- Germany

- /

- Capital Markets

- /

- XTRA:HXCK

The Ernst Russ (ETR:HXCK) Share Price Has Soared 493%, Delighting Many Shareholders

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you buy and hold the right company, the returns can make a huge difference to both you and your family. In the case of Ernst Russ AG (ETR:HXCK), the share price is up an incredible 493% in the last year alone. Also pleasing for shareholders was the 51% gain in the last three months. And shareholders have also done well over the long term, with an increase of 233% in the last three years.

See our latest analysis for Ernst Russ

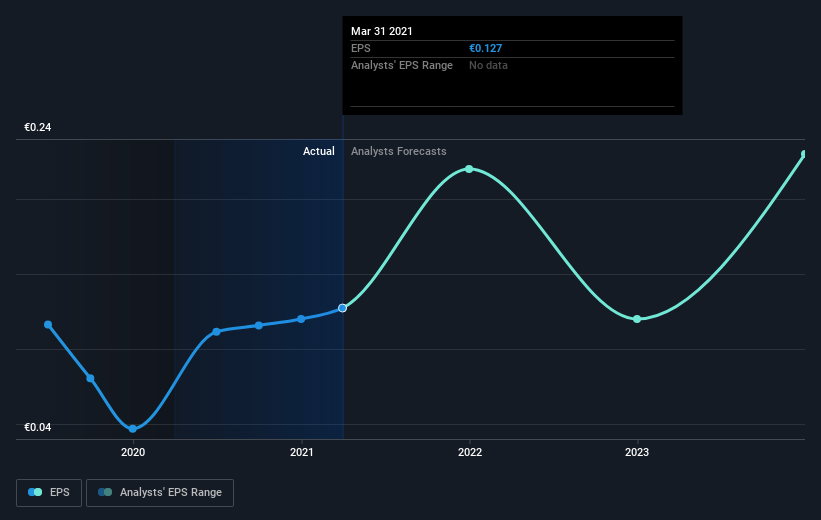

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Ernst Russ grew its earnings per share (EPS) by 61%. This EPS growth is significantly lower than the 493% increase in the share price. This indicates that the market is now more optimistic about the stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Ernst Russ has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

We're pleased to report that Ernst Russ shareholders have received a total shareholder return of 493% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 26% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Ernst Russ you should be aware of, and 1 of them is potentially serious.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

When trading Ernst Russ or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ernst Russ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ernst Russ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:HXCK

Flawless balance sheet and undervalued.

Market Insights

Community Narratives