- Germany

- /

- Capital Markets

- /

- XTRA:CPX

capsensixx (ETR:CPX) soars 10% this week, taking three-year gains to 90%

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. Just take a look at capsensixx AG (ETR:CPX), which is up 90%, over three years, soundly beating the market decline of 2.2% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 2.5% in the last year.

Since the stock has added €4.6m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for capsensixx

SWOT Analysis for capsensixx

- Debt is not viewed as a risk.

- Earnings declined over the past year.

- Trading below our estimate of fair value by more than 20%.

- Lack of analyst coverage makes it difficult to determine CPX's earnings prospects.

- No apparent threats visible for CPX.

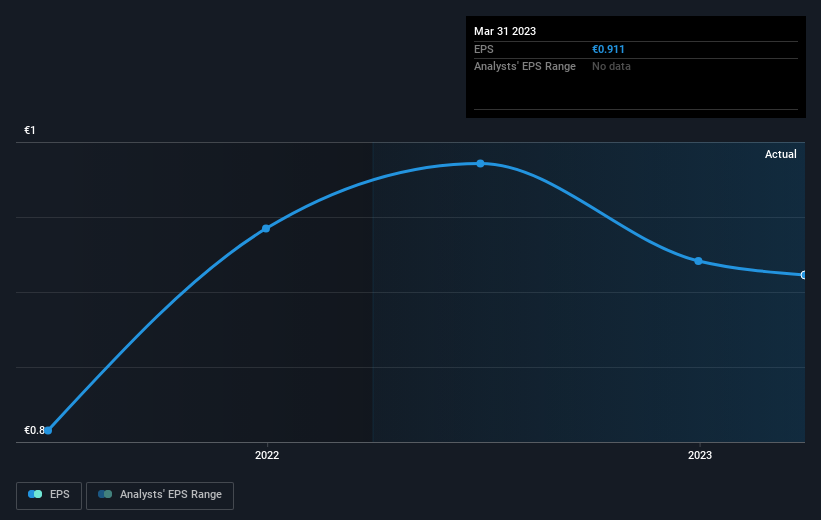

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

A Different Perspective

capsensixx shareholders gained a total return of 2.5% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 0.6% over half a decade This suggests the company might be improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for capsensixx you should know about.

Of course capsensixx may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if capsensixx might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CPX

capsensixx

Engages in the financial administration as a service business.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives