As the German economy faces a forecasted contraction for the second consecutive year, small-cap companies in Germany are navigating a challenging landscape marked by declining factory orders and cautious consumer sentiment. Despite these headwinds, opportunities exist for discerning investors who can identify stocks with strong fundamentals and growth potential that may not yet be reflected in their current valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across various regions, including Germany, the rest of Europe, the Middle East, Africa, Asia and Pacific region, and the Americas with a market cap of approximately €717.45 million.

Operations: Paul Hartmann AG generates revenue through four primary segments: Wound Care (€597.39 million), Infection Management (€516.66 million), Incontinence Management (€769.70 million), and Complementary Divisions (€499.70 million).

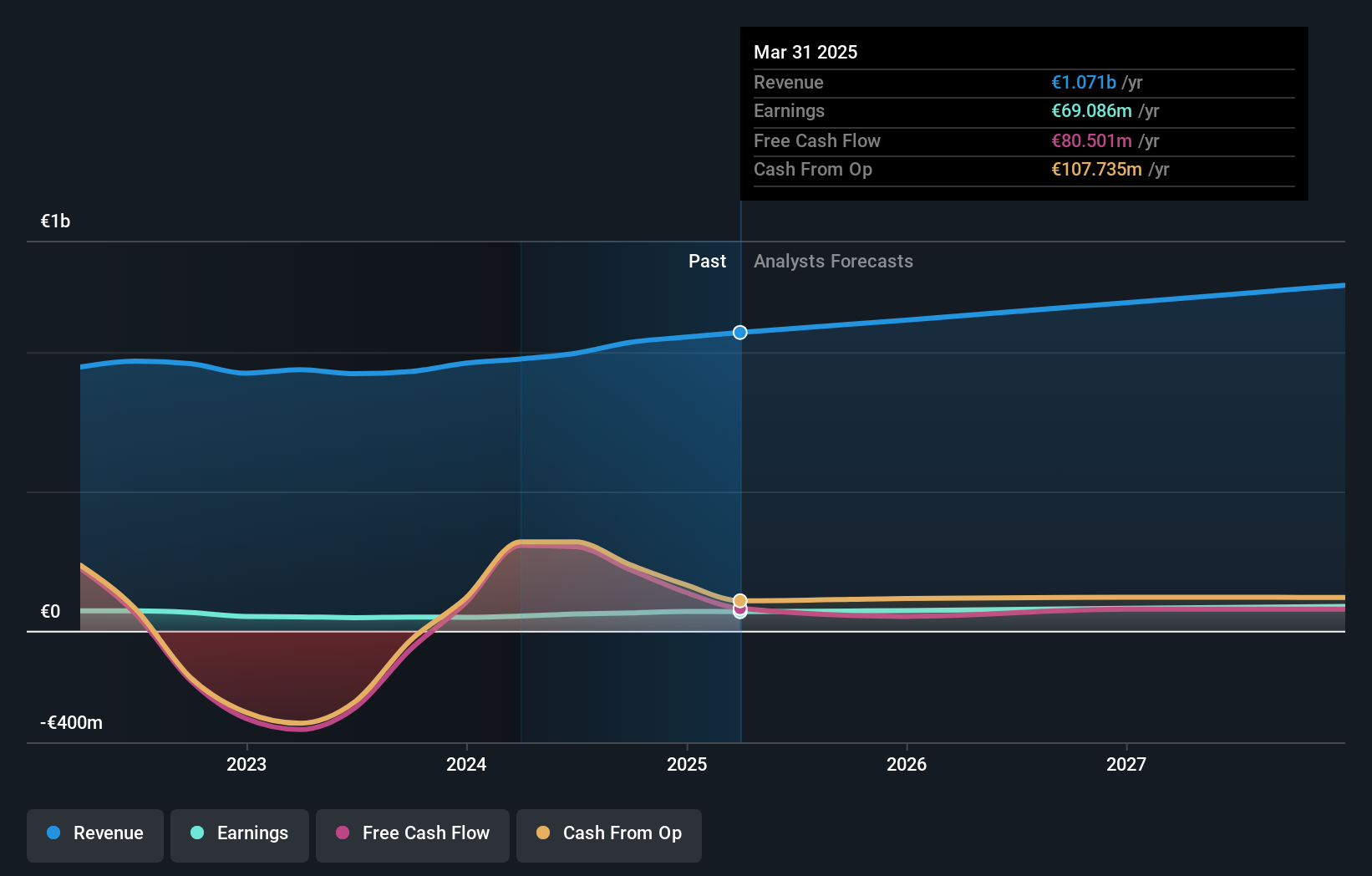

Paul Hartmann, a smaller player in the medical equipment sector, has shown impressive financial resilience. Its earnings surged by 156% over the past year, outpacing the industry's 16% growth. The company reported sales of €1.20 billion for H1 2024, up from €1.17 billion last year, with net income jumping to €42.8 million from €11.69 million. Interest payments are well covered at 6x EBIT, and it trades at a significant discount to its estimated fair value.

- Click here to discover the nuances of Paul Hartmann with our detailed analytical health report.

Examine Paul Hartmann's past performance report to understand how it has performed in the past.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, along with its subsidiaries, specializes in the global production and supply of pumps, valves, and associated services with a market capitalization of approximately €1.12 billion.

Operations: KSB SE & Co. KGaA generates revenue primarily from its pumps segment, contributing €1.52 billion, followed by KSB Supremeserv services at €978.20 million and fittings at €370.94 million.

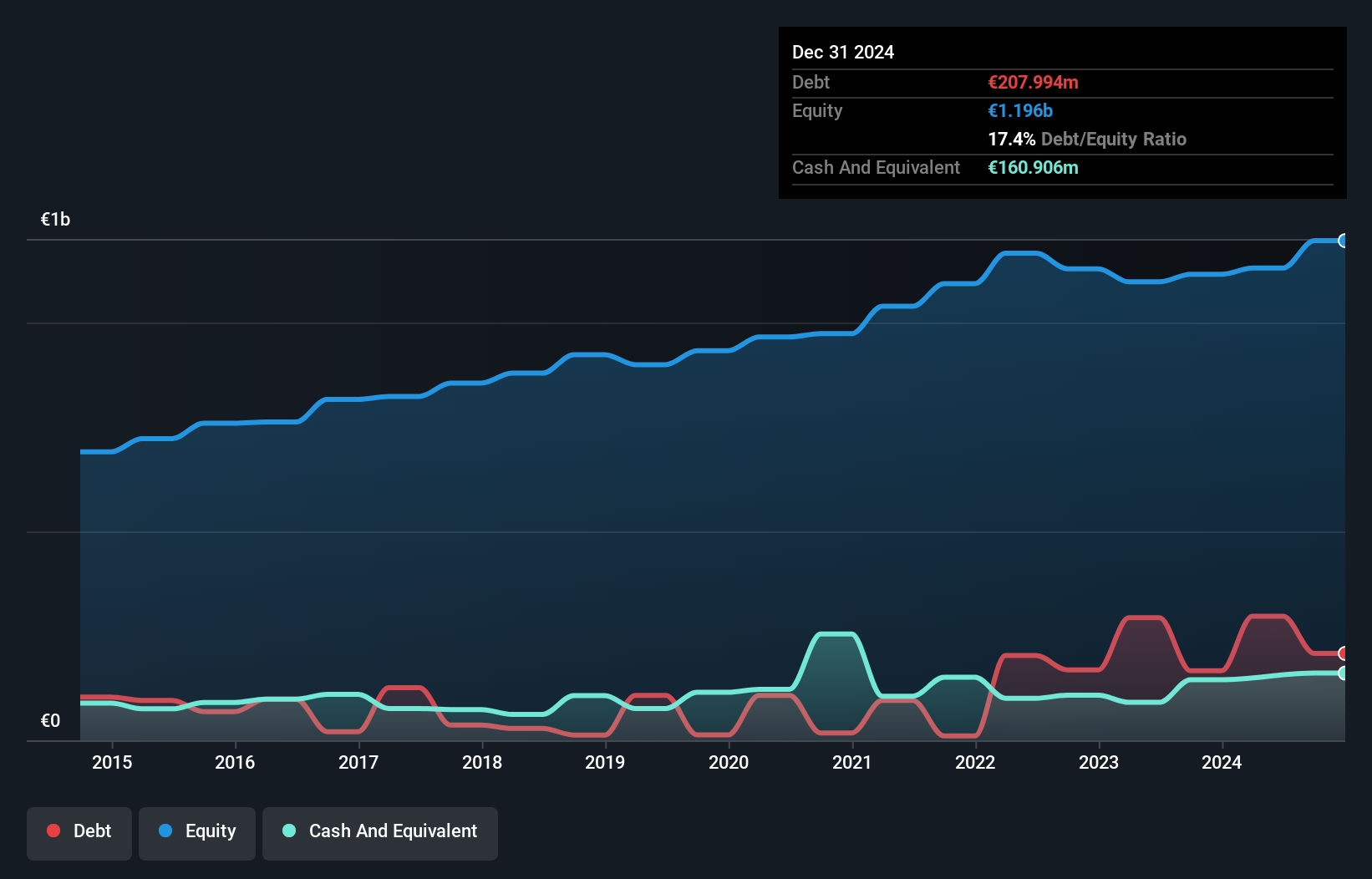

KSB SE KGaA, a promising player in the machinery sector, has shown notable financial resilience despite a one-off loss of €102.5M impacting recent results. The company trades at 77% below its estimated fair value and boasts a robust debt-to-equity ratio improvement from 9.2% to 0.8% over five years. With earnings growth of 16.8%, outpacing the industry average, KSB appears well-positioned for future expansion with free cash flow positivity and strong interest coverage enhancing its appeal.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE, along with its subsidiaries, delivers a range of financial services to private, corporate, and institutional clients in Germany and has a market capitalization of approximately €677.65 million.

Operations: MLP SE generates revenue primarily from Financial Consulting (€429.61 million), FERI (€231.23 million), and Banking (€206.97 million) segments, with additional contributions from DOMCURA and Deutschland.Immobilien. The company experiences a net impact of -€86.32 million due to Consolidation adjustments, affecting overall financial results.

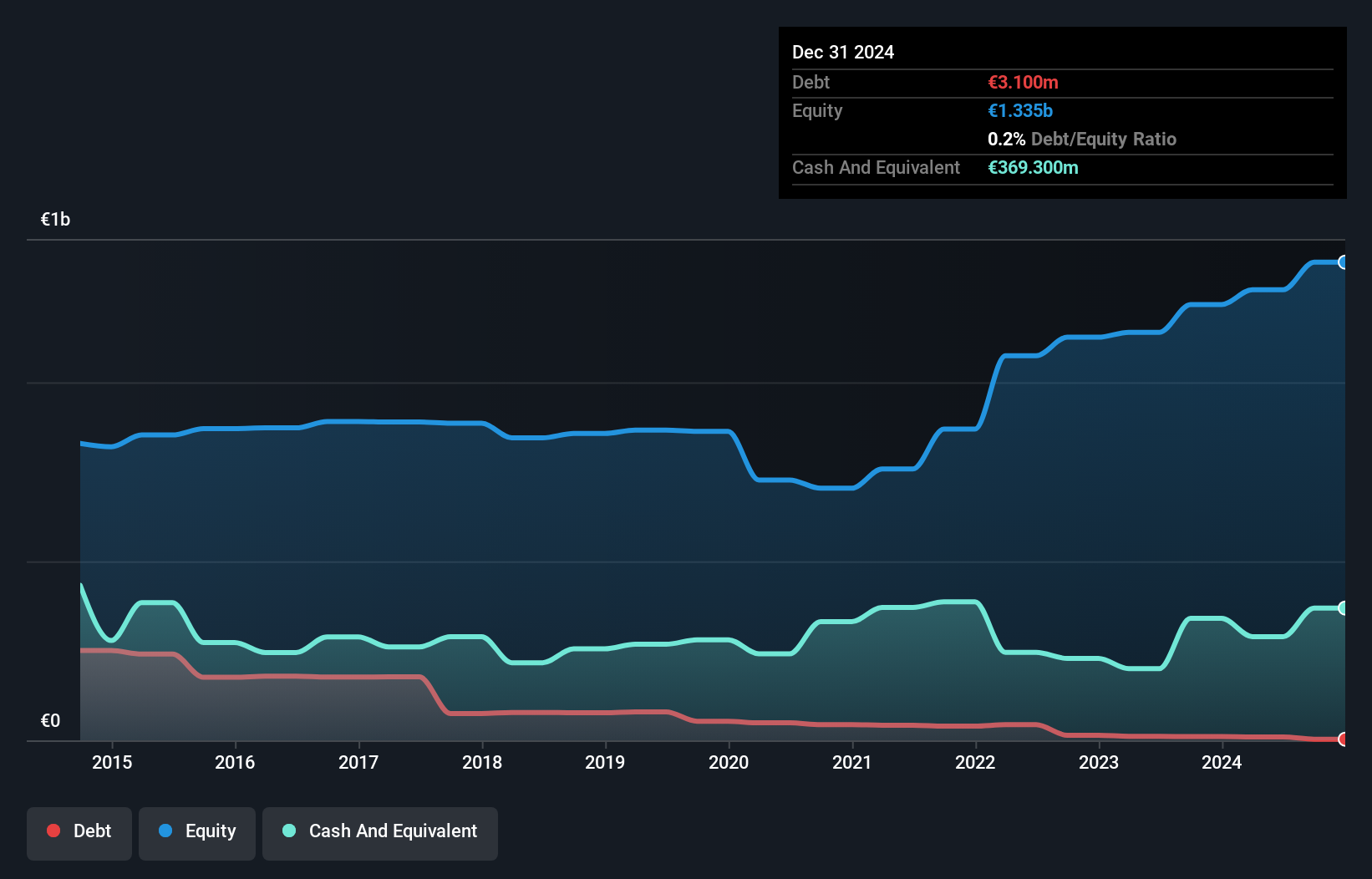

With no debt and trading at 40% below fair value, MLP stands out in Germany's financial scene. The company reported earnings growth of 28% last year, surpassing the industry average of 19%. Recent guidance suggests EBIT for 2024 could hit €95 million, up from a previous range of €75-85 million. In Q2 2024, net income soared to €10.31 million from €2.39 million the previous year, reflecting strong operational performance and quality earnings.

- Dive into the specifics of MLP here with our thorough health report.

Review our historical performance report to gain insights into MLP's's past performance.

Summing It All Up

- Unlock our comprehensive list of 54 German Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.