Exploring Paul Hartmann And 2 Other Undiscovered Gems With Solid Fundamentals

Reviewed by Simply Wall St

As global markets experience heightened volatility due to escalating Middle East tensions and economic uncertainties, the German market has not been immune, with the DAX index recently experiencing a notable decline. In this environment of caution and shifting investor sentiment, identifying stocks with solid fundamentals becomes crucial for navigating potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

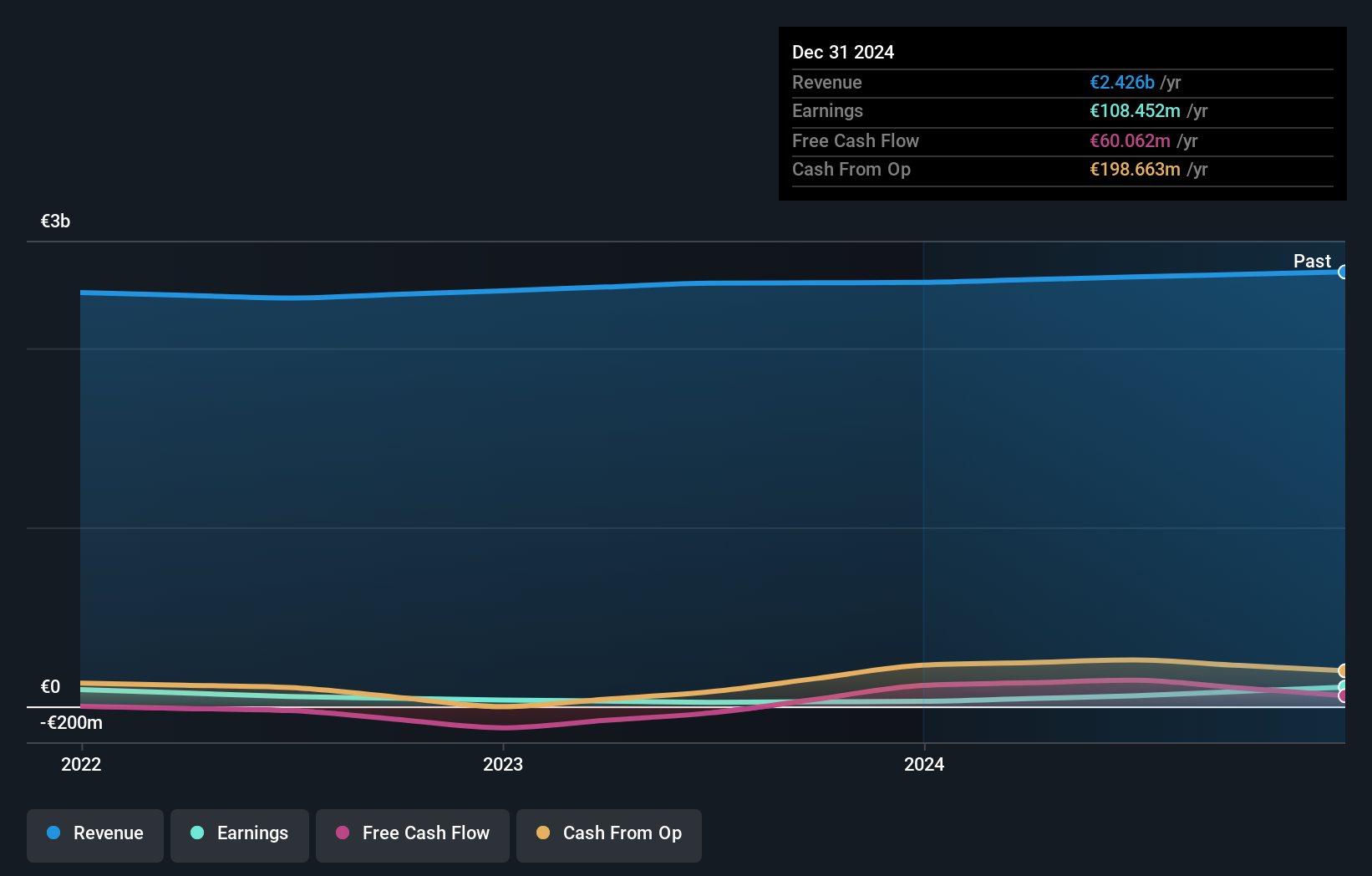

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across Germany, the rest of Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of approximately €721 million.

Operations: Paul Hartmann AG generates revenue primarily from its Incontinence Management segment (€769.70 million), followed by Wound Care (€597.39 million) and Infection Management (€516.66 million). The Complementary divisions contribute €499.70 million to the overall revenue stream.

Paul Hartmann, a notable player in the medical equipment sector, has seen its earnings soar by 156% over the past year, outpacing industry growth of 16%. Despite an increase in debt to equity from 12% to 26.3% over five years, its interest payments are comfortably covered with EBIT at 6.2x coverage. The company is trading significantly below estimated fair value and reported net income of €42.8 million for the first half of 2024, up from €11.69 million last year.

- Navigate through the intricacies of Paul Hartmann with our comprehensive health report here.

Evaluate Paul Hartmann's historical performance by accessing our past performance report.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

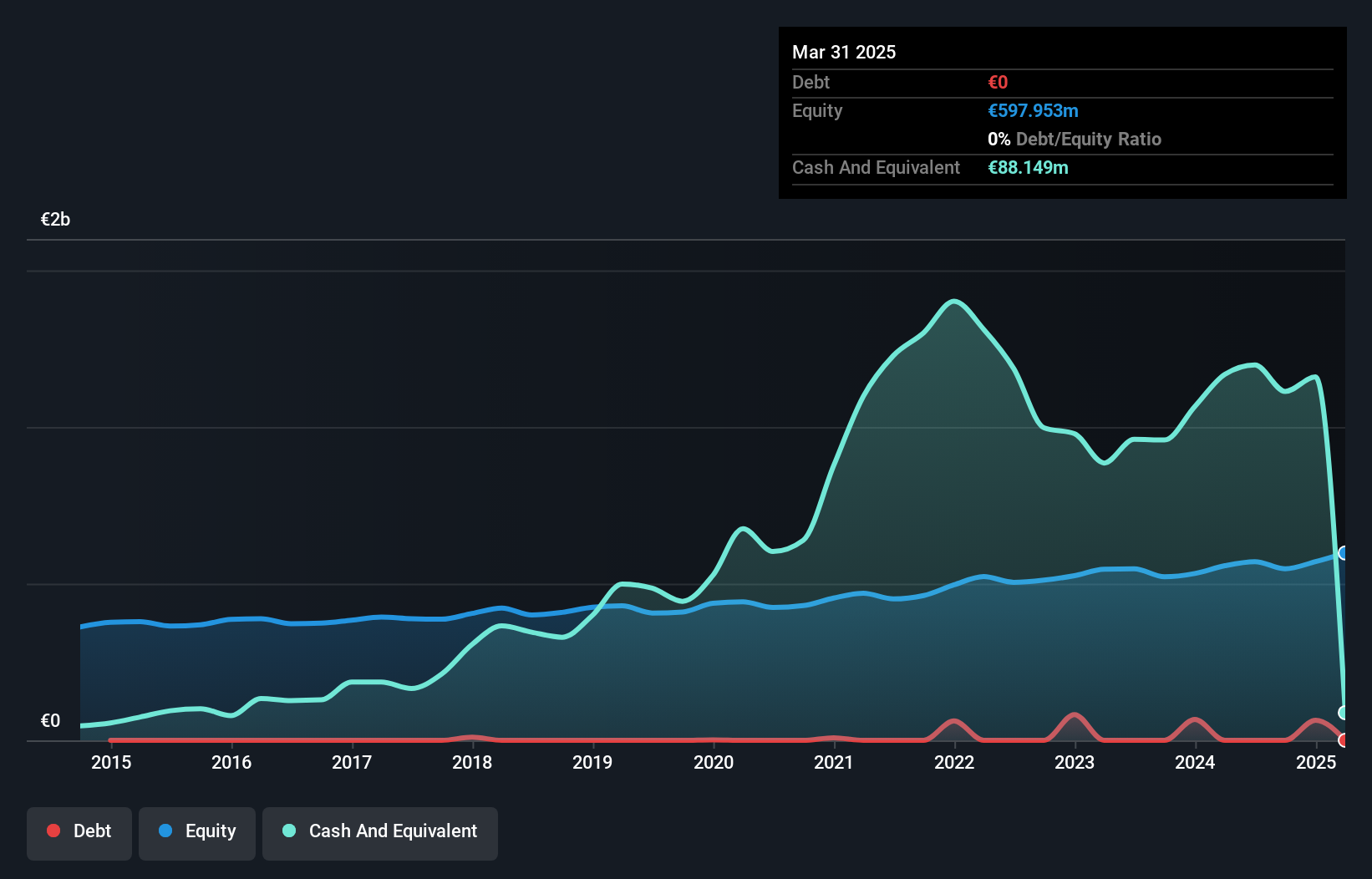

Overview: MLP SE, with a market cap of €654.69 million, operates in Germany offering financial services to private, corporate, and institutional clients through its subsidiaries.

Operations: MLP SE generates revenue through several segments, with Financial Consulting contributing €429.61 million and FERI adding €231.23 million. Banking services account for €206.97 million, while DOMCURA brings in €129.26 million. The company also reports a negative consolidation impact of -€86.32 million on its overall financials.

MLP, a financial services player in Germany, is catching attention with its robust performance. The company posted a net income of €10.31 million for Q2 2024, up from €2.39 million the previous year, showcasing strong earnings growth of 28.4% over the past year. Trading at 42.6% below estimated fair value and debt-free for five years, MLP offers an appealing valuation proposition. With raised EBIT guidance between €85 million to €95 million for 2024, it signals confidence in future profitability.

- Click here to discover the nuances of MLP with our detailed analytical health report.

Review our historical performance report to gain insights into MLP's's past performance.

Mühlbauer Holding (XTRA:MUB)

Simply Wall St Value Rating: ★★★★★★

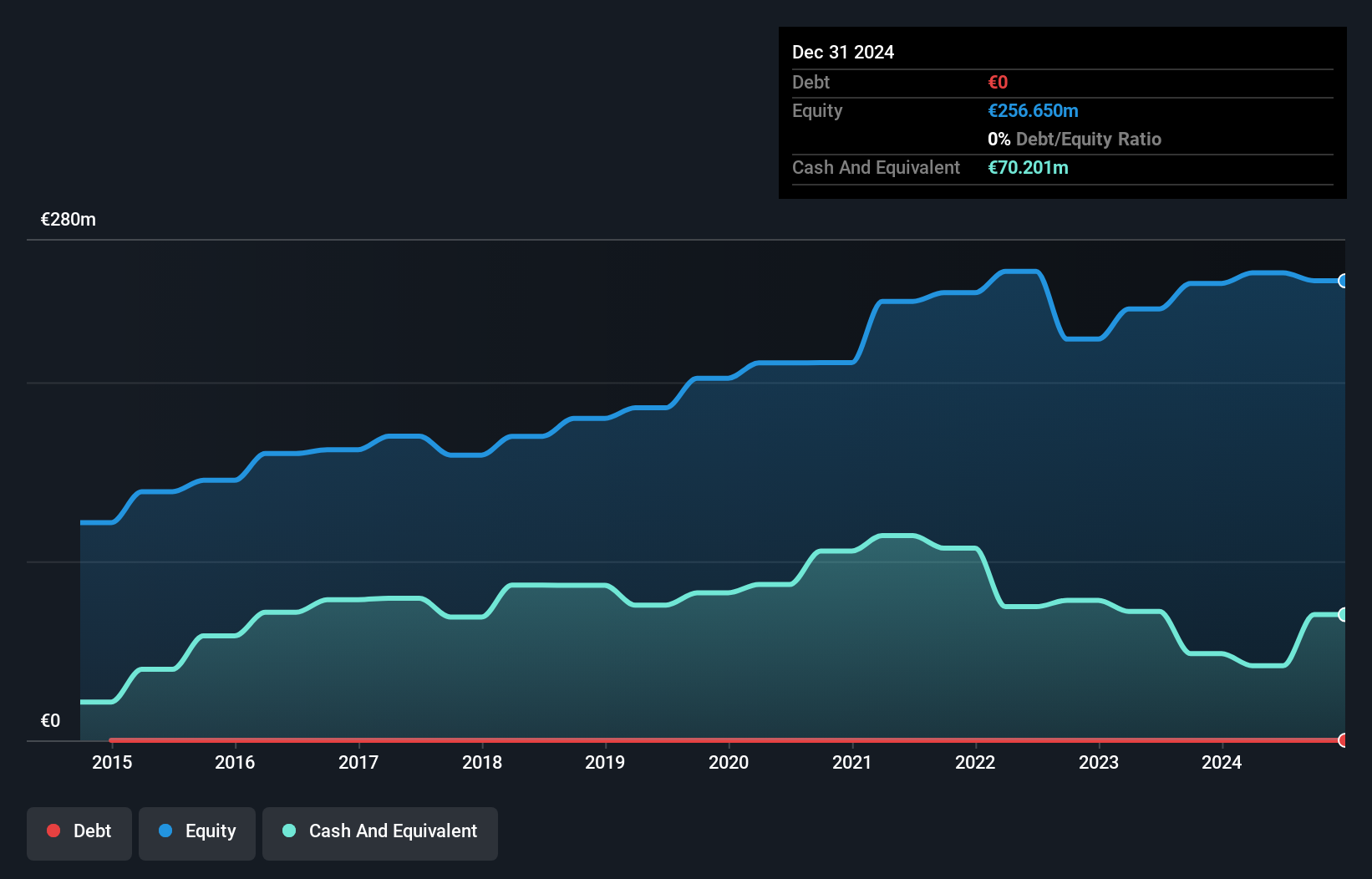

Overview: Mühlbauer Holding AG specializes in the production and personalization of smart cards, passports, solar cells, and RFID solutions across various global markets with a market capitalization of approximately €644.31 million.

Operations: Mühlbauer's revenue is primarily driven by its Automation segment, generating €230.92 million, followed by Tecurity® at €171.70 million and Precision Parts & Systems contributing €53.76 million. The company's financial performance reflects a diverse revenue model across these segments.

Mühlbauer, a debt-free player in the machinery sector, has shown impressive earnings growth of 174.9% over the past year, outpacing its industry despite a 12.7% annual decline over five years. Recent reports indicate sales of €210 million for the first half of 2024, slightly down from last year's €213 million. However, net income dropped significantly to €4.66 million from €21 million previously, with basic earnings per share at €0.33 compared to last year's €1.52.

Seize The Opportunity

- Explore the 56 names from our German Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUB

Mühlbauer Holding

Engages in the production and personalization of smart cards, ePassports, solar cells, and RFID solutions in Germany, rest of Europe, Asia, the United States, Africa, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives