlooks. While forecasts for revenue growth are appealing, recent margin declines and regional pressure may continue to weigh on near-term returns, so reviewing multiple viewpoints is essential.

Explore 7 other fair value estimates on Carl Zeiss Meditec - why the stock might be worth just €53.61!

Build Your Own Carl Zeiss Meditec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carl Zeiss Meditec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carl Zeiss Meditec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carl Zeiss Meditec's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AFX

Carl Zeiss Meditec

Operates as a medical technology company in Germany, rest of Europe, North America, and Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives