Does Kulmbacher Brauerei Aktien-Gesellschaft (MUN:KUL) Have A Place In Your Dividend Portfolio?

Is Kulmbacher Brauerei Aktien-Gesellschaft (MUN:KUL) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

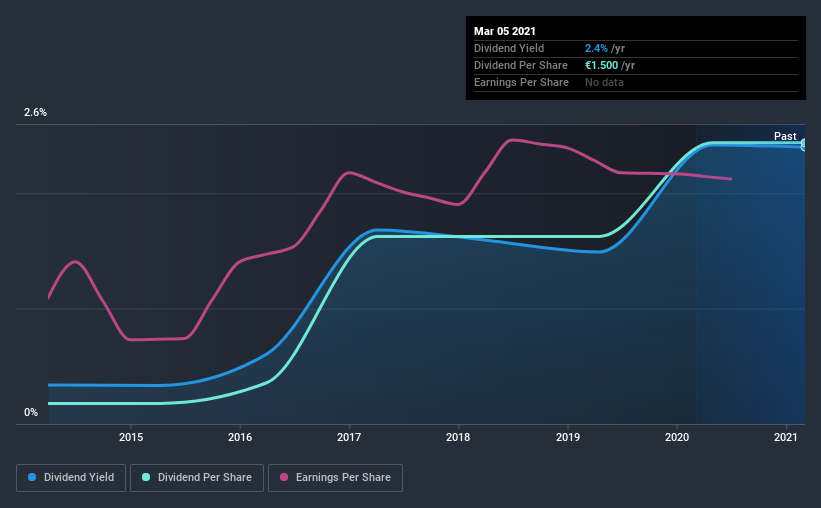

Investors might not know much about Kulmbacher Brauerei Aktien-Gesellschaft's dividend prospects, even though it has been paying dividends for the last seven years and offers a 2.4% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. Some simple analysis can reduce the risk of holding Kulmbacher Brauerei Aktien-Gesellschaft for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Kulmbacher Brauerei Aktien-Gesellschaft!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Kulmbacher Brauerei Aktien-Gesellschaft paid out 61% of its profit as dividends. A payout ratio above 50% generally implies a business is reaching maturity, although it is still possible to reinvest in the business or increase the dividend over time.

While the above analysis focuses on dividends relative to a company's earnings, we do note Kulmbacher Brauerei Aktien-Gesellschaft's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Kulmbacher Brauerei Aktien-Gesellschaft every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Kulmbacher Brauerei Aktien-Gesellschaft has been paying a dividend for the past seven years. Its dividend has not fluctuated much that time, which we like, but we're conscious that the company might not yet have a track record of maintaining dividends in all economic conditions. During the past seven-year period, the first annual payment was €0.1 in 2014, compared to €1.5 last year. Dividends per share have grown at approximately 45% per year over this time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Kulmbacher Brauerei Aktien-Gesellschaft has grown its earnings per share at 23% per annum over the past five years. With recent, rapid earnings per share growth and a payout ratio of 61%, this business looks like an interesting prospect if earnings are reinvested effectively.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think Kulmbacher Brauerei Aktien-Gesellschaft has an acceptable payout ratio. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. In summary, we're unenthused by Kulmbacher Brauerei Aktien-Gesellschaft as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for Kulmbacher Brauerei Aktien-Gesellschaft that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade Kulmbacher Brauerei Aktien-Gesellschaft, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kulmbacher Brauerei Aktien-Gesellschaft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MUN:KUL

Kulmbacher Brauerei Aktien-Gesellschaft

Engages in the brewery business in Germany and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives