Südzucker (XTRA:SZU) Faces Earnings Decline Despite High Dividend Yield and Emerging Market Focus

Reviewed by Simply Wall St

Dive into the specifics of Südzucker here with our thorough analysis report.

Competitive Advantages That Elevate Südzucker

In recent times, Südzucker has demonstrated financial resilience, particularly with its high dividend yield of 8.02%, placing it among the top dividend payers in the German market. The company's dividends are well-supported by earnings and cash flows, with payout ratios at 54.7% and 48.2%, respectively. Over the past five years, it has achieved profitability, with earnings growing by an impressive 75% annually. This financial health is further underscored by the fact that interest payments on debt are comfortably covered by EBIT, at 8.6 times over. Moreover, Südzucker is trading at 54.2% below its estimated fair value of €24.5, with a Price-To-Earnings Ratio of 6.8x, suggesting potential for price appreciation.

Vulnerabilities Impacting Südzucker

The company faces challenges, notably a high net debt to equity ratio of 43.6%, which could pose risks in a volatile market. Additionally, the return on equity stands at a modest 9.5%, and profit margins have contracted from 6.2% to 3.3% over the past year. These financial metrics highlight areas that require strategic attention to maintain competitiveness. Furthermore, the volatility of dividend payments over the past decade raises concerns about the consistency of shareholder returns.

Emerging Markets Or Trends for Südzucker

Opportunities abound for Südzucker, particularly in expanding into emerging markets, which could diversify revenue streams and reduce reliance on mature markets. The company is also investing in digital transformation to enhance operational efficiency, a move that could yield significant cost savings. By staying ahead of regulatory changes, Südzucker can leverage compliance-driven growth opportunities, potentially opening new service avenues and strengthening its competitive edge.

Key Risks and Challenges That Could Impact Südzucker's Success

The company must navigate several threats, including expected revenue and earnings declines of 2.3% and 6.3% annually over the next three years. Economic headwinds and supply chain disruptions also pose risks to operational efficiency and profitability. Additionally, regulatory hurdles could impact business models, necessitating proactive compliance strategies to mitigate potential challenges.

To learn about how Südzucker's valuation metrics are shaping its market position, check out our detailed analysis of Südzucker's Valuation.Conclusion

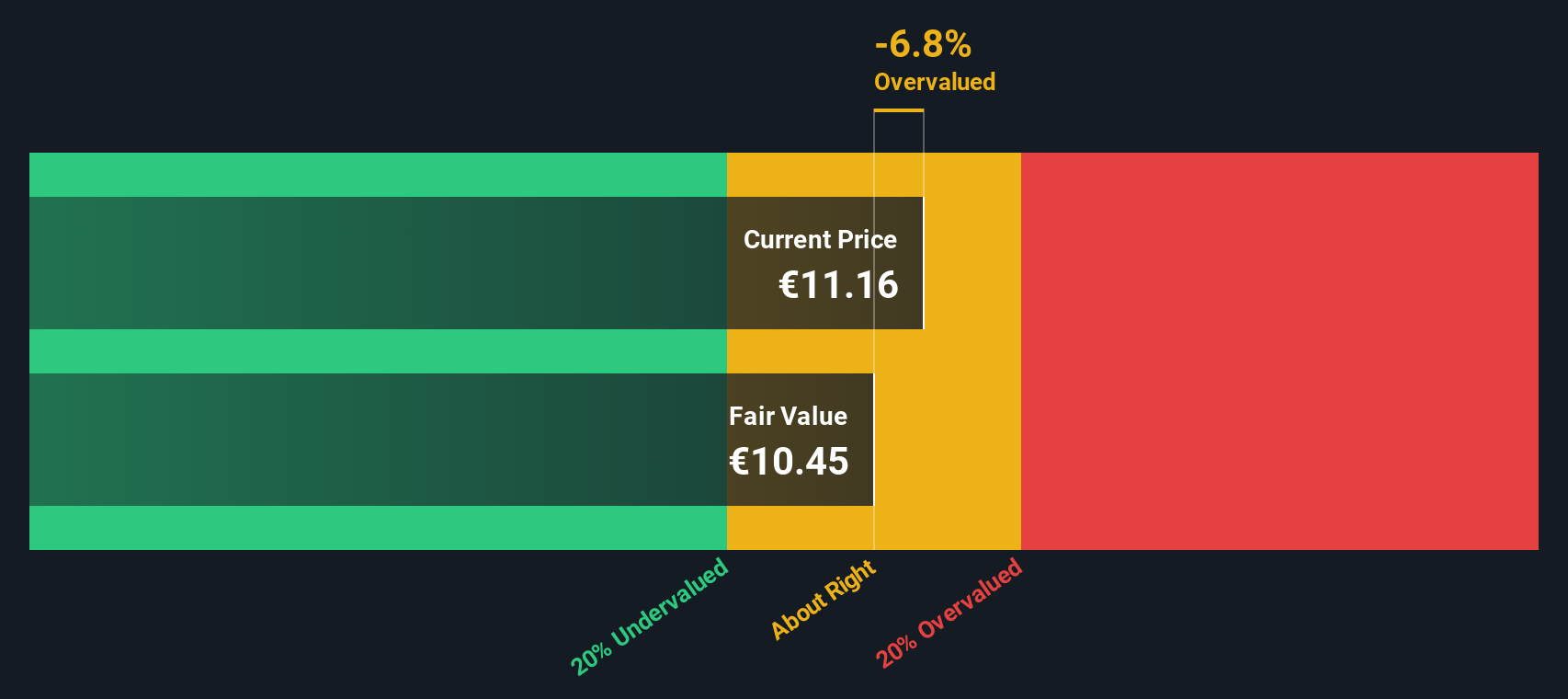

Südzucker's financial resilience, marked by a high dividend yield of 8.02% and strong earnings growth, positions it as a leading dividend payer in Germany, offering a solid foundation for investor confidence. Challenges like a high net debt to equity ratio and declining profit margins require strategic focus. The company's emphasis on emerging markets and digital transformation presents opportunities to diversify revenue streams and enhance efficiency. Trading at 54.2% below its estimated fair value of €24.5 with a Price-To-Earnings Ratio of 6.8x, Südzucker is well-positioned for potential price appreciation, provided it effectively addresses its vulnerabilities and navigates upcoming economic and regulatory challenges. This undervaluation suggests a promising outlook for future performance, contingent on strategic execution and market conditions.

Make It Happen

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About XTRA:SZU

Südzucker

Produces and sells sugar products in Germany, rest of the European Union, the United Kingdom, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives