- Germany

- /

- Capital Markets

- /

- DB:T2G

There's Reason For Concern Over Tradegate AG Wertpapierhandelsbank's (FRA:T2G) Price

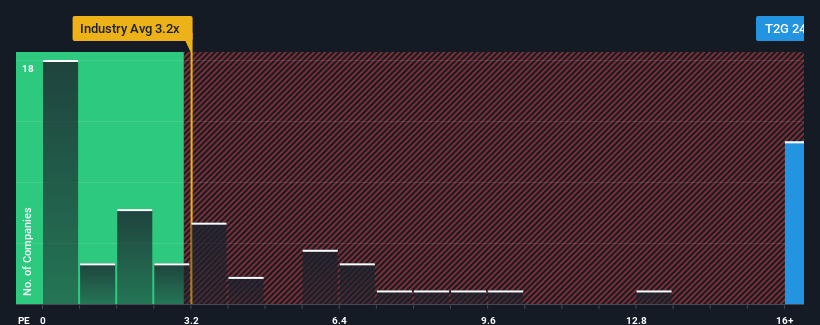

With a price-to-sales (or "P/S") ratio of 24.1x Tradegate AG Wertpapierhandelsbank (FRA:T2G) may be sending very bearish signals at the moment, given that almost half of all the Capital Markets companies in Germany have P/S ratios under 3.2x and even P/S lower than 0.8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Tradegate Wertpapierhandelsbank

How Has Tradegate Wertpapierhandelsbank Performed Recently?

For example, consider that Tradegate Wertpapierhandelsbank's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tradegate Wertpapierhandelsbank's earnings, revenue and cash flow.How Is Tradegate Wertpapierhandelsbank's Revenue Growth Trending?

In order to justify its P/S ratio, Tradegate Wertpapierhandelsbank would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. As a result, revenue from three years ago have also fallen 37% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 3.5% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's odd that Tradegate Wertpapierhandelsbank's P/S sits above the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Tradegate Wertpapierhandelsbank currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. When we see below average revenue, we suspect the share price is at risk of declining, sending the high P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Tradegate Wertpapierhandelsbank is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tradegate Wertpapierhandelsbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:T2G

Tradegate Wertpapierhandelsbank

Provides various banking and financial services in Germany.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives