- Germany

- /

- Food and Staples Retail

- /

- HMSE:B4B

Metro (HMSE:B4B) Q4 Loss Deepens, Challenging Bullish Valuation Narrative

Reviewed by Simply Wall St

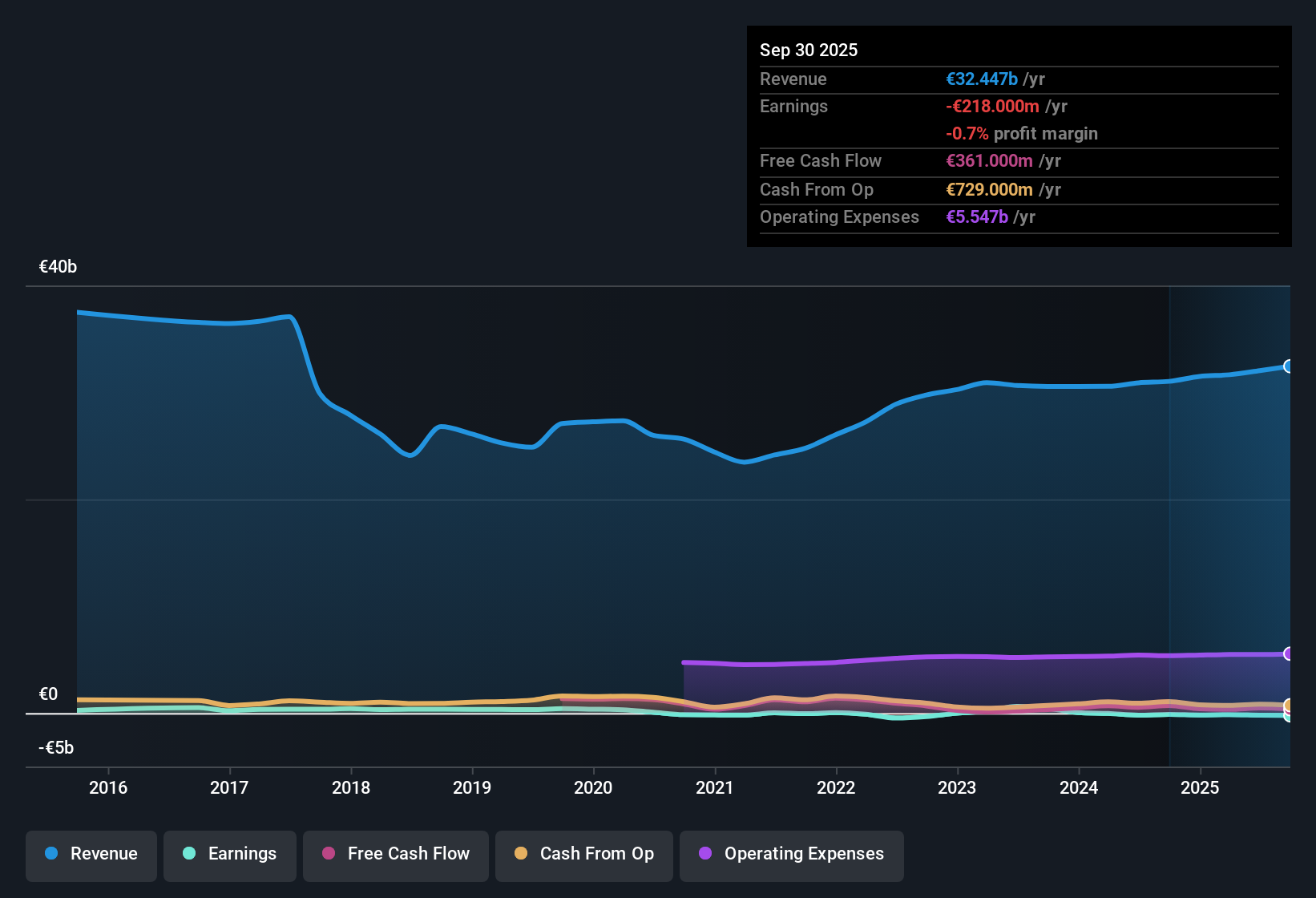

Metro (HMSE:B4B) has capped FY 2025 with fourth quarter revenue of €8.5 billion and a basic EPS of €-0.25, as net income excluding extra items landed at €-96 million. Over the last few quarters the company has seen revenue move from €8.0 billion in Q4 2024 to €8.5 billion in Q4 2025, while EPS shifted from €-0.21 to €-0.25 and trailing twelve month EPS sits at €-0.60 alongside net income of €-218 million on €32.4 billion of revenue. This points to a business that is still wrestling with thin, pressured margins.

See our full analysis for Metro.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the dominant narratives around Metro, and where the latest margin trends might start to challenge them.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trailing losses narrow but persist

- On a trailing basis, Metro generated about €32.4 billion in revenue over FY 2025 but still reported a net loss of €218 million and basic EPS of €-0.60, compared with a trailing loss of €120 million and EPS of €-0.33 at FY 2024 Q4.

- What stands out for bearish investors is that, even with quarterly revenue rising from €8.0 billion in Q4 2024 to €8.5 billion in Q4 2025, the company has not translated this scale into profits, as shown by negative net income in three of the four FY 2025 quarters.

- Critics highlight that Q1 2025 was the only profitable quarter, with €75 million of net income, while the other three quarters together lost €294 million.

- This pattern supports the cautious view that Metro’s thin wholesale margins remain vulnerable, because higher sales alone have not been enough to offset costs across the full year.

Deep valuation discount to DCF fair value

- At a share price of €5.58, Metro trades at a price to sales multiple of 0.1 times, below both the 0.4 times industry average and 0.2 times peer average, and roughly 60.9 percent below a DCF fair value of €14.29.

- Bulls argue that this combination of a low sales multiple and a large gap to DCF fair value heavily supports a value thesis, yet the ongoing losses over the trailing 12 months mean the upside case is closely tied to a turnaround that is not yet visible in the reported numbers.

- Supporters point to the modest 1.4 percent average annual reduction in losses over five years, but the latest trailing loss of €218 million shows profits are still not in sight.

- The tension for value focused investors is that the apparent 60 percent plus discount to DCF fair value exists alongside weak interest coverage and recent shareholder dilution, both of which sit on the risk side of the balance.

Financing strain and dilution risks

- Over the last 12 months Metro’s earnings did not comfortably cover interest payments and shareholders were substantially diluted, all while the business remained loss making with €-218 million of trailing net income.

- From a bearish perspective, these financing and capital structure pressures reinforce concerns that even with Metro’s low 0.1 times price to sales multiple, the balance of risks remains tilted toward the downside until the company consistently generates positive earnings.

- Skeptics underline that weak interest coverage means more of any future operating improvement may need to go toward servicing debt rather than rewarding shareholders.

- Significant dilution over the past year also means any eventual recovery in profitability will be spread across a larger share base, limiting per share benefits in the near term.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Metro's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Metro’s rising revenue has not translated into consistent profits; its interest coverage is weak, and recent shareholder dilution highlights mounting balance sheet pressure.

If you would rather back companies with stronger financial foundations, use our solid balance sheet and fundamentals stocks screener (1942 results) now to quickly find businesses built to handle volatility without diluting shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HMSE:B4B

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026