- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

European Growth Companies With High Insider Ownership November 2025

Reviewed by Simply Wall St

As European markets navigate mixed signals with the pan-European STOXX Europe 600 Index recently pulling back, investor focus remains on growth companies that can thrive despite shifting economic conditions. High insider ownership is often seen as a positive indicator, suggesting alignment between company leadership and shareholder interests, making these stocks particularly appealing in today's cautious yet opportunistic market environment.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 95.9% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85.9% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

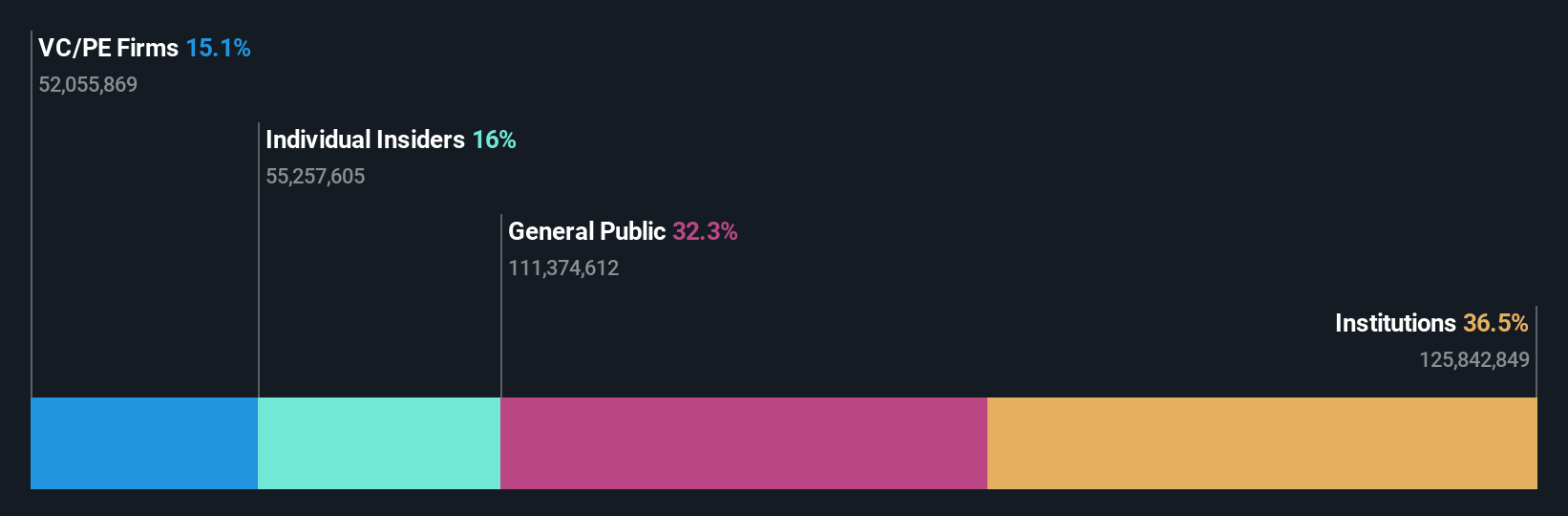

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK9.23 billion.

Operations: Truecaller generates revenue primarily from its communications software segment, which amounted to approximately SEK2.02 billion.

Insider Ownership: 16.1%

Truecaller demonstrates robust growth potential with high insider ownership, marked by significant earnings growth expected at 20.82% annually. Despite revenue growing slower than earnings, it surpasses the Swedish market average. Recent product launches like the Verified Business Customer Experience Platform and adVantage AI engine enhance business communication and engagement, potentially driving further expansion. Analysts predict a substantial stock price increase of 123.5%, while trading at a good value below fair estimates supports its investment appeal amid no substantial insider selling recently.

- Click here to discover the nuances of Truecaller with our detailed analytical future growth report.

- Our valuation report unveils the possibility Truecaller's shares may be trading at a discount.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

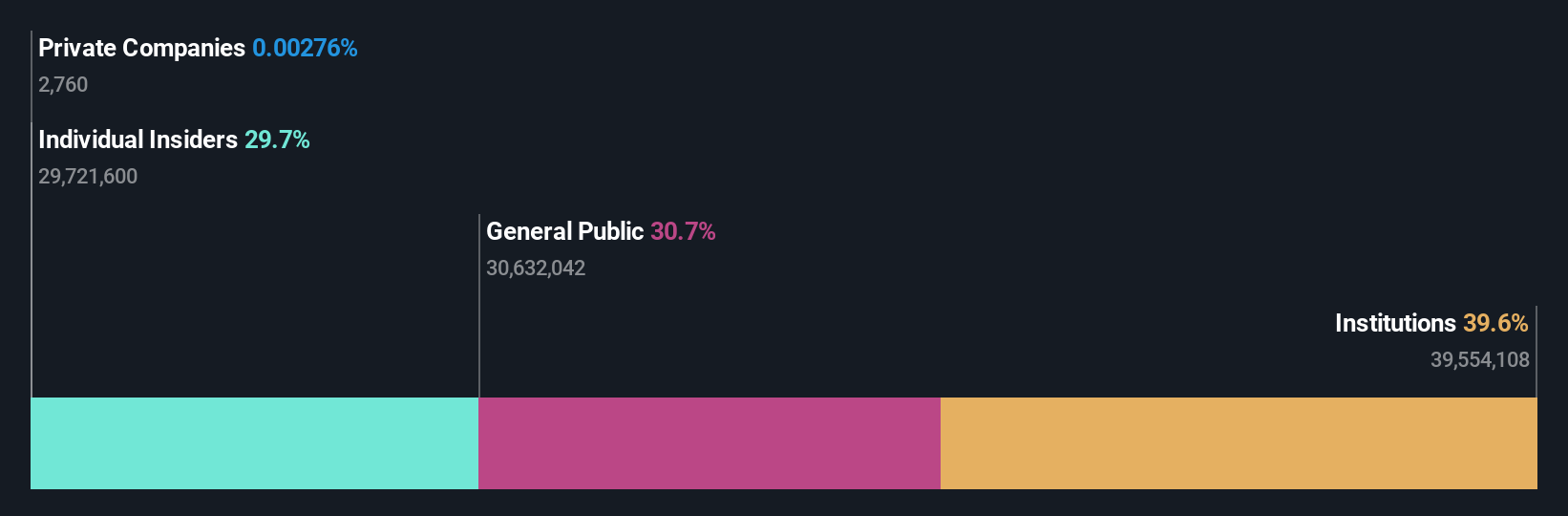

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for personal computers and consoles in Poland, with a market cap of PLN24.99 billion.

Operations: The company's revenue is primarily derived from its CD PROJEKT RED segment, which accounts for PLN812.26 million, and the GOG.Com segment, contributing PLN205.97 million.

Insider Ownership: 29.7%

CD Projekt exhibits strong growth prospects with substantial insider ownership. Earnings are forecast to grow significantly at 51% annually, outpacing the Polish market's 15.8%. Revenue is also expected to increase rapidly by 35.5%, exceeding market averages. Despite recent earnings showing a slight decline in net income, the stock trades well below its estimated fair value and maintains high-quality earnings with robust non-cash components, highlighting its potential as a compelling investment opportunity.

- Click to explore a detailed breakdown of our findings in CD Projekt's earnings growth report.

- Upon reviewing our latest valuation report, CD Projekt's share price might be too optimistic.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

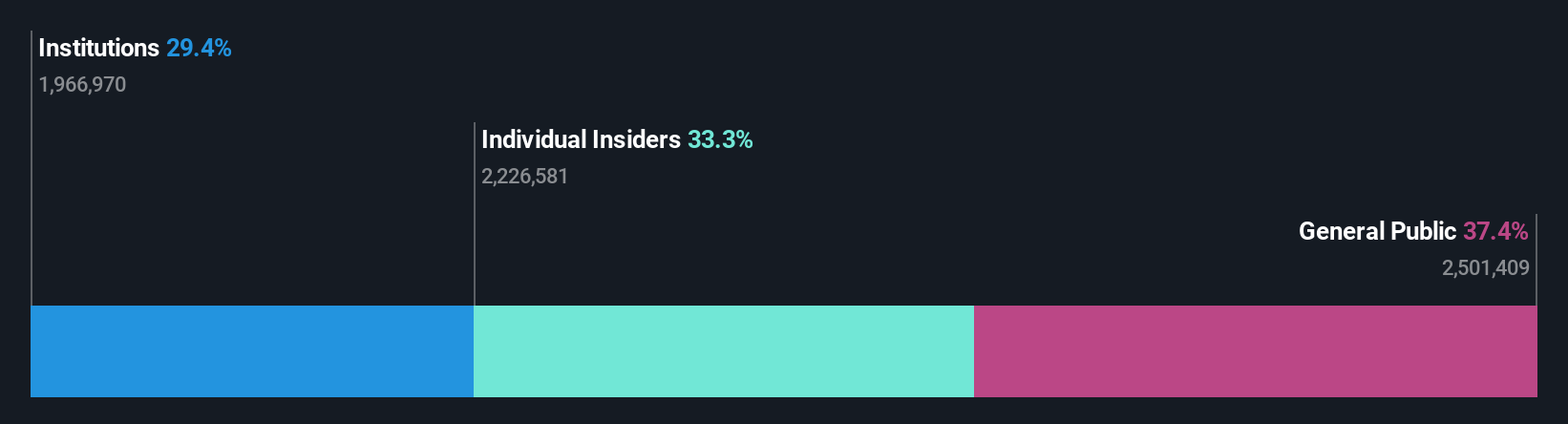

Overview: Hypoport SE develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany with a market cap of €804.73 million.

Operations: The company's revenue is primarily derived from its Real Estate & Mortgage Platforms (€453.13 million), Financing Platforms (€77.69 million), and Insurance Platforms (€65.71 million).

Insider Ownership: 33.3%

Hypoport demonstrates promising growth potential, with earnings expected to grow significantly at 40.75% annually, surpassing the German market's 16.9%. Despite a forecasted revenue increase of 10% per year, which is slower than some high-growth benchmarks, the company maintains steady insider ownership. Recent guidance adjusted revenue expectations for 2025 to at least €600 million due to market conditions but kept EBIT forecasts stable, reflecting management's confidence in profitability amid evolving challenges.

- Navigate through the intricacies of Hypoport with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Hypoport is priced higher than what may be justified by its financials.

Where To Now?

- Get an in-depth perspective on all 189 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Ready To Venture Into Other Investment Styles? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives