- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

Undiscovered Gems in Germany to Watch This September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's rate cuts, small-cap stocks are gaining attention, with Germany's DAX index showing modest gains amid cautious investor sentiment. This September 2024, we explore three lesser-known German stocks that could benefit from these evolving market dynamics and broader economic indicators. In a market where interest rates are shifting and consumer confidence remains robust, identifying promising stocks involves looking for companies with solid fundamentals, growth potential, and resilience in diverse economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE specializes in the production and sale of isotope technology components on a global scale and has a market cap of €906.36 million.

Operations: The company generates revenue primarily from its Medical (€132.80 million) and Isotope Products (€150.97 million) segments. The net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

Eckert & Ziegler has demonstrated robust growth, with earnings surging 31.6% over the past year, outpacing the Medical Equipment industry’s 16.2%. The company's debt to equity ratio improved from 14.7% to 9.5% in five years, and its EBIT covers interest payments by a substantial margin of 20.2x. Recent results show significant gains, with second-quarter sales at €77.76 million and net income reaching €9.54 million compared to €6.17 million last year, highlighting its strong performance trajectory

- Click here and access our complete health analysis report to understand the dynamics of Eckert & Ziegler.

Examine Eckert & Ziegler's past performance report to understand how it has performed in the past.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★☆

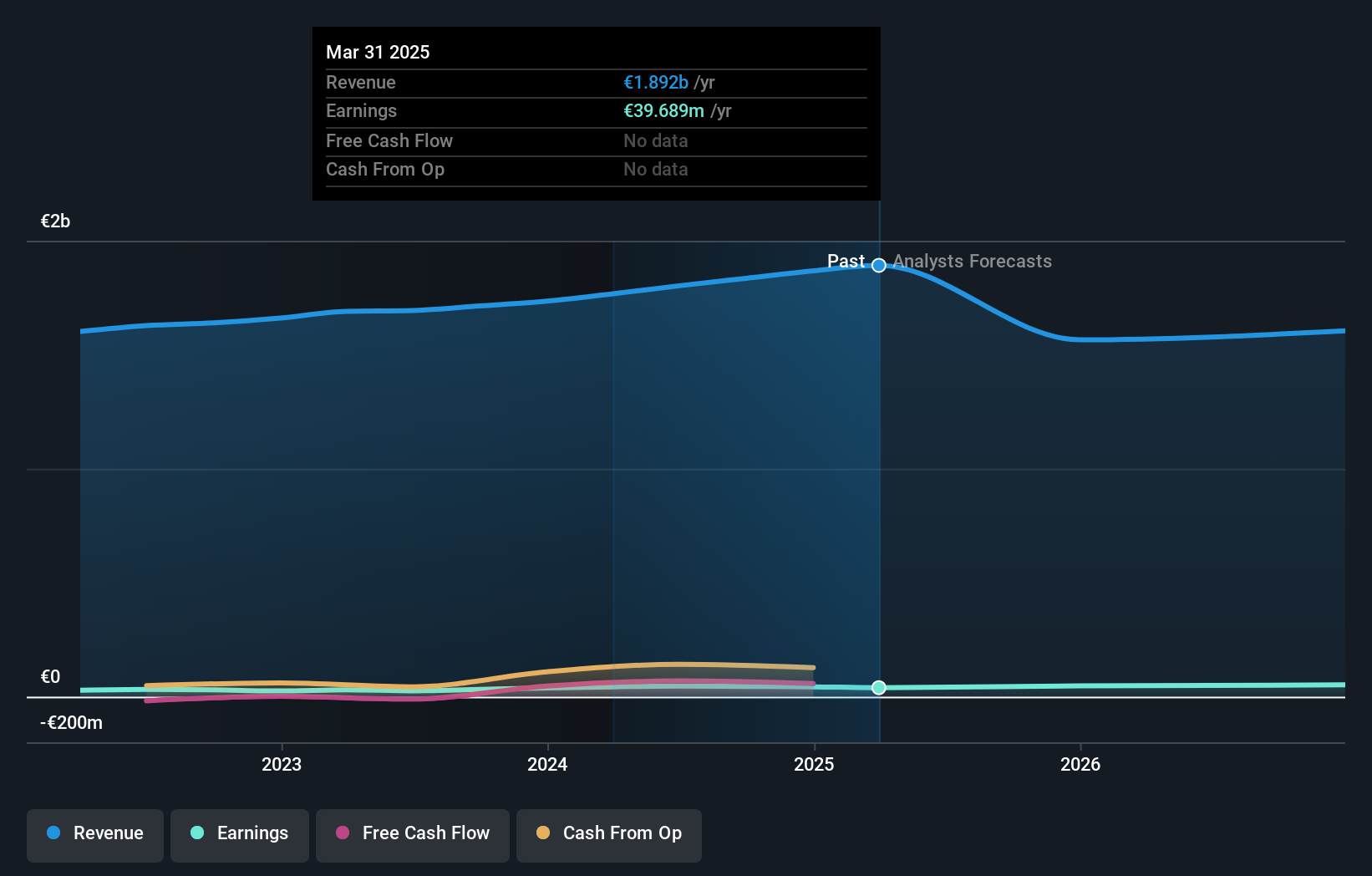

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services in Germany and has a market cap of approximately €843.42 million.

Operations: RHÖN-KLINIKUM generates revenue primarily from its acute hospitals (€1.45 billion), medical care centres (€23.90 million), and rehabilitation hospitals (€34.70 million).

RHÖN-KLINIKUM's earnings growth of 81.6% over the past year outpaced the Healthcare industry's 30.9%, reflecting strong performance. The company reported second-quarter sales of €392.69 million, up from €366.66 million, and net income rose to €9.01 million from €5.73 million a year ago. With a price-to-earnings ratio of 18.1x below the industry average, it appears undervalued relative to peers, while its debt-to-equity ratio increased slightly to 11.1% over five years.

- Delve into the full analysis health report here for a deeper understanding of RHÖN-KLINIKUM.

Explore historical data to track RHÖN-KLINIKUM's performance over time in our Past section.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

Overview: Friedrich Vorwerk Group SE offers solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €470 million.

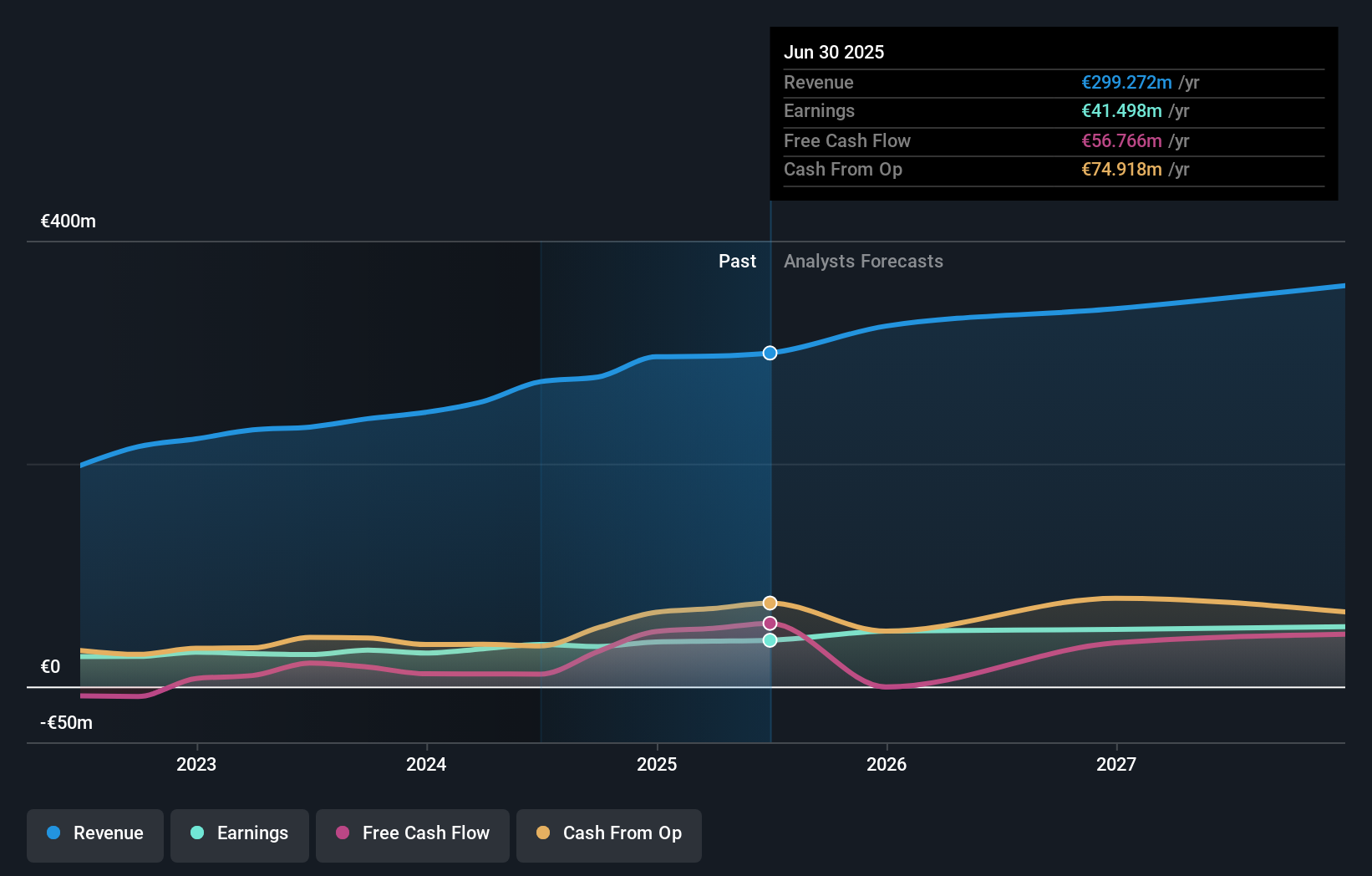

Operations: The company generates revenue through four primary segments: Electricity (€95.30 million), Natural Gas (€160.89 million), Clean Hydrogen (€28.38 million), and Adjacent Opportunities (€117.28 million).

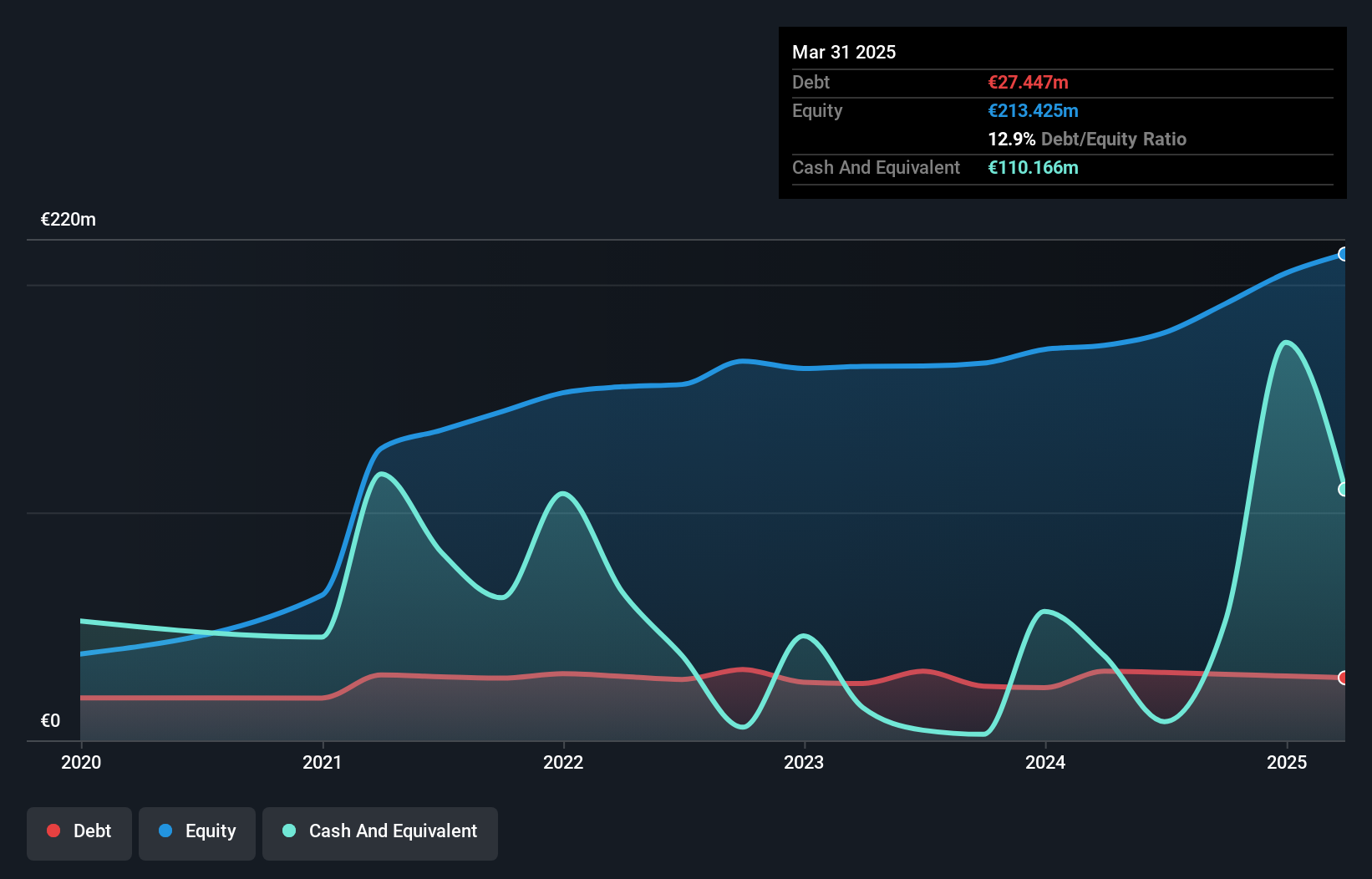

Friedrich Vorwerk Group SE has shown impressive growth, with earnings rising by 48.6% over the past year, outpacing the Oil and Gas industry's 27.6%. For Q2 2024, sales reached €117.41 million, up from €92.55 million a year ago, while net income increased to €7.96 million from €2.38 million previously. The company’s net debt to equity ratio stands at a satisfactory 12.1%, and its EBIT covers interest payments 12.7 times over, indicating strong financial health and high-quality earnings.

- Click here to discover the nuances of Friedrich Vorwerk Group with our detailed analytical health report.

Evaluate Friedrich Vorwerk Group's historical performance by accessing our past performance report.

Taking Advantage

- Dive into all 53 of the German Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Excellent balance sheet with reasonable growth potential.