- Ireland

- /

- Consumer Durables

- /

- ISE:GVR

European Penny Stocks With Market Caps Larger Than €80M

Reviewed by Simply Wall St

The European market recently experienced a downturn, with the STOXX Europe 600 Index declining by 1.10% as investors took profits following record highs, compounded by political turmoil in France and international trade tensions. Despite these challenges, certain segments of the market continue to offer intriguing opportunities for investors willing to explore beyond traditional blue-chip stocks. Penny stocks—though often considered a throwback term—represent such an opportunity, particularly when they are backed by strong balance sheets and solid fundamentals. In this article, we explore several penny stocks that stand out for their financial strength and potential growth prospects amidst current market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.11 | €16.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.32 | €44.1M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.92 | €26.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.55 | DKK115.04M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.52 | €36.65M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.96 | €77.87M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.43M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.079 | €8.35M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Angler Gaming (DB:0QM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angler Gaming plc invests in companies providing online gaming services in Malta and has a market cap of €221.21 million.

Operations: The company's revenue primarily comes from its Casinos & Resorts segment, generating €34.00 million.

Market Cap: €221.21M

Angler Gaming plc, with a market cap of €221.21 million, operates in the online gaming sector and recently reported a decline in sales for Q2 2025 to €6.64 million from €10.21 million the previous year. Despite this, net income for the first half of 2025 increased to €1.82 million from €1.51 million year-over-year, reflecting improved profit margins at 6.3%. The company is debt-free and its short-term assets exceed liabilities significantly, indicating strong financial health in that regard. However, earnings have declined by an average of 46.3% annually over five years despite forecasts suggesting future growth potential.

- Click to explore a detailed breakdown of our findings in Angler Gaming's financial health report.

- Review our growth performance report to gain insights into Angler Gaming's future.

Glenveagh Properties (ISE:GVR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glenveagh Properties PLC, along with its subsidiaries, focuses on constructing and selling houses and apartments for private buyers, local authorities, and the private rental sector in Ireland, with a market cap of approximately €976.21 million.

Operations: The company generates revenue through its Partnerships segment, which accounts for €192.61 million, with a segment adjustment of €865.99 million.

Market Cap: €976.21M

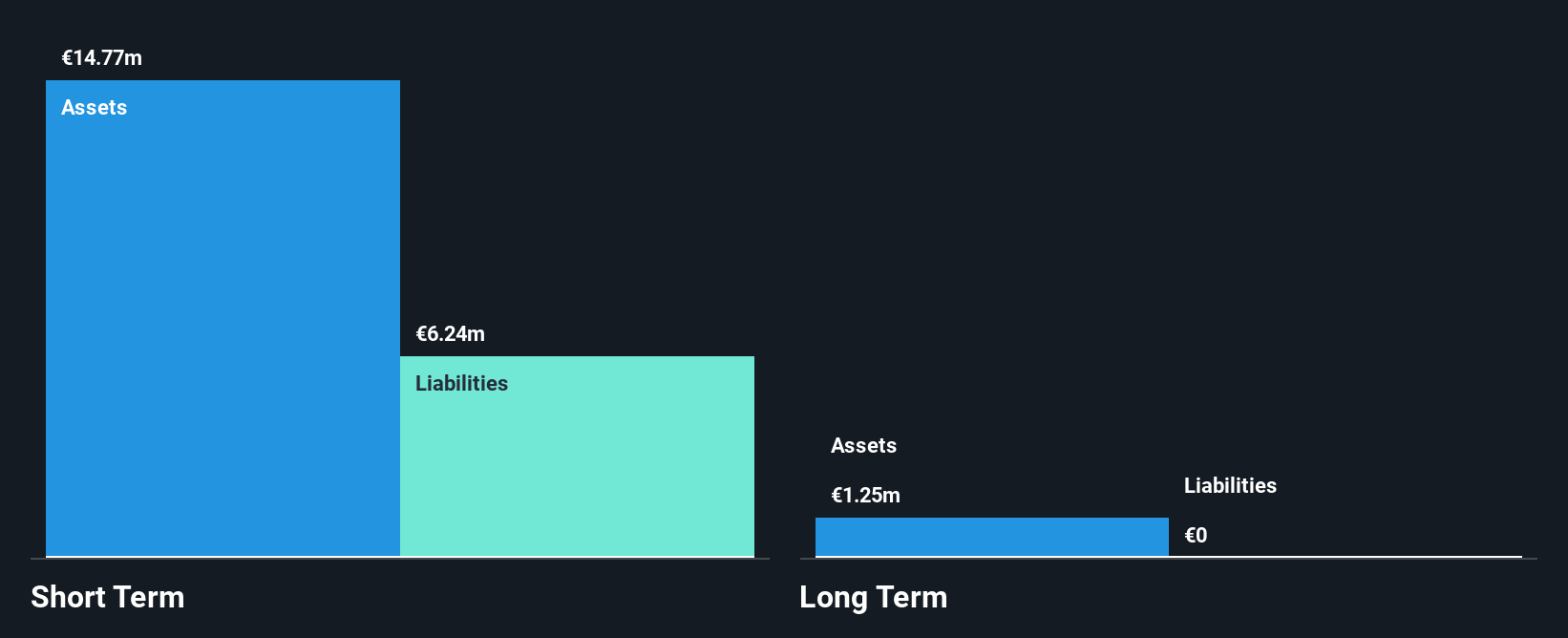

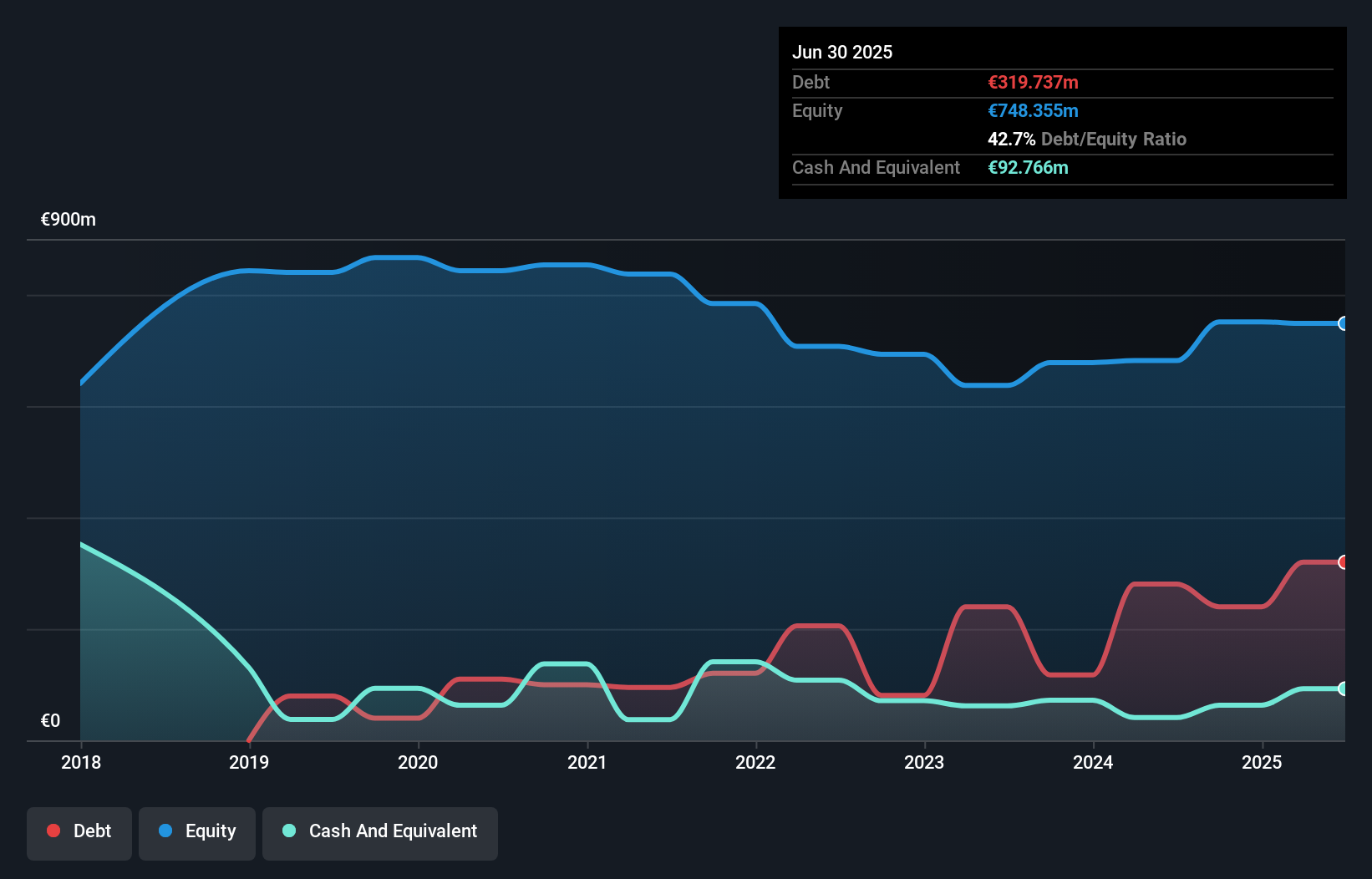

Glenveagh Properties PLC, with a market cap of €976.21 million, has shown robust financial health and growth potential within the penny stock segment. Recent earnings reports highlight significant revenue growth to €341.59 million for H1 2025 from €152.19 million a year ago, alongside net income rising to €28.36 million. The company maintains strong liquidity with short-term assets exceeding both short and long-term liabilities substantially, while its debt is well-covered by operating cash flow at 28.2%. Despite an increase in debt-to-equity ratio over five years, Glenveagh's interest payments are adequately covered by EBIT (7.9x), reflecting manageable financial leverage.

- Click here and access our complete financial health analysis report to understand the dynamics of Glenveagh Properties.

- Examine Glenveagh Properties' earnings growth report to understand how analysts expect it to perform.

Kudelski (SWX:KUD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kudelski SA, along with its subsidiaries, offers digital access and security solutions for digital television and interactive applications across Switzerland, the United States, France, Germany, Austria, and other international markets with a market cap of CHF75.23 million.

Operations: The company generates revenue from its Cybersecurity segment amounting to $106.04 million and the Internet of Things segment contributing $45.13 million.

Market Cap: CHF75.23M

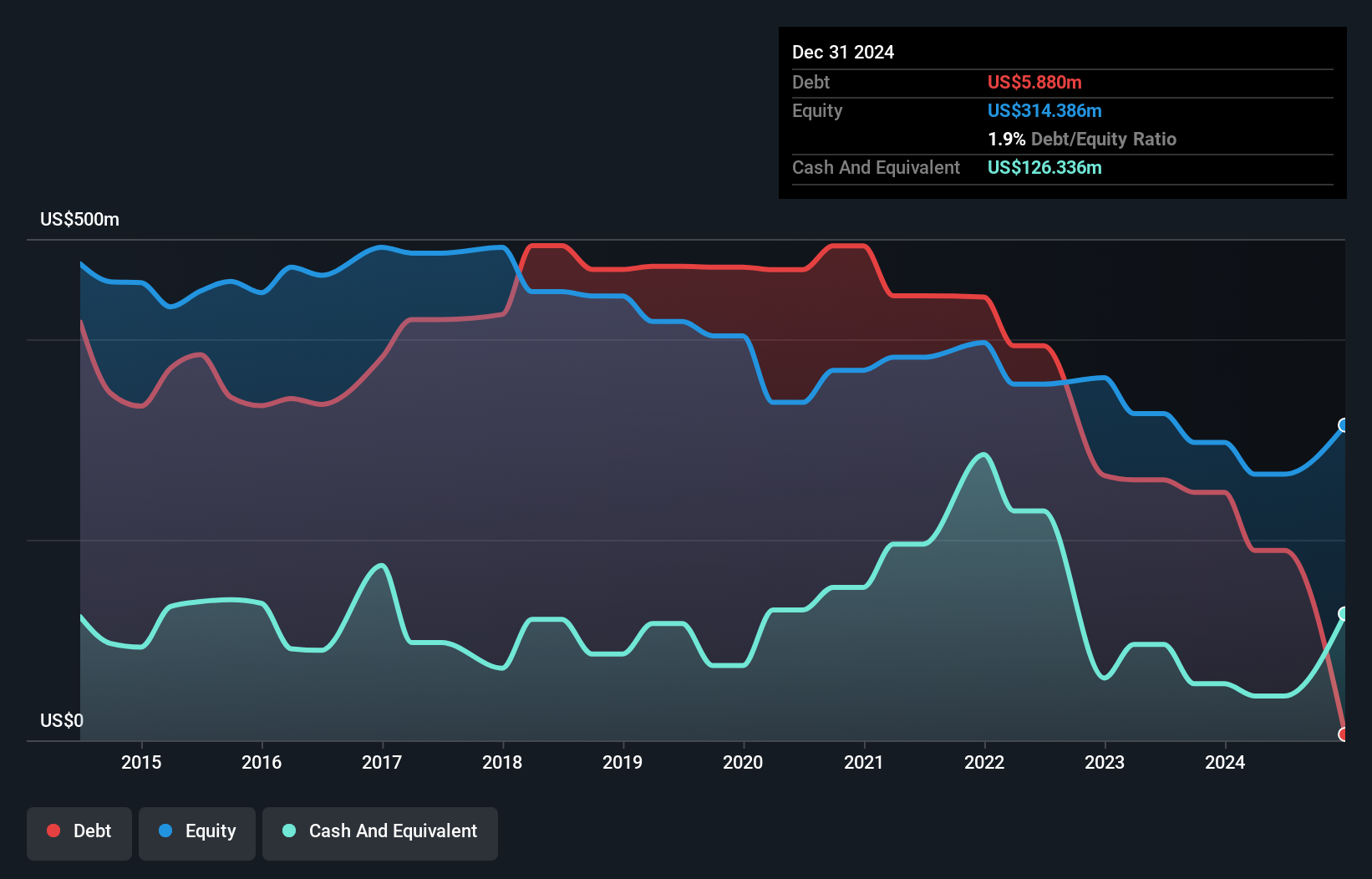

Kudelski SA, with a market cap of CHF75.23 million, operates in digital security and IoT sectors, generating significant revenues from both segments. Despite a net loss of US$34.24 million for H1 2025 and declining sales compared to the previous year, the company remains strategically active through partnerships like its recent collaboration with Broadpeak to enhance streaming security solutions. Kudelski's financial position is bolstered by more cash than total debt and short-term assets exceeding liabilities; however, it faces challenges with high volatility and less than one year of cash runway based on current free cash flow trends.

- Navigate through the intricacies of Kudelski with our comprehensive balance sheet health report here.

- Gain insights into Kudelski's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Jump into our full catalog of 279 European Penny Stocks here.

- Want To Explore Some Alternatives? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:GVR

Glenveagh Properties

Glenveagh Properties PLC, together with its subsidiaries, constructs and sells houses and apartments for the private buyers, local authorities, and the private rental sector in Ireland.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives