- Germany

- /

- Capital Markets

- /

- DB:T2G

Some Confidence Is Lacking In Tradegate AG Wertpapierhandelsbank's (FRA:T2G) P/S

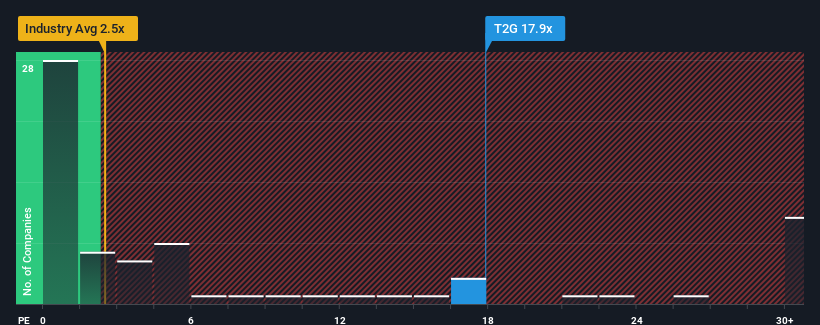

When you see that almost half of the companies in the Capital Markets industry in Germany have price-to-sales ratios (or "P/S") below 2.5x, Tradegate AG Wertpapierhandelsbank (FRA:T2G) looks to be giving off strong sell signals with its 17.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Tradegate Wertpapierhandelsbank

How Tradegate Wertpapierhandelsbank Has Been Performing

Revenue has risen at a steady rate over the last year for Tradegate Wertpapierhandelsbank, which is generally not a bad outcome. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tradegate Wertpapierhandelsbank will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Tradegate Wertpapierhandelsbank would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 55% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 4.0% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's strange that Tradegate Wertpapierhandelsbank is trading at a higher P/S in comparison. In general, when revenue shrink rapidly the P/S premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Tradegate Wertpapierhandelsbank revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for Tradegate Wertpapierhandelsbank that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tradegate Wertpapierhandelsbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:T2G

Tradegate Wertpapierhandelsbank

Provides various financial services in Germany.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives