With tonies SE (FRA:TNIE) It Looks Like You'll Get What You Pay For

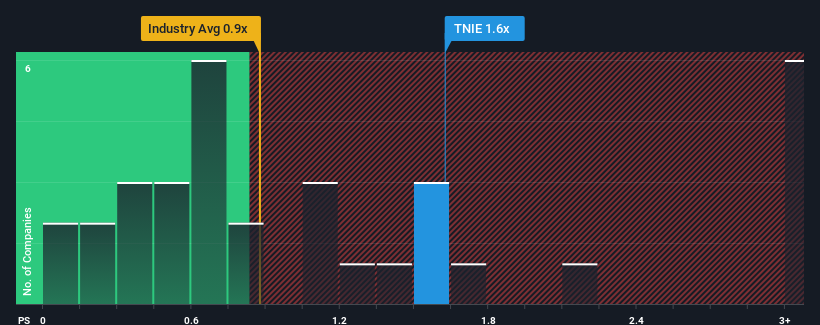

When close to half the companies in the Leisure industry in Germany have price-to-sales ratios (or "P/S") below 0.9x, you may consider tonies SE (FRA:TNIE) as a stock to potentially avoid with its 1.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for tonies

How Has tonies Performed Recently?

Recent times have been advantageous for tonies as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on tonies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, tonies would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. The strong recent performance means it was also able to grow revenue by 168% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 31% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader industry.

In light of this, it's understandable that tonies' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From tonies' P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into tonies shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for tonies with six simple checks.

If these risks are making you reconsider your opinion on tonies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:TNIE

tonies

Through its subsidiaries, develops, produces, and distributes audio systems in Germany, the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives