UNITEDLABELS Aktiengesellschaft (ETR:ULC) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

The UNITEDLABELS Aktiengesellschaft (ETR:ULC) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

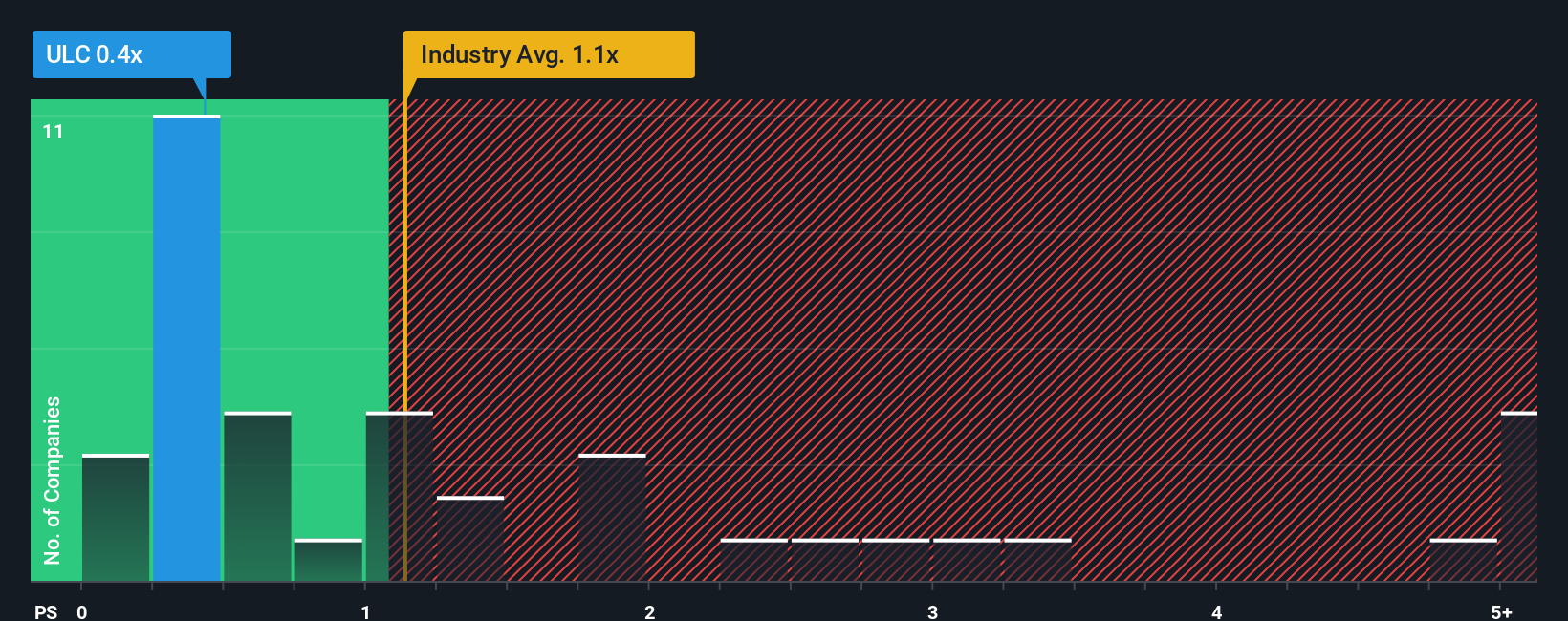

After such a large drop in price, it would be understandable if you think UNITEDLABELS is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Germany's Leisure industry have P/S ratios above 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for UNITEDLABELS

What Does UNITEDLABELS' Recent Performance Look Like?

UNITEDLABELS hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on UNITEDLABELS will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For UNITEDLABELS?

There's an inherent assumption that a company should underperform the industry for P/S ratios like UNITEDLABELS' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 10%. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 25% each year over the next three years. With the industry only predicted to deliver 8.0% per annum, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that UNITEDLABELS' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From UNITEDLABELS' P/S?

The southerly movements of UNITEDLABELS' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems UNITEDLABELS currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware UNITEDLABELS is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of UNITEDLABELS' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ULC

UNITEDLABELS

Provides branded products for media and entertainment industry in Germany and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives