- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

Top German Growth Stocks With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As of July 2024, the German market has shown resilience amid mixed global economic signals, with the DAX gaining 1.35% over the past week. This backdrop provides an interesting environment to explore growth companies with high insider ownership, as these stocks often signal strong confidence from those closest to the business. In such a market, identifying growth stocks with significant insider ownership can be particularly compelling since it suggests that company executives and key stakeholders have substantial skin in the game and believe in their company's long-term potential.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.3% | 34.7% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| NAGA Group (XTRA:N4G) | 14.1% | 78.3% |

| Exasol (XTRA:EXL) | 25.3% | 105.4% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 21.9% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 47.4% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

| Encavis (XTRA:ECV) | 15.6% | 30.1% |

Here's a peek at a few of the choices from the screener.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.96 billion.

Operations: The company's revenue segments are comprised of €1.62 billion from the DACH region and €369.34 million from international markets.

Insider Ownership: 17.7%

Earnings Growth Forecast: 47.4% p.a.

Redcare Pharmacy is expected to become profitable in the next 3 years, with earnings forecasted to grow 47.38% annually. Despite a highly volatile share price and past shareholder dilution, it trades at 70.7% below our fair value estimate. Recent earnings for H1 2024 showed sales of €1.12 billion, up from €791.94 million a year ago, with a reduced net loss of €12.07 million compared to €14.78 million previously, indicating improving financial health amidst strong insider ownership.

- Navigate through the intricacies of Redcare Pharmacy with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Redcare Pharmacy's current price could be inflated.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE offers solutions for energy transformation and transportation across Germany and Europe, with a market cap of €402 million.

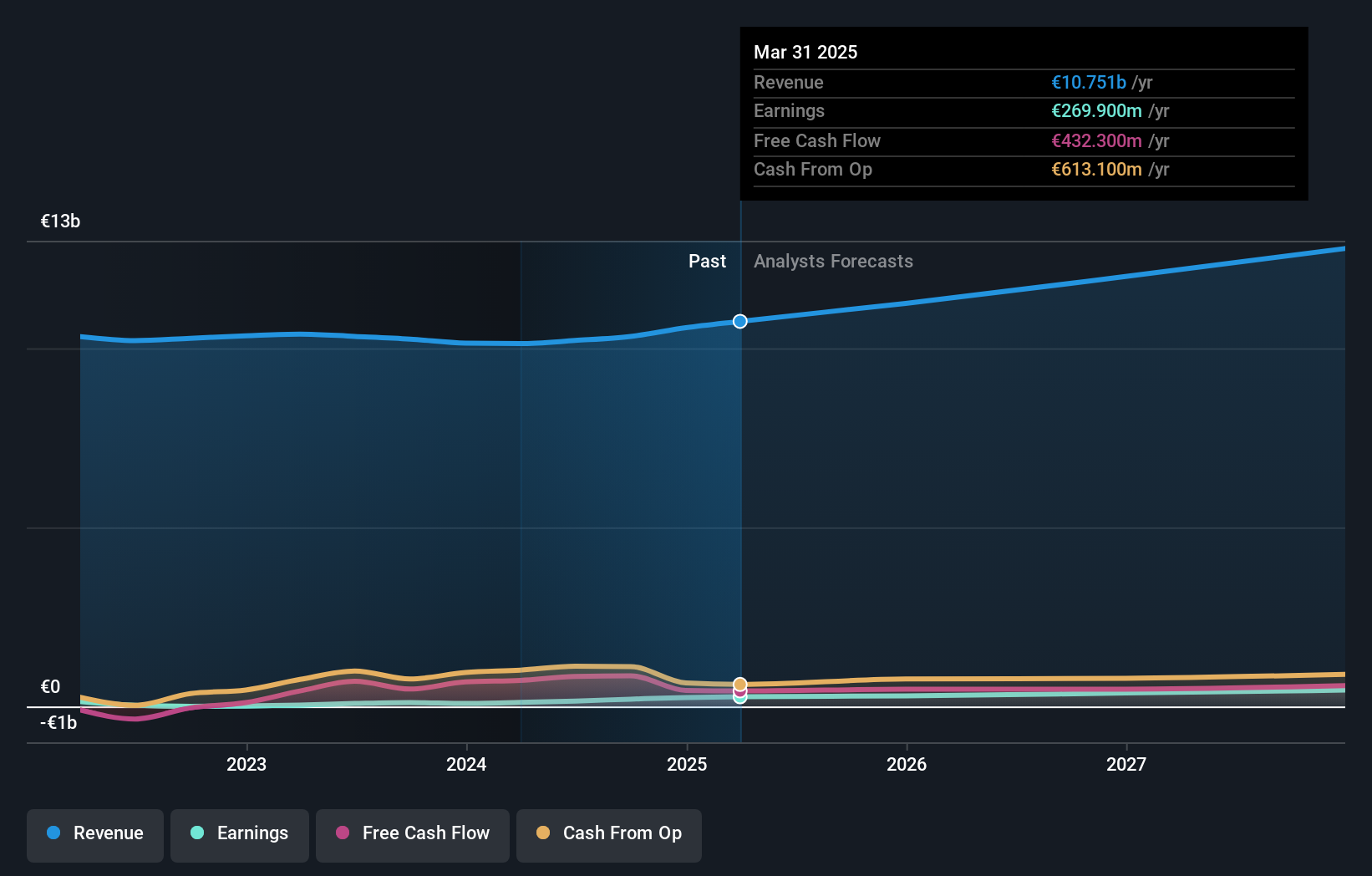

Operations: The company's revenue segments include Electricity (€72.07 million), Natural Gas (€157.60 million), Clean Hydrogen (€28.59 million), and Adjacent Opportunities (€118.73 million).

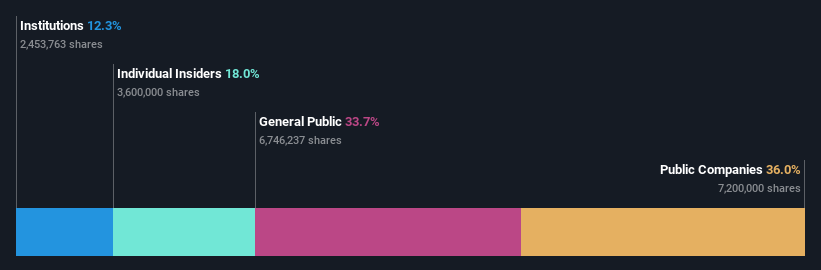

Insider Ownership: 18%

Earnings Growth Forecast: 30.4% p.a.

Friedrich Vorwerk Group SE's earnings are forecast to grow 30.45% annually, outpacing the German market's expected growth of 19.6%. Recent Q1 2024 results showed revenue increasing to €81.2 million from €78.51 million and net income doubling to €1.56 million, reflecting strong financial performance despite slower revenue growth (8.3% per year) compared to industry benchmarks. With significant insider ownership, the company presents a compelling case for growth-focused investors in Germany.

- Click here to discover the nuances of Friedrich Vorwerk Group with our detailed analytical future growth report.

- According our valuation report, there's an indication that Friedrich Vorwerk Group's share price might be on the expensive side.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products, with a market cap of approximately €6.18 billion.

Operations: Zalando SE's revenue segments include Reconciliation at -€274.10 million and Segment Adjustment at €10.40 billion.

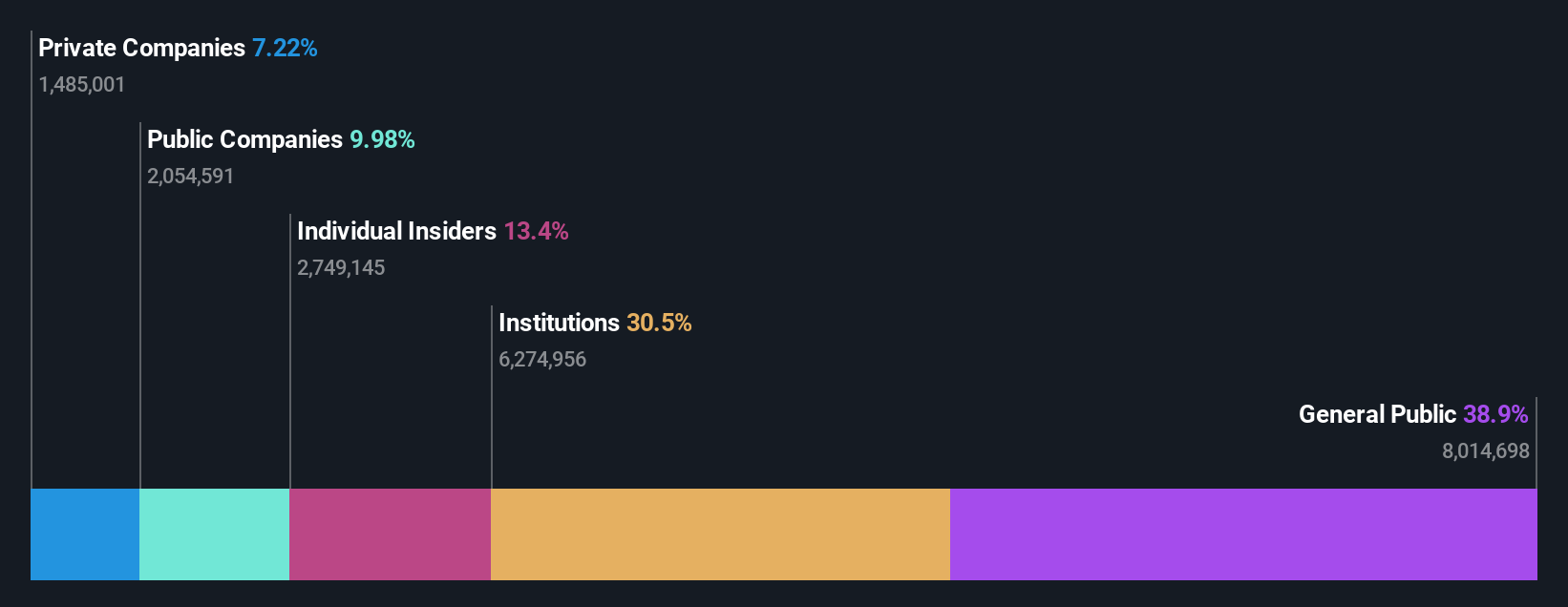

Insider Ownership: 10.4%

Earnings Growth Forecast: 26.4% p.a.

Zalando SE, a growth company with high insider ownership, is forecast to see earnings grow 26.42% annually, outpacing the German market's 19.6% average. Despite revenue growth of only 5.4% per year, Zalando trades at 52.4% below its estimated fair value and expects an operating profit in 2024 with gross merchandise volume and sales growth between 0%-5%. Recent presentations at major conferences highlight the company's proactive engagement with investors and stakeholders.

- Get an in-depth perspective on Zalando's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Zalando's shares may be trading at a premium.

Where To Now?

- Get an in-depth perspective on all 20 Fast Growing German Companies With High Insider Ownership by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Reasonable growth potential with adequate balance sheet.