- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Three Undiscovered German Gems with Promising Potential

Reviewed by Simply Wall St

The German market has shown resilience, with the DAX gaining 0.35% amid mixed performances in Europe and a backdrop of rising eurozone government bond yields. Despite broader economic uncertainties, Germany's industrial output and orders have exceeded expectations, suggesting potential opportunities for discerning investors. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial. Here are three lesser-known German companies that stand out as promising candidates for those looking to capitalize on the current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Paul Hartmann | NA | 1.12% | -17.65% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG is engaged in the mining, production, and sale of salt in Germany, Europe, and internationally with a market cap of €630.45 million.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily from its salt segment (€275.89 million) and waste management services (€61.20 million), with additional income from other segments (€18.63 million).

Südwestdeutsche Salzwerke (SSH) has had a strong year, with earnings growing by 188%, significantly outpacing the Food industry’s 21.1%. The company reported sales of €163.06 million for the half-year ending June 2024, up from €154.03 million last year. Net income also saw a jump to €15.4 million from €7.96 million previously, resulting in basic earnings per share rising to €1.47 from €0.76 last year. SSH's debt-to-equity ratio increased to 0.7 over five years while maintaining high-quality earnings and well-covered interest payments at 845x EBIT coverage

- Dive into the specifics of Südwestdeutsche Salzwerke here with our thorough health report.

Gain insights into Südwestdeutsche Salzwerke's past trends and performance with our Past report.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE specializes in the global manufacturing and sale of isotope technology components, with a market cap of €900.94 million.

Operations: Eckert & Ziegler SE generates revenue primarily through the manufacturing and sale of isotope technology components. The company's financial performance includes a gross profit margin of 47.5%, reflecting its cost structure and pricing strategy.

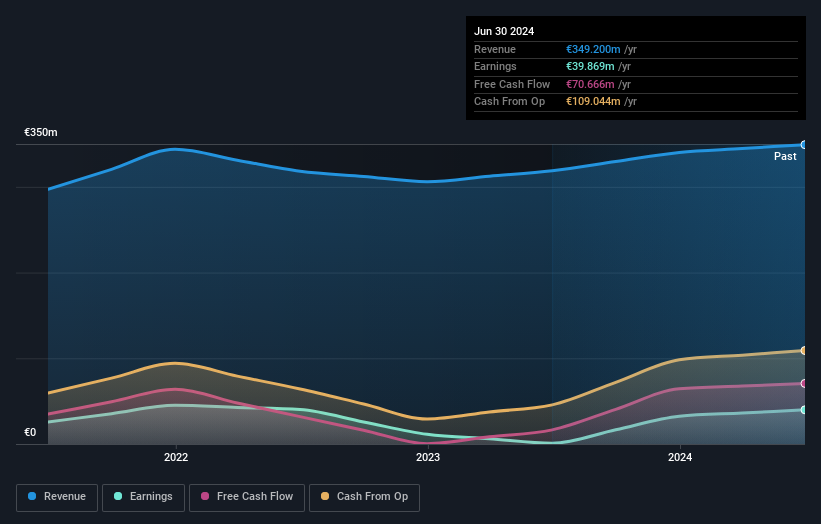

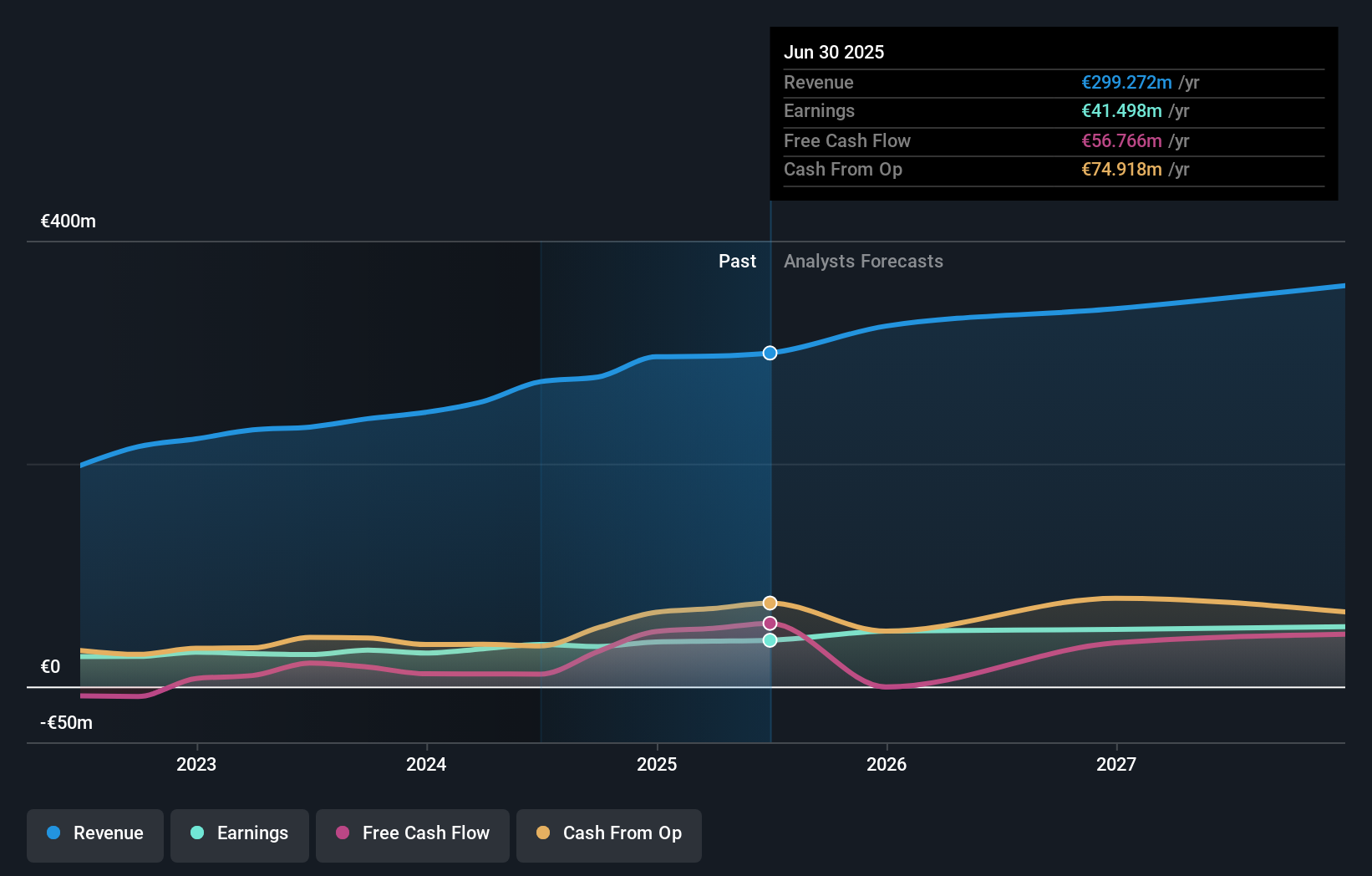

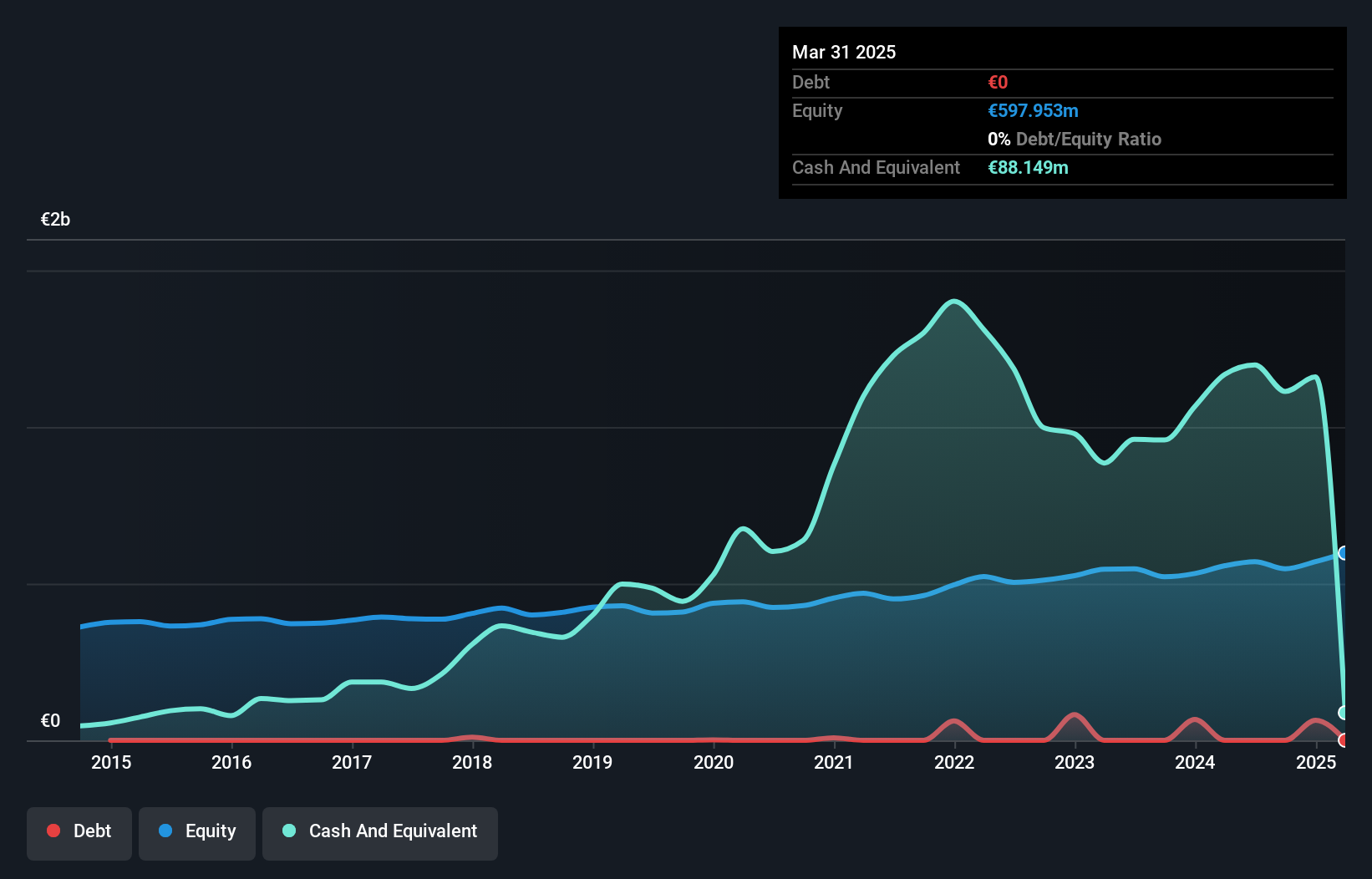

Eckert & Ziegler, a notable player in the medical equipment sector, has demonstrated strong financial health with its debt to equity ratio improving from 14.7% to 9.5% over five years and earnings growth of 38.8% last year, surpassing the industry's -6.4%. The company's EBIT covers its interest payments 20.6 times over, indicating robust profitability. Recent earnings reports show sales rising to €77.76 million in Q2 2024 from €60.03 million the previous year, with net income increasing to €9.54 million from €6.17 million.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE, along with its subsidiaries, offers financial services to private, corporate, and institutional clients in Germany and has a market cap of €638.37 million.

Operations: MLP SE generates revenue through financial services provided to private, corporate, and institutional clients in Germany. The company's net profit margin is 8.5%.

MLP, a small cap financial services firm in Germany, has shown impressive performance with earnings growing 28.4% over the past year, outpacing the industry’s 8.2%. Trading at 46.2% below its estimated fair value and repurchasing shares worth €6.2 million this year, it offers good relative value compared to peers. With no debt and high-quality earnings, MLP reported net income of €10.31 million for Q2 2024, up from €2.39 million a year ago.

Key Takeaways

- Investigate our full lineup of 46 German Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Eckert & Ziegler, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives