In the current global market landscape, investors are navigating a complex environment marked by fluctuating interest rates and geopolitical uncertainties, with U.S. stocks experiencing volatility due to AI competition fears and mixed corporate earnings results. Amid these challenges, growth companies with significant insider ownership can offer unique opportunities as they often indicate strong confidence from those closest to the business. In this article, we explore three such companies that stand out for their potential in today's shifting economic climate.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.4% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's uncover some gems from our specialized screener.

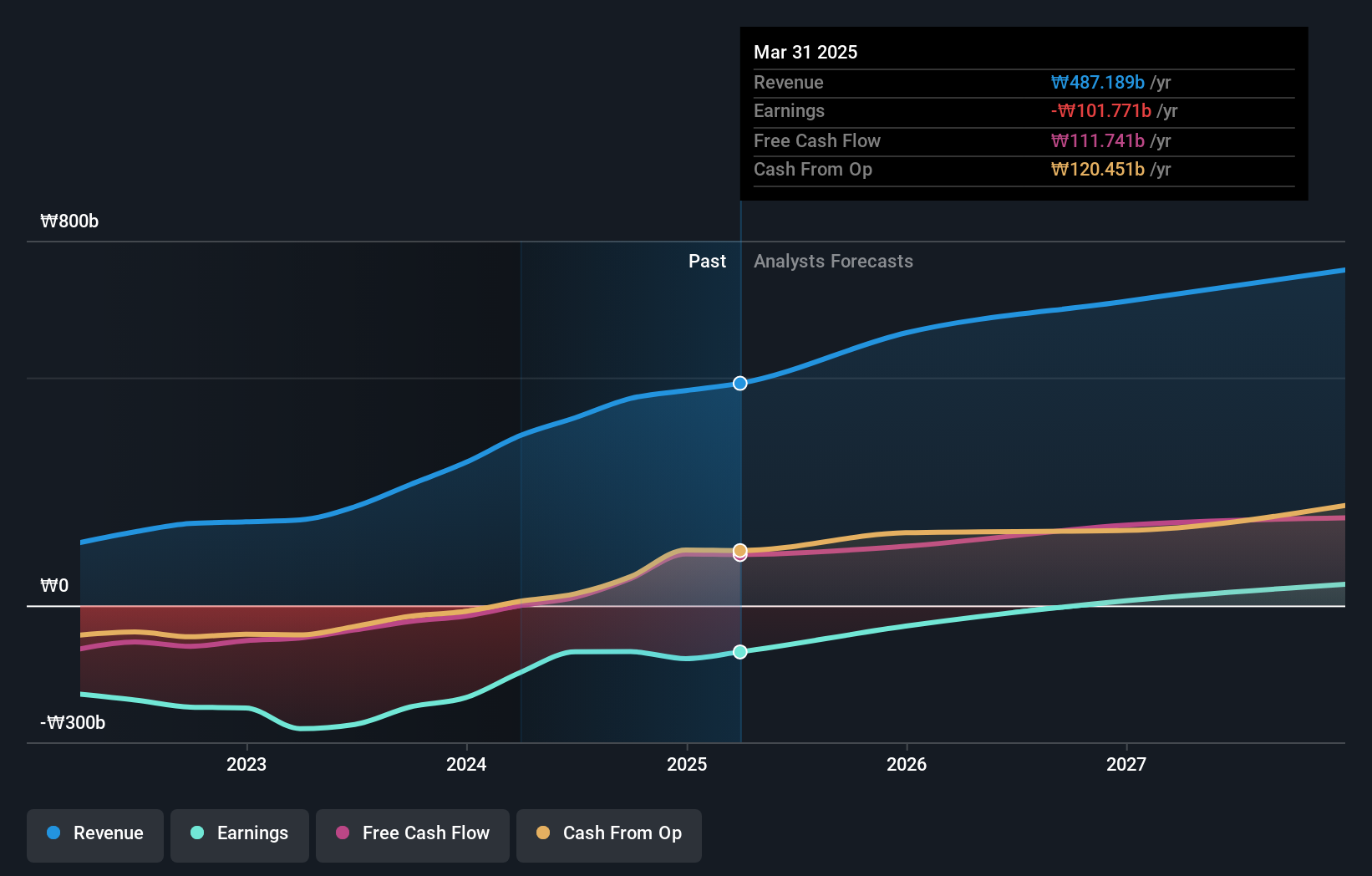

Lotte Tour Development (KOSE:A032350)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Tour Development Co., Ltd., along with its subsidiaries, provides travel and tourism services in South Korea and has a market cap of approximately ₩610.33 billion.

Operations: The company's revenue is primarily derived from the Dream Tower Integrated Resort Division at ₩366.86 billion, followed by the Travel Related Service Sector (excluding Internet Journalism) at ₩85.02 billion, and the Internet Media Sector at ₩2.30 billion.

Insider Ownership: 29.6%

Lotte Tour Development's recent earnings report shows significant sales growth, yet it remains unprofitable with a reduced net loss. Despite being dropped from the KOSPI 200 Index, the company's revenue is forecast to grow faster than the Korean market average. It trades at a substantial discount to its estimated fair value and is expected to become profitable within three years, indicating potential for future growth despite current low return on equity forecasts.

- Delve into the full analysis future growth report here for a deeper understanding of Lotte Tour Development.

- Our valuation report here indicates Lotte Tour Development may be undervalued.

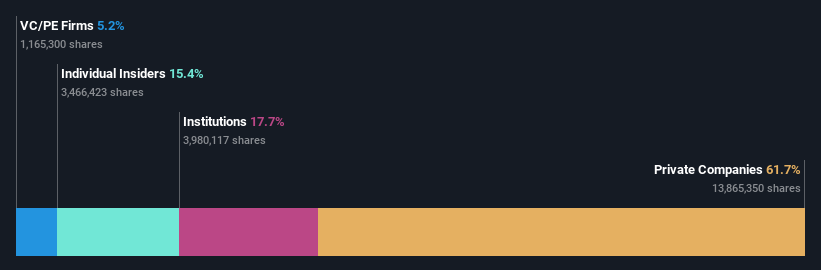

TF Bank (OM:TFBANK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via a proprietary IT platform in Sweden, with a market cap of SEK7.98 billion.

Operations: The company generates its revenue through three main segments: Credit Cards (SEK616.31 million), Consumer Lending (SEK609.26 million), and Ecommerce Solutions excluding Credit Cards (SEK393.34 million).

Insider Ownership: 15.4%

TF Bank's earnings and revenue are forecast to grow faster than the Swedish market, with earnings expected to increase by 17.4% annually. The company trades at a significant discount to its estimated fair value, and analysts agree on a potential price rise of 20.5%. Recent results show strong performance with net income more than doubling year-over-year. Insider buying has occurred recently, although not in substantial volumes, indicating positive insider sentiment.

- Dive into the specifics of TF Bank here with our thorough growth forecast report.

- The analysis detailed in our TF Bank valuation report hints at an deflated share price compared to its estimated value.

HomeToGo (XTRA:HTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HomeToGo SE operates a marketplace for vacation rentals, connecting users in Luxembourg and internationally, with a market cap of €252.97 million.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to €200.22 million.

Insider Ownership: 11.3%

HomeToGo is forecast to achieve profitability within three years, outpacing average market growth. The company's revenue is expected to grow 15.9% annually, surpassing the German market's rate. Despite a volatile share price recently, HomeToGo trades significantly below its estimated fair value and analysts predict a substantial price increase. Recent earnings results show improved sales and reduced net loss year-over-year. The company has completed a share buyback program, enhancing shareholder value without significant insider trading activity noted recently.

- Click here to discover the nuances of HomeToGo with our detailed analytical future growth report.

- The valuation report we've compiled suggests that HomeToGo's current price could be quite moderate.

Turning Ideas Into Actions

- Dive into all 1478 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade TF Bank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives