Top German Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As European markets react to the latest interest rate cuts from the ECB, Germany’s DAX has shown notable resilience, rising by 2.17% in recent weeks. Against this backdrop of cautious optimism and economic recalibration, identifying growth companies with high insider ownership can be particularly compelling for investors seeking stability and potential upside. In this context, stocks with significant insider ownership often signal strong confidence from those closest to the company’s operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| Stemmer Imaging (XTRA:S9I) | 25.1% | 23.2% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| adidas (XTRA:ADS) | 16.6% | 41.8% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Beyond Frames Entertainment (DB:8WP) | 10.8% | 112.2% |

| Redcare Pharmacy (XTRA:RDC) | 17.4% | 51.8% |

| elumeo (XTRA:ELB) | 25.8% | 120.2% |

| Your Family Entertainment (DB:RTV) | 17.3% | 116.8% |

Here's a peek at a few of the choices from the screener.

adidas (XTRA:ADS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: adidas AG, with a market cap of €40.55 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: Revenue Segments (in millions of €): Greater China: €3.26 billion, Latin America: €2.39 billion, North America: €5.07 billion, Segment Adjustment: €11.29 billion

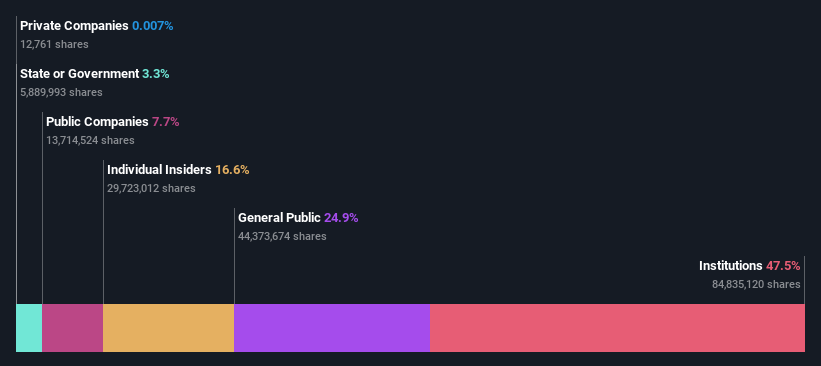

Insider Ownership: 16.6%

Earnings Growth Forecast: 41.8% p.a.

adidas AG has demonstrated robust growth, with second-quarter 2024 sales rising to €5.82 billion from €5.34 billion a year ago and net income increasing to €190 million from €84 million. The company raised its full-year guidance, expecting high-single-digit revenue growth and operating profit around €1 billion despite unfavorable currency effects. Earnings are forecasted to grow significantly at 41.8% annually over the next three years, outpacing the German market's average earnings growth rate of 20%.

- Click here to discover the nuances of adidas with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that adidas is trading beyond its estimated value.

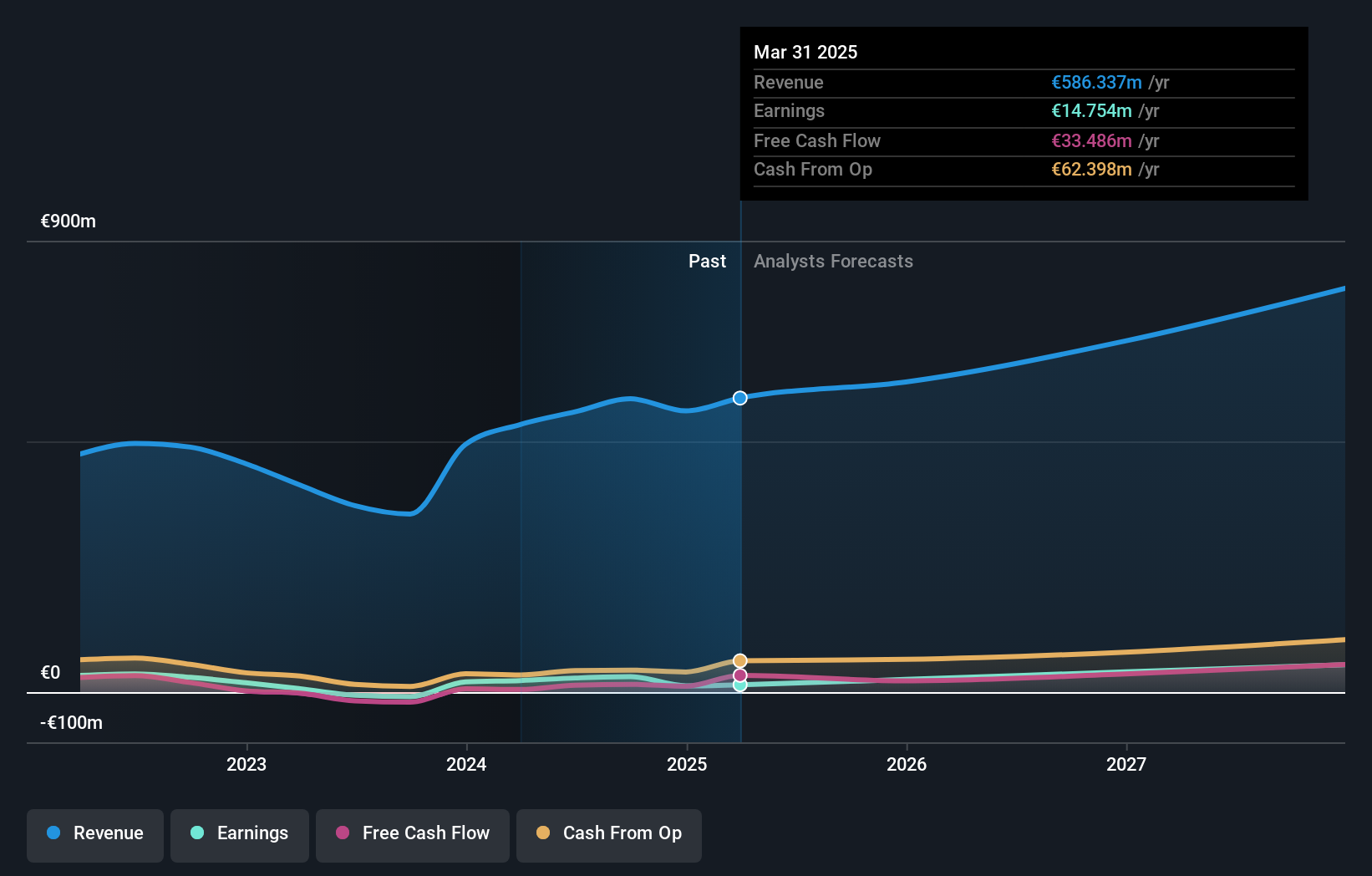

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE develops and markets technology platforms for the financial services, property, and insurance industries in Germany, with a market cap of €1.84 billion.

Operations: The company's revenue segments are Credit Platform (€157.97 million), Insurance Platform (€66.89 million), and Segment Adjustment (€175.87 million).

Insider Ownership: 35%

Earnings Growth Forecast: 35% p.a.

Hypoport SE has shown significant growth, with second-quarter 2024 sales increasing to €110.62 million from €85.29 million a year ago and net income rising to €2.4 million from a net loss of €2.61 million. The company's earnings are forecasted to grow significantly at 35% annually over the next three years, outpacing the German market's average of 19.9%. Despite high volatility in its share price, Hypoport became profitable this year and maintains substantial insider ownership.

- Navigate through the intricacies of Hypoport with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Hypoport's share price might be on the expensive side.

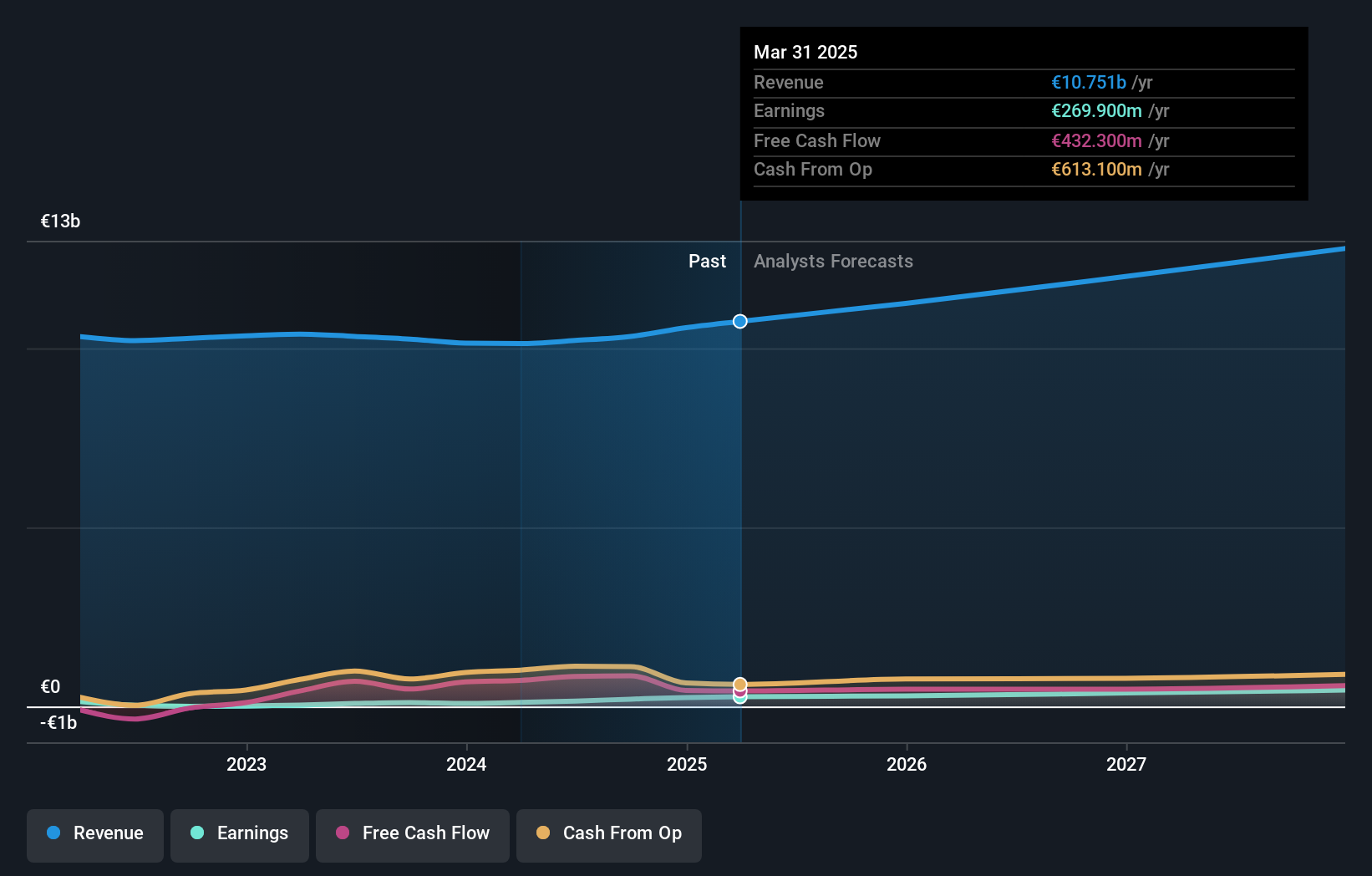

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products with a market cap of €6.84 billion.

Operations: The company generates revenue of €10.49 billion from its online platform for fashion and lifestyle products.

Insider Ownership: 10.4%

Earnings Growth Forecast: 25.1% p.a.

Zalando SE reported strong second-quarter 2024 earnings with sales of €2.64 billion, up from €2.56 billion a year ago, and net income rising to €95.7 million from €56.6 million. Despite CFO Dr. Sandra Dembeck's upcoming departure, the company is trading at 54% below its estimated fair value and has no recent insider trading activity. Earnings are forecasted to grow significantly at 25% annually over the next three years, surpassing the German market average of 19%.

- Dive into the specifics of Zalando here with our thorough growth forecast report.

- Our valuation report here indicates Zalando may be overvalued.

Where To Now?

- Reveal the 22 hidden gems among our Fast Growing German Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America.

High growth potential with excellent balance sheet.