- Germany

- /

- Capital Markets

- /

- XTRA:LUS1

Investors Aren't Buying Lang & Schwarz Aktiengesellschaft's (ETR:LUS1) Revenues

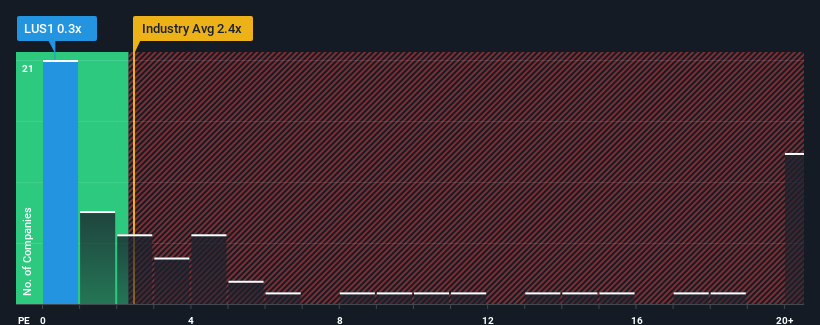

With a price-to-sales (or "P/S") ratio of 0.3x Lang & Schwarz Aktiengesellschaft (ETR:LUS1) may be sending very bullish signals at the moment, given that almost half of all the Capital Markets companies in Germany have P/S ratios greater than 2.4x and even P/S higher than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Lang & Schwarz

How Has Lang & Schwarz Performed Recently?

Lang & Schwarz has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Lang & Schwarz will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Lang & Schwarz's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Lang & Schwarz's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 25% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to shrink 4.3% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

In light of this, it's understandable that Lang & Schwarz's P/S sits below the majority of other companies. However, when revenue shrink rapidly P/S often shrinks too, which could set up shareholders for future disappointment regardless. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Lang & Schwarz revealed its sharp three-year contraction in revenue is contributing to its low P/S, given the industry is set to shrink less severely. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. However, we're still cautious about the company's ability to prevent an acceleration of its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Lang & Schwarz that you should be aware of.

If these risks are making you reconsider your opinion on Lang & Schwarz, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:LUS1

Lang & Schwarz

Engages in the development and issuance of derivative financial instruments in Germany.

Acceptable track record second-rate dividend payer.

Market Insights

Community Narratives