- Germany

- /

- Capital Markets

- /

- XTRA:JDC

Undiscovered Gems in Europe to Watch This September 2025

Reviewed by Simply Wall St

As European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index ending slightly lower amid varied monetary policy decisions, investors are keenly observing opportunities in small-cap stocks that may benefit from these dynamic conditions. In this context, identifying promising stocks involves looking for companies that can capitalize on shifting interest rates and economic indicators while demonstrating resilience and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 394.25% | 3.36% | 6.34% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Value Rating: ★★★★★★

Overview: ForFarmers N.V. operates as a provider of feed solutions for both conventional and organic livestock farming across several countries including the Netherlands, the United Kingdom, Germany, Poland, and Belgium with a market capitalization of approximately €398.62 million.

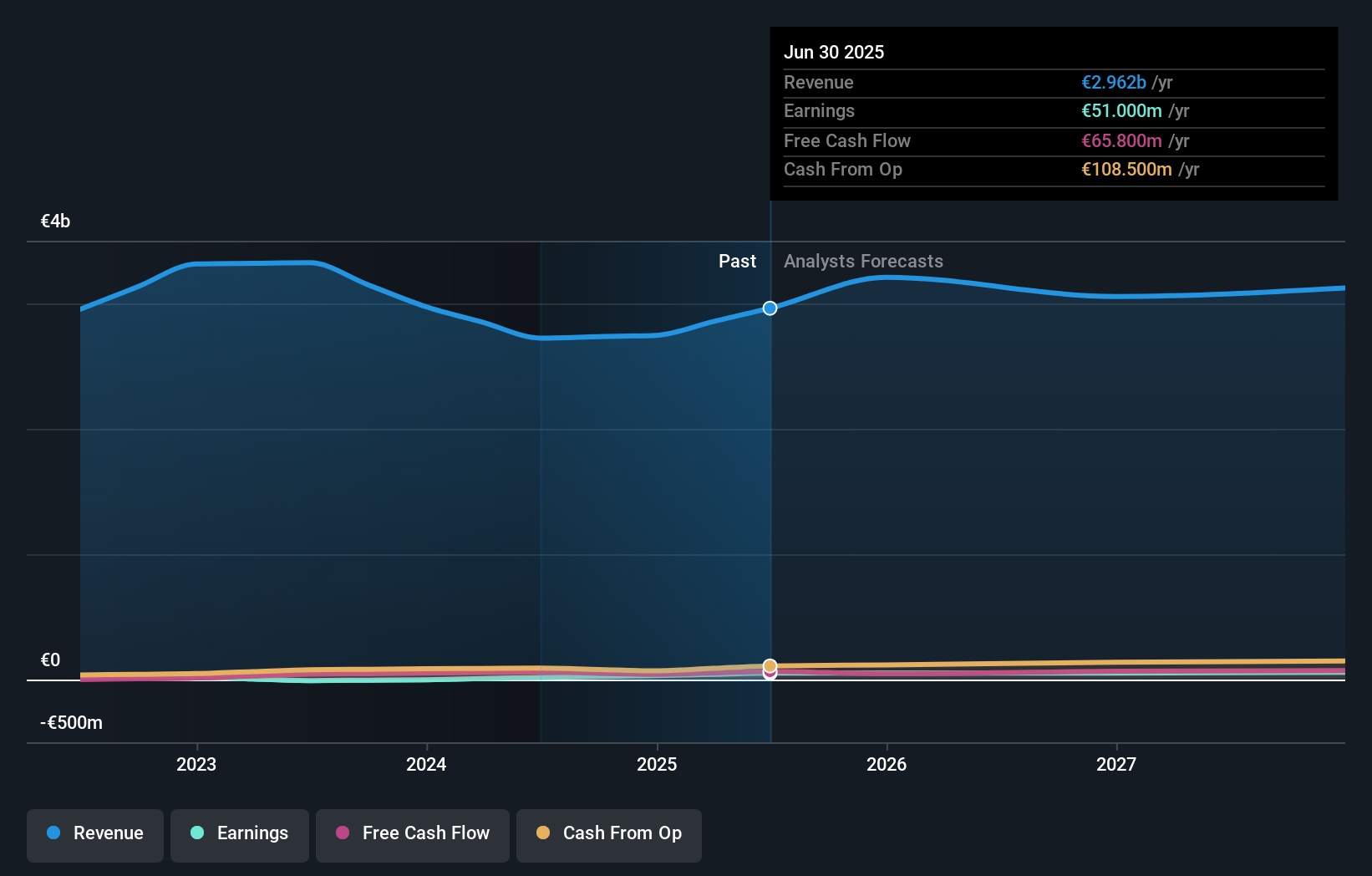

Operations: ForFarmers generates revenue primarily from its food processing segment, amounting to €2.96 billion.

ForFarmers, a notable player in the European feed market, is making waves with its strategic expansion and sustainability initiatives. Its earnings soared by 193% over the past year, outpacing the food industry average of 4.8%. The company boasts a satisfactory net debt to equity ratio of 11.8%, reflecting prudent financial management. With recent half-year sales hitting €1.57 billion, up from €1.36 billion last year, and net income jumping to €23.6 million from €4 million, ForFarmers shows robust growth potential despite challenges like regulatory pressures and market volatility impacting ventures such as HaBeMa in Germany.

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions, including the Americas, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of NOK6.73 billion.

Operations: Pexip generates revenue primarily from the sale of collaboration services, amounting to NOK1.19 billion.

Pexip Holding, a nimble player in the video technology space, has turned profitable recently, marking a notable shift in its financial health. The company's debt to equity ratio impressively dropped from 0.5 to 0.1 over five years, indicating improved financial stability with more cash than total debt on hand. Its earnings per share surged significantly from NOK 0.07 to NOK 0.42 year-over-year for the second quarter of 2025, showcasing robust growth alongside sales increasing to NOK 281 million from NOK 266 million previously. However, despite trading below estimated fair value and forecasting a promising earnings growth of over 20% annually, Pexip must navigate challenges posed by larger competitors and market commoditization risks while leveraging strategic partnerships and AI advancements for sustained success.

JDC Group (XTRA:JDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of approximately €421.87 million.

Operations: JDC Group AG generates revenue primarily through its Advisortech segment, which contributes €206.29 million, and the Advisory segment, contributing €47.00 million. The company incurs a negative impact from Reconciliation at -€19.46 million.

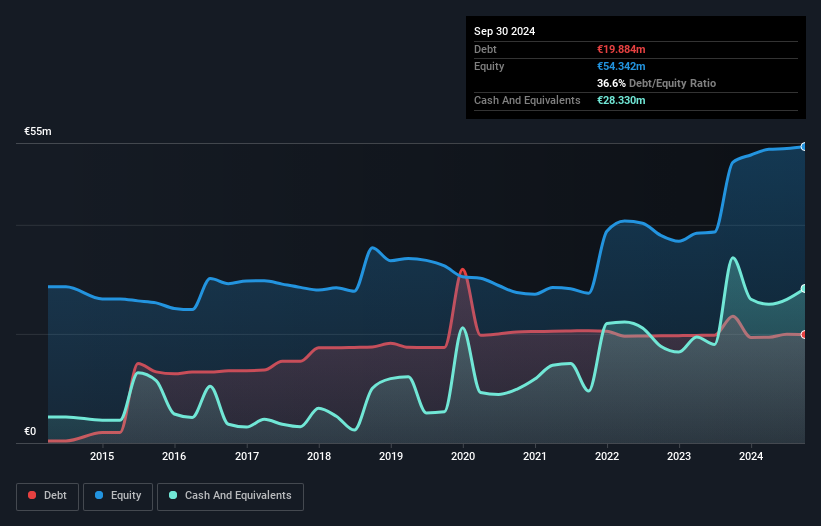

JDC Group, a nimble player in the financial services sector, has shown impressive growth with earnings surging by 41.8% over the past year, outpacing its industry peers. The company's debt to equity ratio has notably improved from 69.2% to 32.4% over five years, reflecting prudent financial management. With net income for Q2 2025 at €1.14 million compared to €0.679 million a year prior and basic EPS rising from €0.05 to €0.08, JDC's profitability is on an upward trajectory despite potential risks from its reliance on the German market and partner payouts that could pressure margins further down the line.

Next Steps

- Investigate our full lineup of 335 European Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JDC

JDC Group

Operates as a financial services company in Germany and Austria.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives