- Germany

- /

- Hospitality

- /

- XTRA:DHER

Delivery Hero SE (ETR:DHER) Stocks Shoot Up 31% But Its P/S Still Looks Reasonable

Delivery Hero SE (ETR:DHER) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

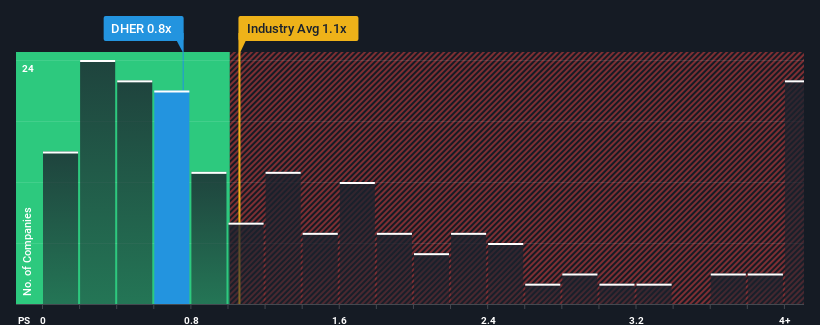

Even after such a large jump in price, it's still not a stretch to say that Delivery Hero's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Germany, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Delivery Hero

What Does Delivery Hero's Recent Performance Look Like?

There hasn't been much to differentiate Delivery Hero's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Delivery Hero.How Is Delivery Hero's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Delivery Hero's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 12% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's understandable that Delivery Hero's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Delivery Hero's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Delivery Hero maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you take the next step, you should know about the 2 warning signs for Delivery Hero that we have uncovered.

If these risks are making you reconsider your opinion on Delivery Hero, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DHER

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives