- Germany

- /

- Capital Markets

- /

- DB:T2G

Some Shareholders Feeling Restless Over Tradegate AG Wertpapierhandelsbank's (FRA:T2G) P/S Ratio

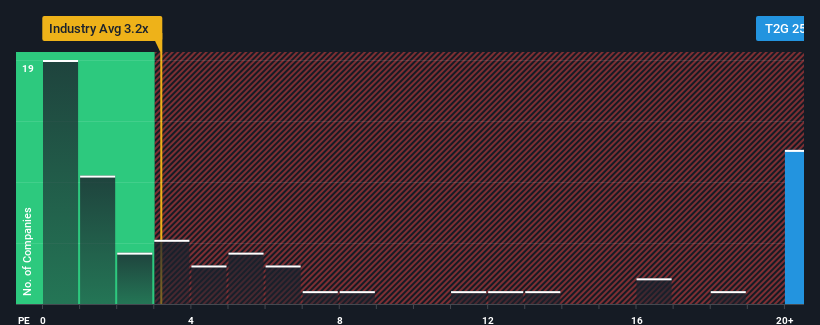

Tradegate AG Wertpapierhandelsbank's (FRA:T2G) price-to-sales (or "P/S") ratio of 25.6x might make it look like a strong sell right now compared to the Capital Markets industry in Germany, where around half of the companies have P/S ratios below 3.2x and even P/S below 1.1x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tradegate Wertpapierhandelsbank

What Does Tradegate Wertpapierhandelsbank's Recent Performance Look Like?

For example, consider that Tradegate Wertpapierhandelsbank's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tradegate Wertpapierhandelsbank's earnings, revenue and cash flow.How Is Tradegate Wertpapierhandelsbank's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Tradegate Wertpapierhandelsbank's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 60% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 2.5% shows the industry is more attractive on an annualised basis regardless.

In light of this, it's odd that Tradegate Wertpapierhandelsbank's P/S sits above the majority of other companies. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Tradegate Wertpapierhandelsbank currently trades on a much higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Tradegate Wertpapierhandelsbank with six simple checks on some of these key factors.

If you're unsure about the strength of Tradegate Wertpapierhandelsbank's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tradegate Wertpapierhandelsbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:T2G

Tradegate Wertpapierhandelsbank

Provides various banking and financial services in Germany.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives