- Germany

- /

- Industrials

- /

- XTRA:MBB

Exploring Three Undiscovered German Stocks With Potential

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating European indices with Germany's DAX experiencing a notable drop, investors are increasingly attentive to the dynamics shaping market potentials. This environment sets an intriguing stage for uncovering undervalued opportunities within the German market, particularly among stocks that may not yet be on every investor’s radar but have potential for significant impact under current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| IVU Traffic Technologies | NA | 9.22% | 5.72% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Eisen- und Hüttenwerke | NA | -14.56% | 7.71% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

| centrotherm international | 20.54% | 8.23% | 54.11% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| EUWAX | 4.67% | -5.08% | 433.28% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

MBB (XTRA:MBB)

Simply Wall St Value Rating: ★★★★★★

Overview: MBB SE operates as a holding company, focusing on acquiring and managing medium-sized businesses in the technology and engineering sectors across Germany and globally, with a market capitalization of approximately €595.65 million.

Operations: The company generates its revenue primarily through three segments: Service & Infrastructure (€487.10 million), Technical Applications (€378.50 million), and Consumer Goods (€94.23 million). It incurs significant costs in goods sold and operating expenses, with recent figures showing Cost of Goods Sold at €598.17 million and operating expenses at €341.49 million, impacting the net income which stood at €18.51 million as of the latest report in 2024.

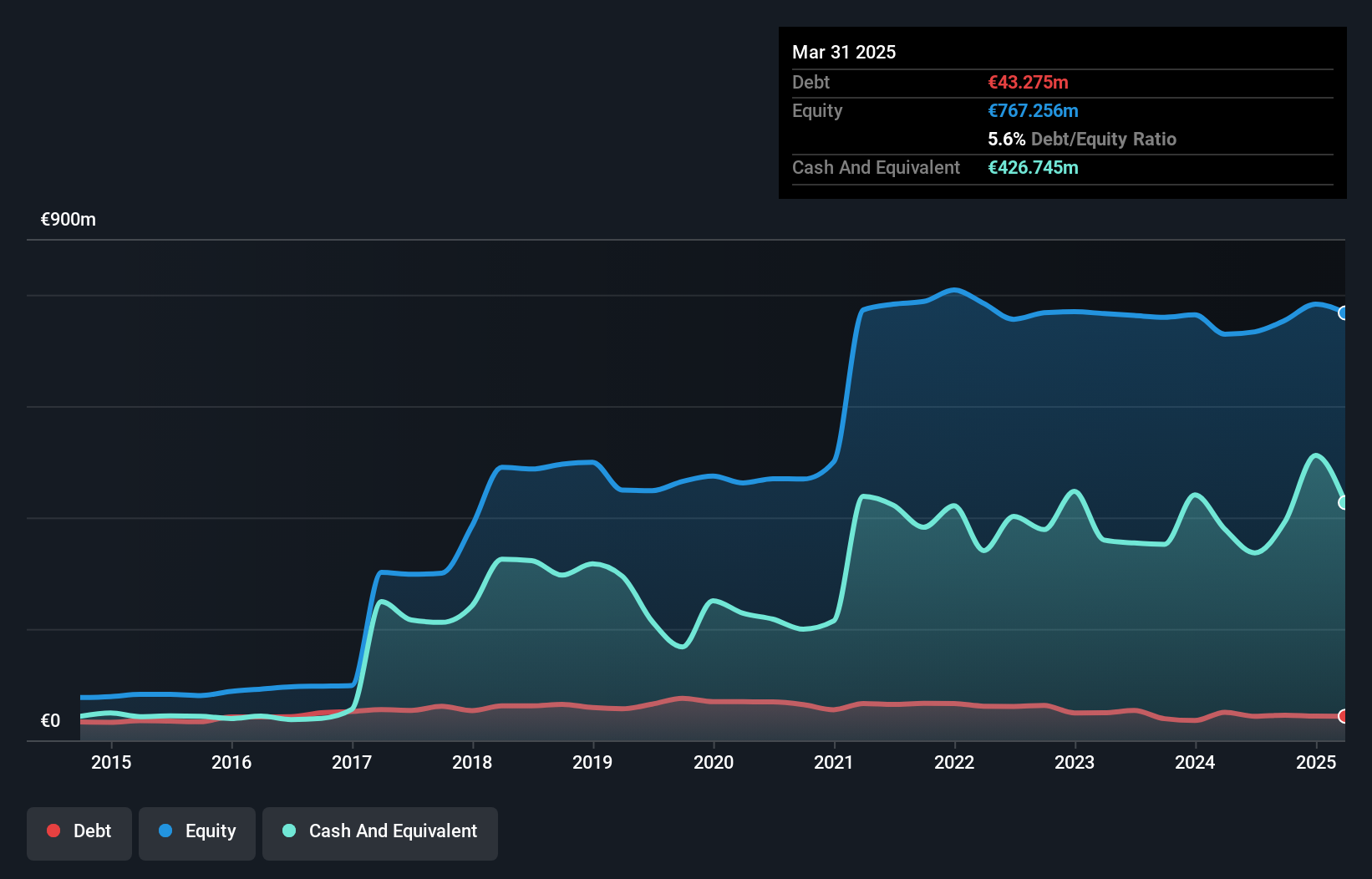

MBB, a standout in the industrials sector, has demonstrated robust performance with a 63.9% earnings growth over the past year—surpassing its industry's average of 5.9%. This growth trajectory is supported by high-quality earnings and a valuation that suggests it trades 15.6% below its fair value. Additionally, MBB has improved its financial health by reducing its debt-to-equity ratio from 12.6% to 6.9% over five years, showcasing prudent financial management amidst rapid growth forecasts of 33.45% annually.

- Unlock comprehensive insights into our analysis of MBB stock in this health report.

Assess MBB's past performance with our detailed historical performance reports.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE operates as a diversified financial services provider, offering products and advisory services in areas such as insurance, investments, and pensions primarily to clients across Germany. The company has a market capitalization of approximately €615.53 million.

Operations: MLP primarily generates revenue through diverse financial services including banking, real estate, and industrial brokerage, with significant contributions from financial consulting. The company's cost structure involves substantial operating expenses and cost of goods sold (COGS), impacting overall profitability as evidenced by varying net income margins over the years.

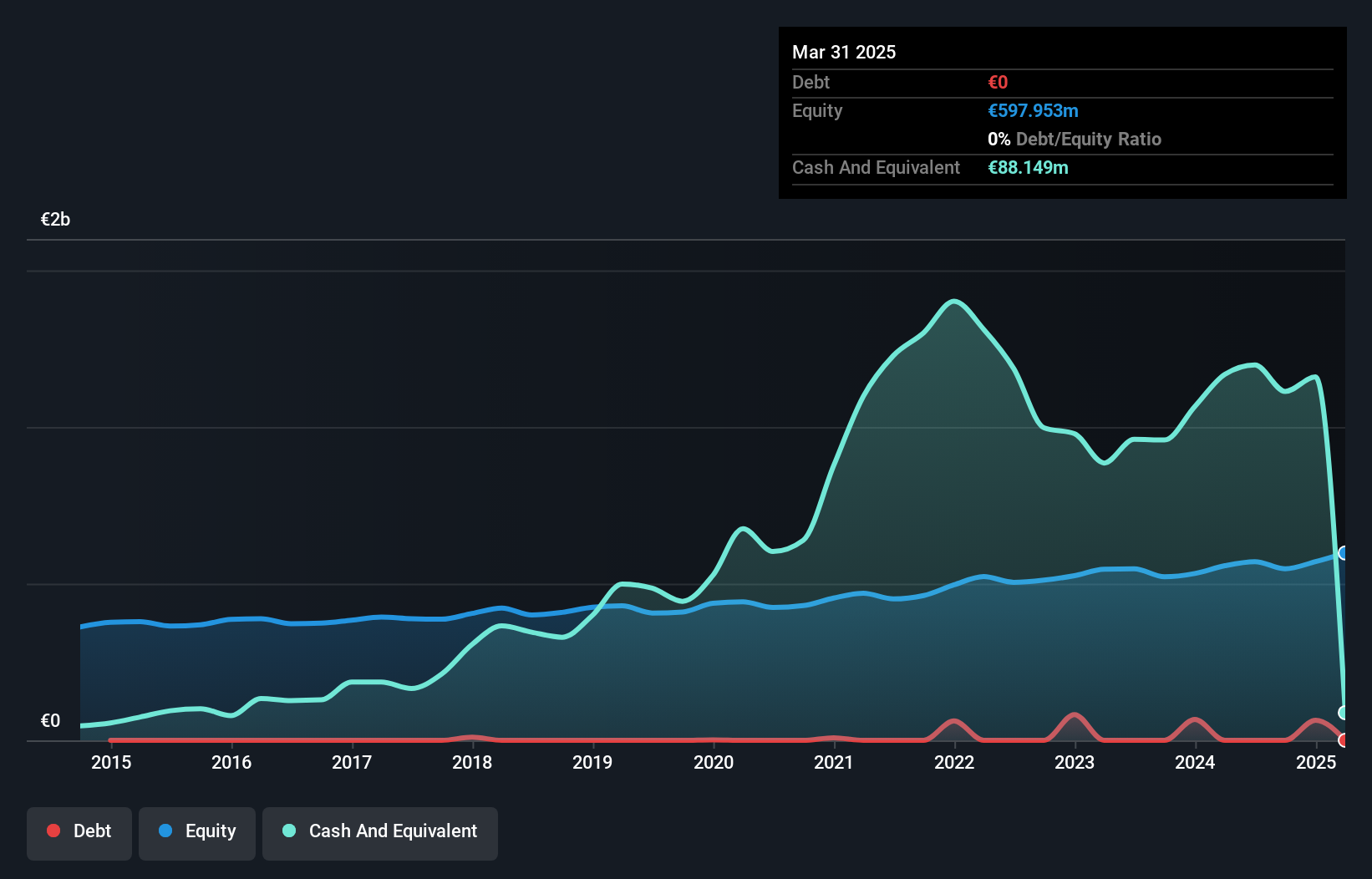

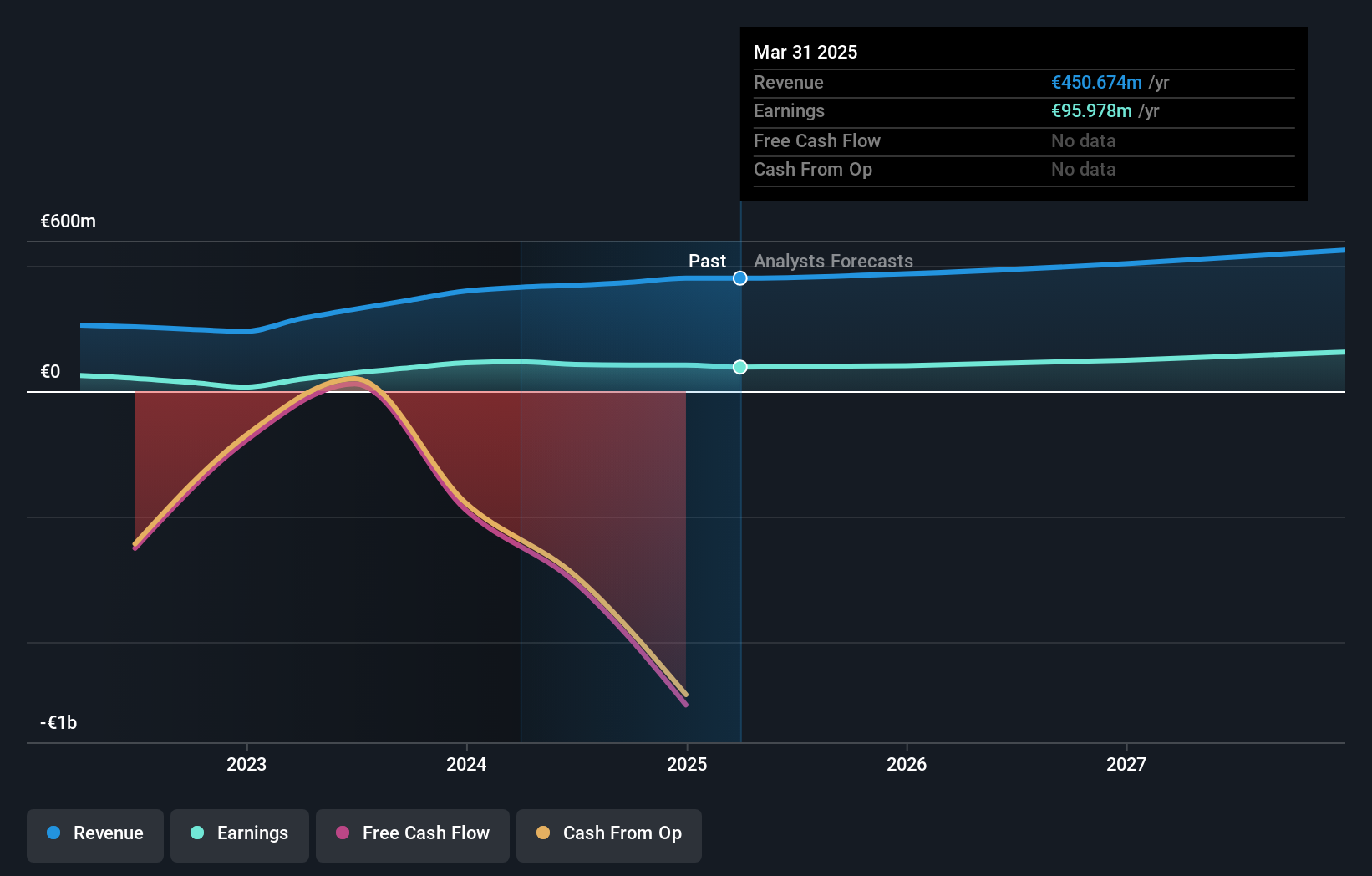

MLP SE, a lesser-known gem in Germany's financial sector, is trading at 41.6% below its estimated fair value, making it an attractive prospect for value investors. Recently, the company showcased robust first-quarter earnings with a revenue increase to €284 million from €263 million year-over-year and net income rising to €28 million. Notably debt-free, MLP has demonstrated consistent profit growth, outpacing its industry with a 5.1% earnings increase last year and forecasting an 8.62% annual growth moving forward. Additionally, the company repurchased shares worth €3.1 million in early 2024, underscoring its strong financial health and commitment to shareholder value.

- Take a closer look at MLP's potential here in our health report.

Examine MLP's past performance report to understand how it has performed in the past.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProCredit Holding AG operates as a commercial bank offering services to small and medium enterprises and private customers across Europe, South America, and Germany, with a market capitalization of €515.95 million.

Operations: The company generates its revenue primarily through banking services, consistently achieving a high gross profit margin of 100% over recent periods. This performance is supported by significant net income growth, with the latest figures showing €113.37 million on revenues of €399.40 million.

ProCredit Holding, a lesser spotlighted entity in Germany's financial sector, showcases robust health with total assets of €10B and equity of €1B. Its earnings soared by 146% last year, outpacing the industry's growth. With total deposits at €7.5B and loans at €6.7B, its strategic management is evident through a sufficient bad loan allowance covering 119% of non-performing loans currently at 2.4%. Recent results revealed a rise in net income to €33.5M from last year’s €29.5M, underscoring potential undervalued status as it trades 66% below estimated fair value.

- Navigate through the intricacies of ProCredit Holding with our comprehensive health report here.

Understand ProCredit Holding's track record by examining our Past report.

Summing It All Up

- Access the full spectrum of 39 German Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBB

MBB

Engages in the acquisition and management of medium-sized companies primarily in the technology and engineering sectors in Germany and internationally.

Flawless balance sheet with reasonable growth potential.