- Germany

- /

- Food and Staples Retail

- /

- XTRA:HFG

HelloFresh SE (ETR:HFG) Stock Rockets 35% As Investors Are Less Pessimistic Than Expected

HelloFresh SE (ETR:HFG) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 72% in the last year.

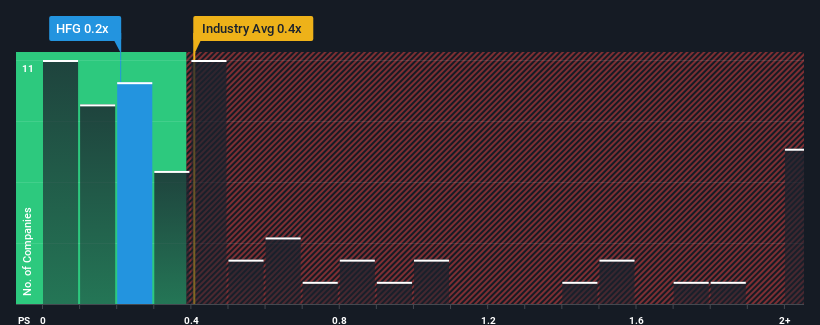

In spite of the firm bounce in price, there still wouldn't be many who think HelloFresh's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in Germany's Consumer Retailing industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for HelloFresh

How HelloFresh Has Been Performing

HelloFresh hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think HelloFresh's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

HelloFresh's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.8%. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 0.03% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 6.9% per year, which is noticeably more attractive.

In light of this, it's curious that HelloFresh's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From HelloFresh's P/S?

HelloFresh appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at the analysts forecasts of HelloFresh's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with HelloFresh, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HelloFresh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HFG

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives