- Germany

- /

- Capital Markets

- /

- XTRA:DBK

A Look at Deutsche Bank (XTRA:DBK) Valuation Following New Bond Offering and Stakeholder Presentation

Reviewed by Simply Wall St

Deutsche Bank (XTRA:DBK) recently caught the market’s attention with the announcement of a new fixed-income bond offering and news of an upcoming company presentation at the General Counsel Conference East. These developments provide investors with additional context on the bank’s current funding strategies and ongoing engagement with stakeholders.

See our latest analysis for Deutsche Bank.

Deutsche Bank’s recent bond issuance and high-profile conference appearance have added fresh momentum to the share price. The stock has surged over 98% year-to-date, closing at $33.35. The one-year total shareholder return is an eye-catching 120%, suggesting renewed confidence in the bank's outlook and a growing appetite for its turnaround story among investors.

If the renewed momentum in banking has you considering what’s next, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With impressive recent gains and a revived narrative around its prospects, the key question now is whether Deutsche Bank is still trading at attractive levels or if the market is already factoring in all of its future growth.

Most Popular Narrative: 4.9% Overvalued

Deutsche Bank’s current share price of €33.35 is modestly above the narrative’s fair value estimate of €31.80, suggesting the market’s optimism slightly outruns calculated fundamentals. With this small premium, market confidence appears strong even as detailed forecasts anchor the narrative’s projections.

The accelerating mobilization of German household savings into capital markets and investment products, driven by both government incentives (e.g., early investment programs), anticipated pension reforms, and the growing shift away from deposit-based savings, positions Deutsche Bank as the gateway to European investment for domestic and global clients. This can drive recurring fee income and AUM growth in wealth and asset management, supporting top-line revenue expansion and enhancing net margins due to higher-margin business mix.

Curious what assumptions drive this valuation? The narrative hints that higher margins and new revenue streams shape Deutsche Bank’s future, yet it keeps the most critical growth levers a mystery. See which bold forecasts underpin this price, and decide what you believe.

Result: Fair Value of €31.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit losses or adverse litigation outcomes could quickly undermine Deutsche Bank’s outlook and bring the recent surge in investor optimism to a halt.

Find out about the key risks to this Deutsche Bank narrative.

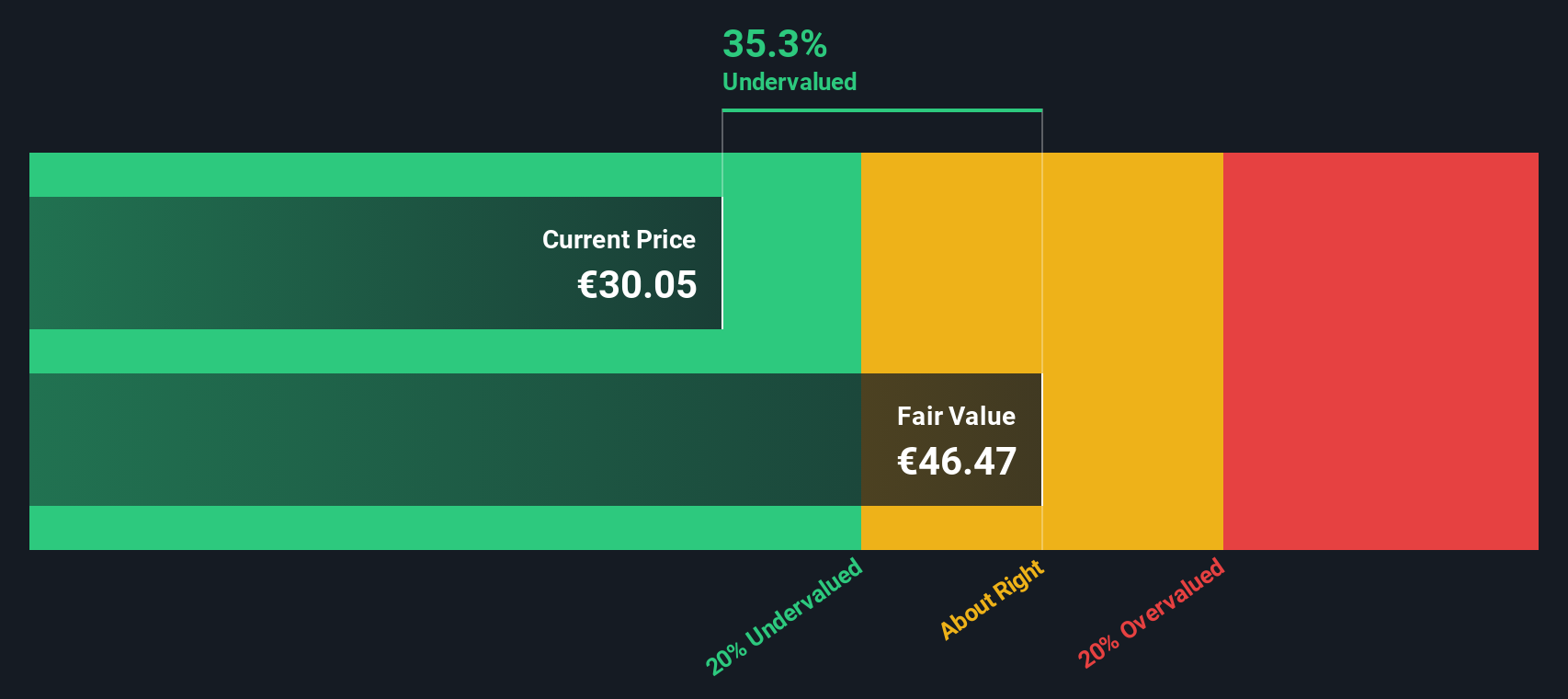

Another View: SWS DCF Model Suggests More Upside

While multiples suggest Deutsche Bank is priced just above fair value, our SWS DCF model tells a different story. The DCF approach values the bank at €35.48 per share, pointing to a 6% undervaluation at current prices. Is this a sign of deeper value, or simply optimism reflected in the forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Deutsche Bank Narrative

If you find yourself questioning these conclusions or want to dig deeper into the numbers, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Deutsche Bank research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop here. There are standout opportunities waiting for you beyond Deutsche Bank. Open your investment horizons and get ahead of tomorrow’s trends today.

- Capture reliable passive income and boost your portfolio by checking out these 14 dividend stocks with yields > 3% with solid yields above 3%.

- Tap into the next wave of medical breakthroughs by browsing these 32 healthcare AI stocks, featuring innovators harnessing artificial intelligence in healthcare solutions.

- Supercharge your returns with these 863 undervalued stocks based on cash flows offering strong cash flow potential at compelling prices that others may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DBK

Deutsche Bank

A stock corporation, provides corporate and investment banking, private clients, and asset management products and services in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives