- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

European Dividend Stocks And 2 More Top Picks

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the STOXX Europe 600 Index climbing 2.77% amid easing trade tensions, investors are increasingly looking towards dividend stocks as a stable source of income in uncertain economic times. In this environment, selecting dividend stocks that offer consistent payouts and potential for growth can be an effective strategy to navigate market fluctuations while benefiting from regular income streams.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.88% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.61% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.22% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.93% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.27% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.11% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.34% | ★★★★★★ |

Click here to see the full list of 234 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Glanbia (ISE:GL9)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Glanbia plc is a global nutrition company operating through its subsidiaries, with a market capitalization of approximately €2.90 billion.

Operations: Glanbia plc generates revenue through its Glanbia Nutritionals segment, contributing $2.10 billion, and its Glanbia Performance Nutrition segment, which adds $1.81 billion.

Dividend Yield: 3.2%

Glanbia's dividend payments, while covered by earnings (63.5% payout ratio) and cash flows (29.9% cash payout ratio), have been historically volatile and unreliable, with a yield of 3.24%, below the Irish market's top tier. Recent strategic moves include plans to divest its Slim-Fast brand to focus on growth opportunities, despite declining sales from $5.43 billion to $3.84 billion and reduced net income from $344.4 million to $164.7 million year-over-year, reflecting financial challenges impacting dividend stability prospects.

- Unlock comprehensive insights into our analysis of Glanbia stock in this dividend report.

- Our expertly prepared valuation report Glanbia implies its share price may be too high.

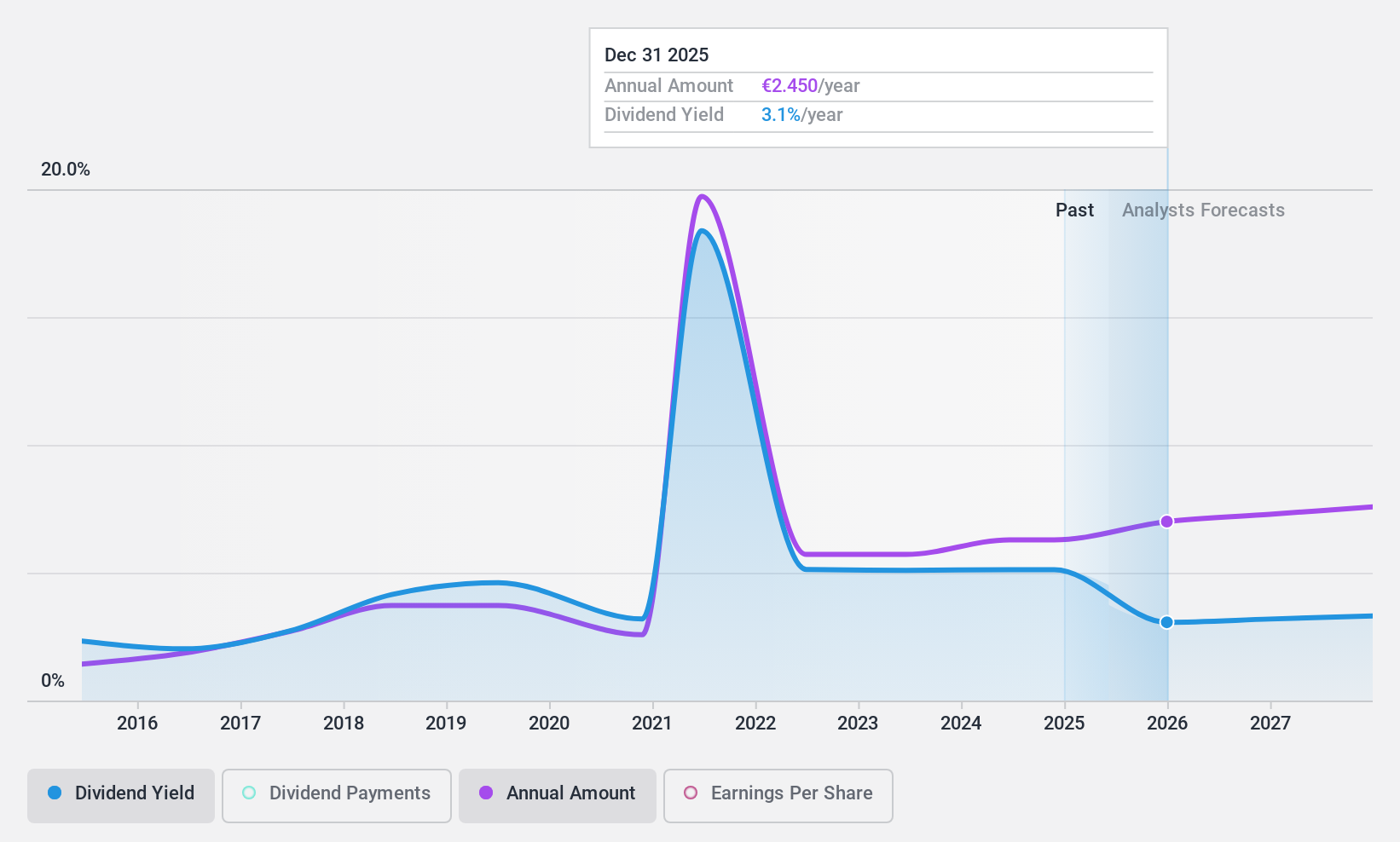

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE is a global construction company with a market capitalization of approximately €9.14 billion.

Operations: Strabag SE generates revenue through its segments: North + West (€7.35 billion), South + East (€7.28 billion), and International + Special Divisions (€3.06 billion).

Dividend Yield: 3.2%

Strabag's dividend payments, although covered by earnings (34% payout ratio) and cash flows (39.8% cash payout ratio), have been unstable over the past decade. The recent annual dividend of €2.50 per share reflects an increase, yet the yield remains below Austria's top tier at 3.23%. Despite a volatile share price and declining revenue forecasts, Strabag reported improved net income of €823 million for 2024, indicating potential financial resilience amidst market fluctuations.

- Take a closer look at Strabag's potential here in our dividend report.

- According our valuation report, there's an indication that Strabag's share price might be on the cheaper side.

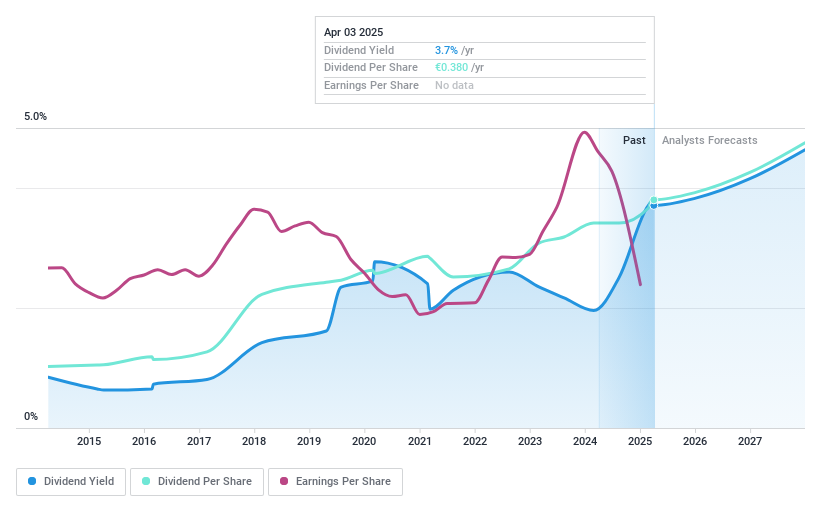

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market cap of €171.31 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue through its Management Services segment (€34.81 million), Transaction Services segment (€6.19 million), and Miscellaneous activities (€2.03 million).

Dividend Yield: 5.6%

MPC Münchmeyer Petersen Capital's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 56.6% and 64.6%, respectively. Despite only three years of dividend history, the yield is competitive at 5.56%, ranking in Germany's top quartile. While dividends have been stable, large one-off items affect earnings quality. Recent results show net income growth to €16.81 million for 2024, supporting its dividend sustainability amidst favorable analyst price targets and good relative value trading conditions.

- Click to explore a detailed breakdown of our findings in MPC Münchmeyer Petersen Capital's dividend report.

- Our comprehensive valuation report raises the possibility that MPC Münchmeyer Petersen Capital is priced lower than what may be justified by its financials.

Seize The Opportunity

- Delve into our full catalog of 234 Top European Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MPCK

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives