- Germany

- /

- Hospitality

- /

- XTRA:TIMA

ZEAL Network's (ETR:TIMA) Promising Earnings May Rest On Soft Foundations

Despite posting some strong earnings, the market for ZEAL Network SE's (ETR:TIMA) stock hasn't moved much. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

View our latest analysis for ZEAL Network

A Closer Look At ZEAL Network's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

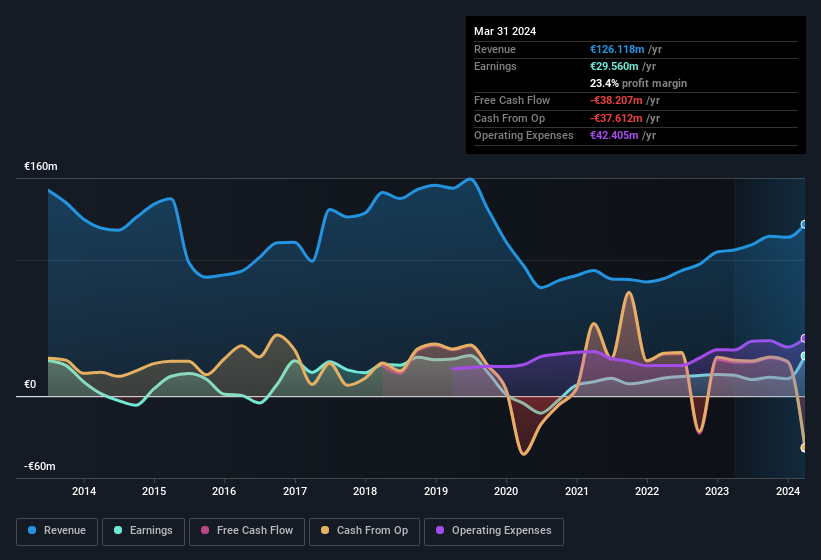

For the year to March 2024, ZEAL Network had an accrual ratio of 0.27. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of €38m, in contrast to the aforementioned profit of €29.6m. It's worth noting that ZEAL Network generated positive FCF of €25m a year ago, so at least they've done it in the past. However, as we will discuss below, we can see that the company's accrual ratio has been impacted by its tax situation. This would certainly have contributed to the weak cash conversion. The good news for shareholders is that ZEAL Network's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

In addition to the notable accrual ratio, we can see that ZEAL Network received a tax benefit of €8.0m. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On ZEAL Network's Profit Performance

This year, ZEAL Network couldn't match its profit with cashflow. If the tax benefit is not repeated, then profit would drop next year, all else being equal. Considering all this we'd argue ZEAL Network's profits probably give an overly generous impression of its sustainable level of profitability. If you'd like to know more about ZEAL Network as a business, it's important to be aware of any risks it's facing. Be aware that ZEAL Network is showing 2 warning signs in our investment analysis and 1 of those shouldn't be ignored...

Our examination of ZEAL Network has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if ZEAL Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TIMA

ZEAL Network

Engages in the online lottery brokerage business in Germany.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives