- Germany

- /

- Medical Equipment

- /

- XTRA:AFX

A Fresh Look at Carl Zeiss Meditec (XTRA:AFX) Valuation Following Major Ophthalmic Technology Reveals

Reviewed by Simply Wall St

Carl Zeiss Meditec (XTRA:AFX) is making headlines with its upcoming showcase at the European Society of Cataract and Refractive Surgeons (ESCRS) conference, where it will highlight major innovations in ophthalmic workflow technology. Announcing the debut of its fully integrated cataract and glaucoma solutions, along with the newly CE-marked CIRRUS PathFinder, an AI-enabled support tool for clinicians, the company is signaling a renewed push to improve efficiency and patient outcomes in eye care. For investors considering their next move with the stock, these developments could represent a turning point in how Carl Zeiss Meditec is perceived in the fast-evolving medical technology space.

Despite this wave of product developments, the stock story over the past year has been tougher. Shares are down almost 29% in the last year, with a 32% decline in the past three months alone, even as annual revenue and net income growth have both turned positive. Momentum has clearly faded, putting Carl Zeiss Meditec at a potential crossroads just as it unveils fresh innovation in front of the industry’s biggest audience. Recent news aside, the market seems cautious about pricing in near-term growth, with performance lagging historical returns.

After such a steep drop and a surge of new product launches, is this Carl Zeiss Meditec’s moment for a turnaround, or is the market simply adjusting to reflect future growth risks already?

Most Popular Narrative: 22.9% Undervalued

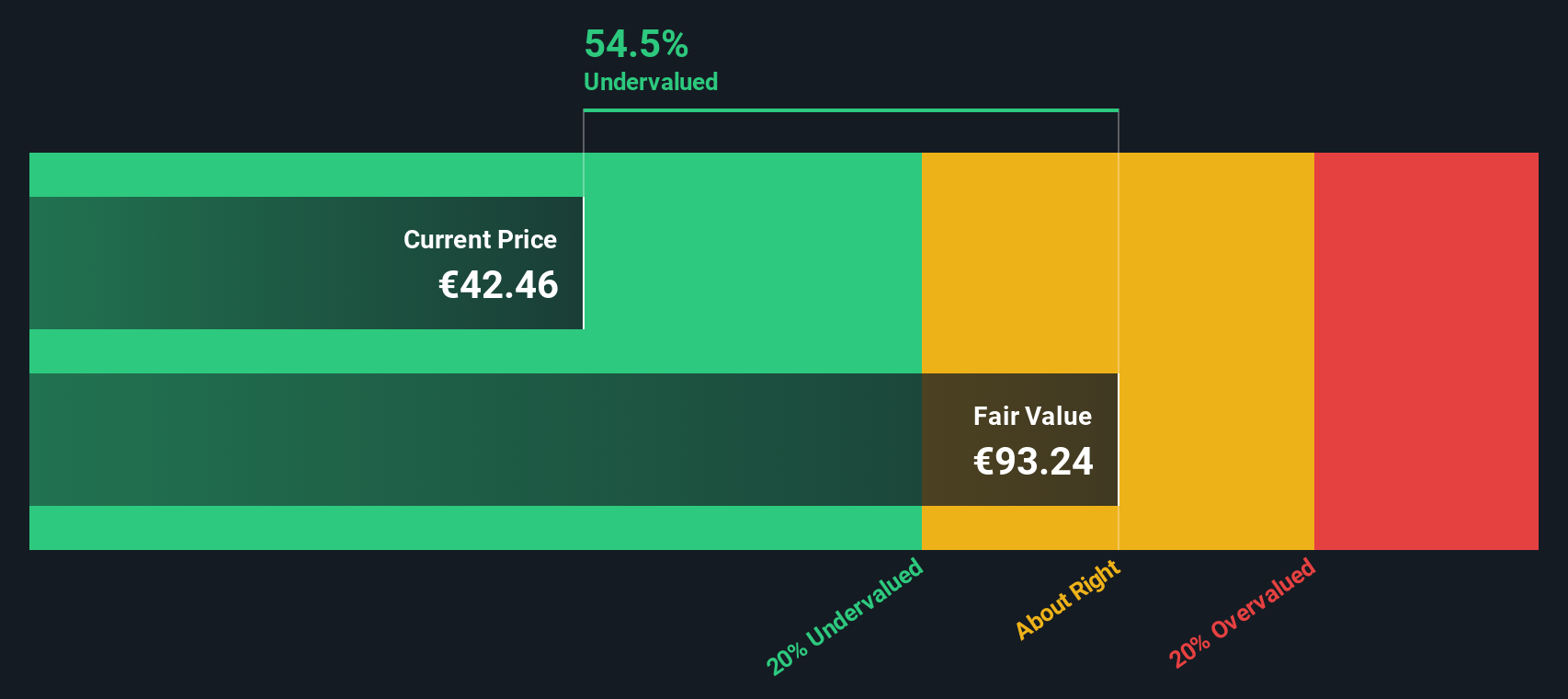

The most popular narrative currently values Carl Zeiss Meditec as notably undervalued, with its fair worth estimated well above the current share price. This signals significant upside potential based on future growth, efficiency improvements, and market expansion.

The recent approval of the VISUMAX 800 in China, earlier than expected, positions Carl Zeiss Meditec AG for potential revenue growth. The launch is expected to boost higher ASP (Average Selling Price) for both devices and treatment packs, enhancing future revenue streams.

Feeling bullish about Carl Zeiss Meditec? This narrative hinges on a bold future where rising earnings and shifting product mix set the tone for a higher valuation. There is a formula at play here: one that combines clinical breakthroughs, robust financial forecasts, and a market multiple that signals real conviction. Want to unravel the details behind this price target? The story is deeper than you might think.

Result: Fair Value of €53.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, weak market conditions in China and recent declines in organic sales growth could easily shift the outlook for Carl Zeiss Meditec’s recovery.

Find out about the key risks to this Carl Zeiss Meditec narrative.Another View: SWS DCF Model

Taking a different approach, our SWS DCF model also points to Carl Zeiss Meditec being undervalued. This supports what the first valuation suggested. But do the cash flow projections truly reflect future realities?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Carl Zeiss Meditec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Carl Zeiss Meditec Narrative

If this perspective does not quite fit your view, or you would rather rely on your own insights, you can quickly craft your own analysis in just a few minutes. Do it your way

A great starting point for your Carl Zeiss Meditec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Put yourself ahead of the herd by uncovering stocks set to benefit from game-changing trends. Do not let market moves leave you behind; unique opportunities await with these smart filters:

- Target stable income streams by checking out dividend opportunities using dividend stocks with yields > 3% to pinpoint stocks offering robust yields above 3%.

- Unearth next-level tech potential by scanning AI penny stocks for companies tapping into artificial intelligence breakthroughs and rapid innovation.

- Find value before the crowd by searching undervalued stocks based on cash flows for stocks trading below their intrinsic cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About XTRA:AFX

Carl Zeiss Meditec

Operates as a medical technology company in Germany, rest of Europe, North America, and Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion