- Germany

- /

- Hospitality

- /

- XTRA:ACX

Spotlight On 3 European Penny Stocks With Market Caps Over €10M

Reviewed by Simply Wall St

As European markets experience a positive shift, with the STOXX Europe 600 Index rising by 3.44% amid easing tariff concerns, investors are eyeing opportunities for growth in various sectors. Penny stocks, though often overlooked and considered niche investments, continue to offer potential for significant returns when backed by strong financial fundamentals. In this article, we highlight three promising European penny stocks that combine solid balance sheets with growth potential, offering investors a chance to explore underappreciated opportunities in the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Transferator (NGM:TRAN A) | SEK2.77 | SEK263.63M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.78 | SEK283.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.68 | PLN124.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.56 | €53.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.20 | €24.32M | ✅ 3 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.58 | €17.13M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22.01M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 435 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Nextedia (ENXTPA:ALNXT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nextedia S.A. operates in France, offering cybersecurity, cloud and digital workspace, and customer experience solutions, with a market cap of €21.55 million.

Operations: The company generates revenue from its Direct Marketing segment, which amounts to €64.6 million.

Market Cap: €21.55M

Nextedia S.A., with a market cap of €21.55 million, operates in France's IT sector, providing cybersecurity and digital solutions. It generated €64.6 million in revenue from its Direct Marketing segment. Despite a volatile share price recently, the company trades at 59.1% below estimated fair value and has high-quality earnings, with short-term assets covering both short-term and long-term liabilities comfortably. Earnings grew significantly by 293.8% last year, surpassing industry growth rates; however, they have declined by an average of 5.6% over five years. The debt-to-equity ratio is satisfactory at 1.3%, although cash flow remains negative.

- Click here and access our complete financial health analysis report to understand the dynamics of Nextedia.

- Evaluate Nextedia's prospects by accessing our earnings growth report.

Biomass Energy Project (WSE:BEP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Biomass Energy Project S.A. operates in Poland, focusing on energy crop plantations, with a market capitalization of PLN21.75 million.

Operations: The company generates revenue primarily from its agriculture segment, amounting to PLN1.89 billion.

Market Cap: PLN21.75M

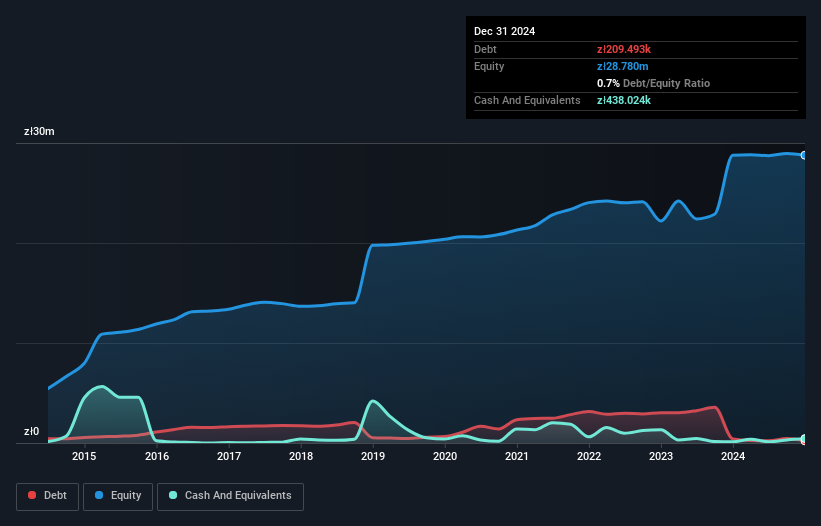

Biomass Energy Project S.A., with a market cap of PLN21.75 million, operates in Poland's energy crop sector. Despite generating less than US$1 million in revenue, recent earnings show improvement, with a 40.6% growth over the past year and net profit margins rising to 21.1%. The company benefits from strong asset coverage for both short and long-term liabilities and has reduced its debt-to-equity ratio significantly over five years. However, share price volatility remains high compared to other Polish stocks, and operating cash flow is negative despite well-covered interest payments by EBIT at 31.8 times coverage.

- Unlock comprehensive insights into our analysis of Biomass Energy Project stock in this financial health report.

- Assess Biomass Energy Project's previous results with our detailed historical performance reports.

bet-at-home.com (XTRA:ACX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: bet-at-home.com AG, with a market cap of €17.76 million, operates through its subsidiaries to offer online sports betting and gaming services.

Operations: The company's revenue is primarily derived from online sports bets, generating €46.12 million, and online gaming activities such as casino, poker, games, and virtual sports, contributing €5.78 million.

Market Cap: €17.76M

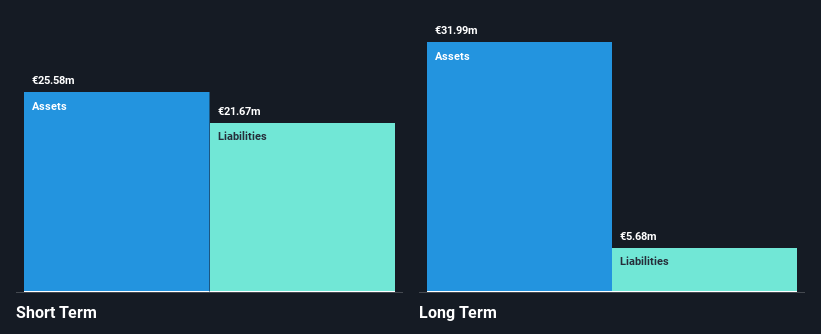

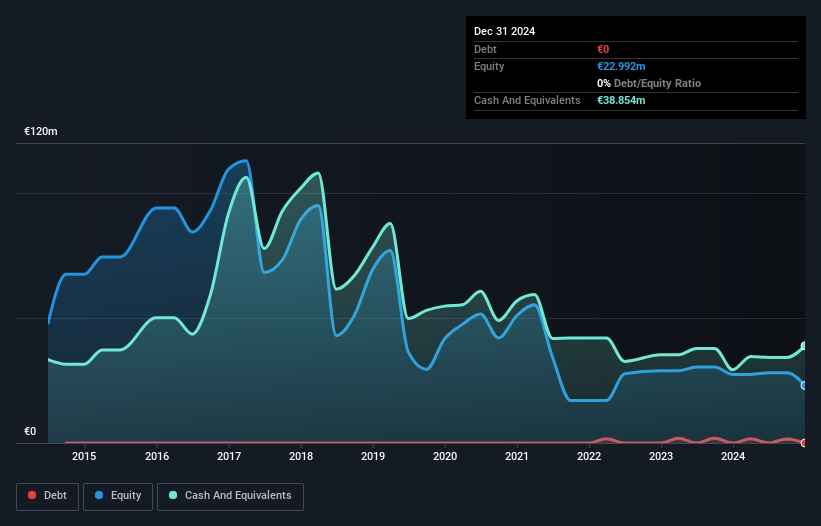

bet-at-home.com AG, with a market cap of €17.76 million, reported 2024 sales of €52.3 million but faced a net loss of €4.45 million, highlighting ongoing profitability challenges despite revenue growth from the previous year. The company remains debt-free and its short-term assets comfortably exceed both short and long-term liabilities, suggesting financial stability in this area. However, it struggles with negative return on equity at -19.36% due to unprofitability over the past five years. Trading significantly below estimated fair value may attract investors seeking potential recovery opportunities in the online betting sector amidst volatile market conditions.

- Click to explore a detailed breakdown of our findings in bet-at-home.com's financial health report.

- Assess bet-at-home.com's future earnings estimates with our detailed growth reports.

Make It Happen

- Reveal the 435 hidden gems among our European Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ACX

bet-at-home.com

Through its subsidiaries, provides online sports betting and gaming services.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives