- Germany

- /

- Diversified Financial

- /

- XTRA:CHG

CHAPTERS Group AG's (ETR:CHG) Shares Climb 36% But Its Business Is Yet to Catch Up

Despite an already strong run, CHAPTERS Group AG (ETR:CHG) shares have been powering on, with a gain of 36% in the last thirty days. The last 30 days bring the annual gain to a very sharp 81%.

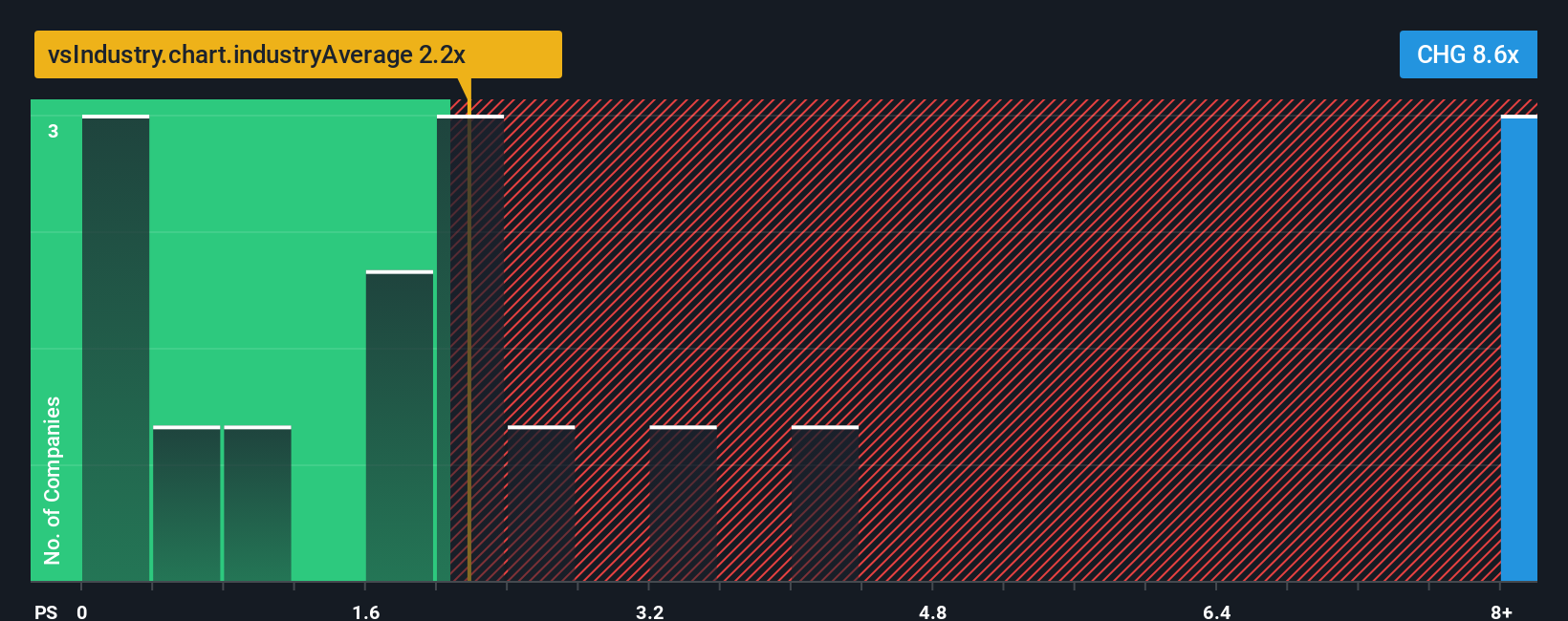

After such a large jump in price, when almost half of the companies in Germany's Diversified Financial industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider CHAPTERS Group as a stock not worth researching with its 8.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for CHAPTERS Group

How CHAPTERS Group Has Been Performing

CHAPTERS Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CHAPTERS Group.Is There Enough Revenue Growth Forecasted For CHAPTERS Group?

In order to justify its P/S ratio, CHAPTERS Group would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 68% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 24% as estimated by the only analyst watching the company. That's shaping up to be similar to the 23% growth forecast for the broader industry.

With this in consideration, we find it intriguing that CHAPTERS Group's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Shares in CHAPTERS Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that CHAPTERS Group currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for CHAPTERS Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CHG

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives