Is There Now an Opportunity in PUMA After This Week’s 8.9% Stock Surge?

Reviewed by Bailey Pemberton

- Ever wondered if PUMA is a hidden value play or just another stock feeling the pressure this year? Let’s dive right into what’s making headlines and what the numbers say.

- PUMA’s stock surged 8.9% this week, but that comes after a steep 22.2% drop in the last month and a significant 61.6% decline year-to-date, signaling big swings in market sentiment.

- Much of the recent volatility follows sector-wide shifts after major competitor announcements. Investor focus has shifted from immediate setbacks to the potential for long-term brand rejuvenation and global retail expansion. Headlines have highlighted management changes and new marketing partnerships, both of which seem designed to reassure shareholders that the company is actively adapting to these rapidly changing conditions.

- On the valuation front, PUMA scores a 5 out of 6 on our valuation checklist, showing strength across most key metrics. We’ll break down the traditional ways analysts judge value, but stick around to see the deeper approach we use to uncover the real story behind PUMA’s price.

Find out why PUMA's -60.6% return over the last year is lagging behind its peers.

Approach 1: PUMA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. The approach aims to determine the “intrinsic value” of the stock, independent of current market sentiment, by considering how much cash PUMA can generate over time.

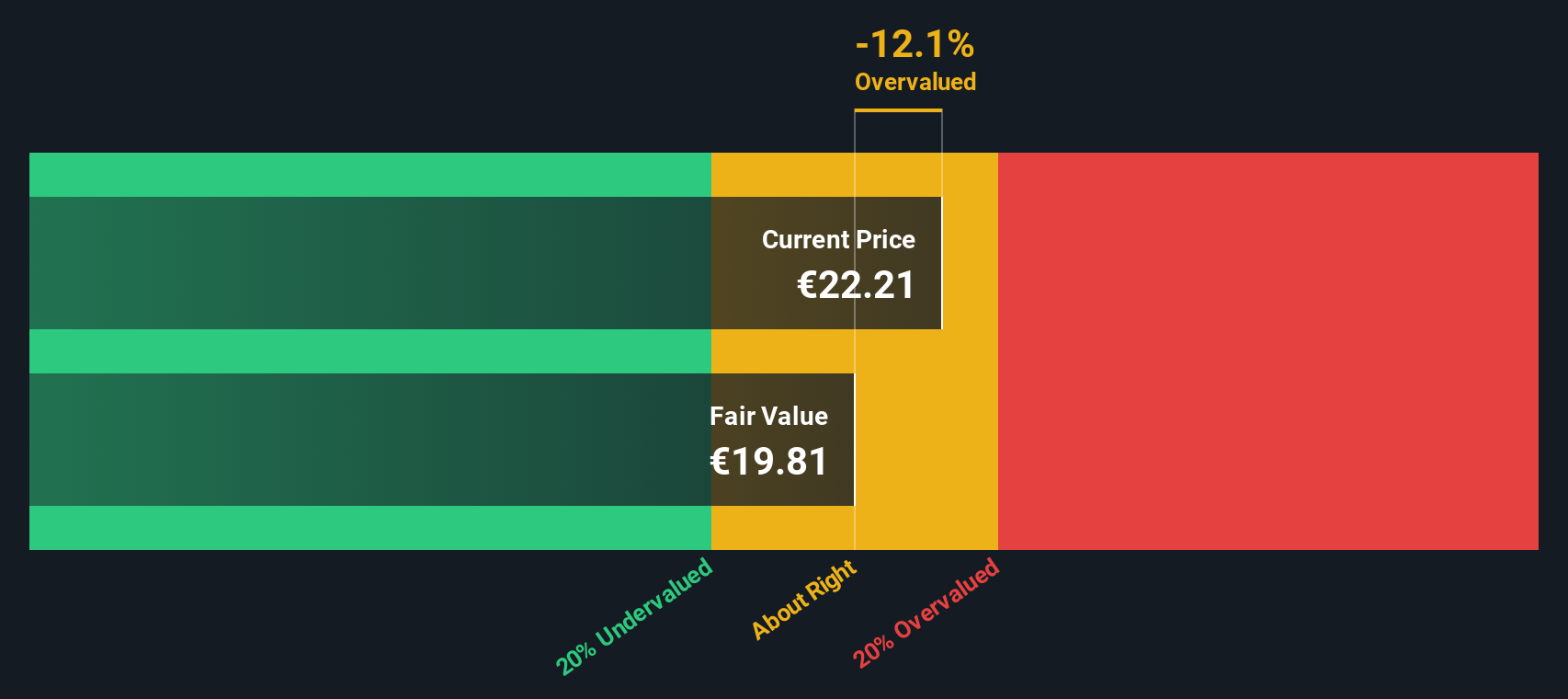

Currently, PUMA’s latest twelve months Free Cash Flow (FCF) stands at -€13.4 Million, indicating recent business challenges. However, analyst and model forecasts see a turnaround and project FCF to reach €249 Million by 2029. While analysts provide estimates up to 2029, Simply Wall St extends this projection to build a 10-year outlook, showing expected ongoing growth in annual free cash flow.

According to the two-stage Free Cash Flow to Equity model, PUMA’s estimated intrinsic value per share is €21.81. With the DCF model implying the stock is trading at a 22.0% discount, it suggests the shares are undervalued relative to their underlying business fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PUMA is undervalued by 22.0%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: PUMA Price vs Sales

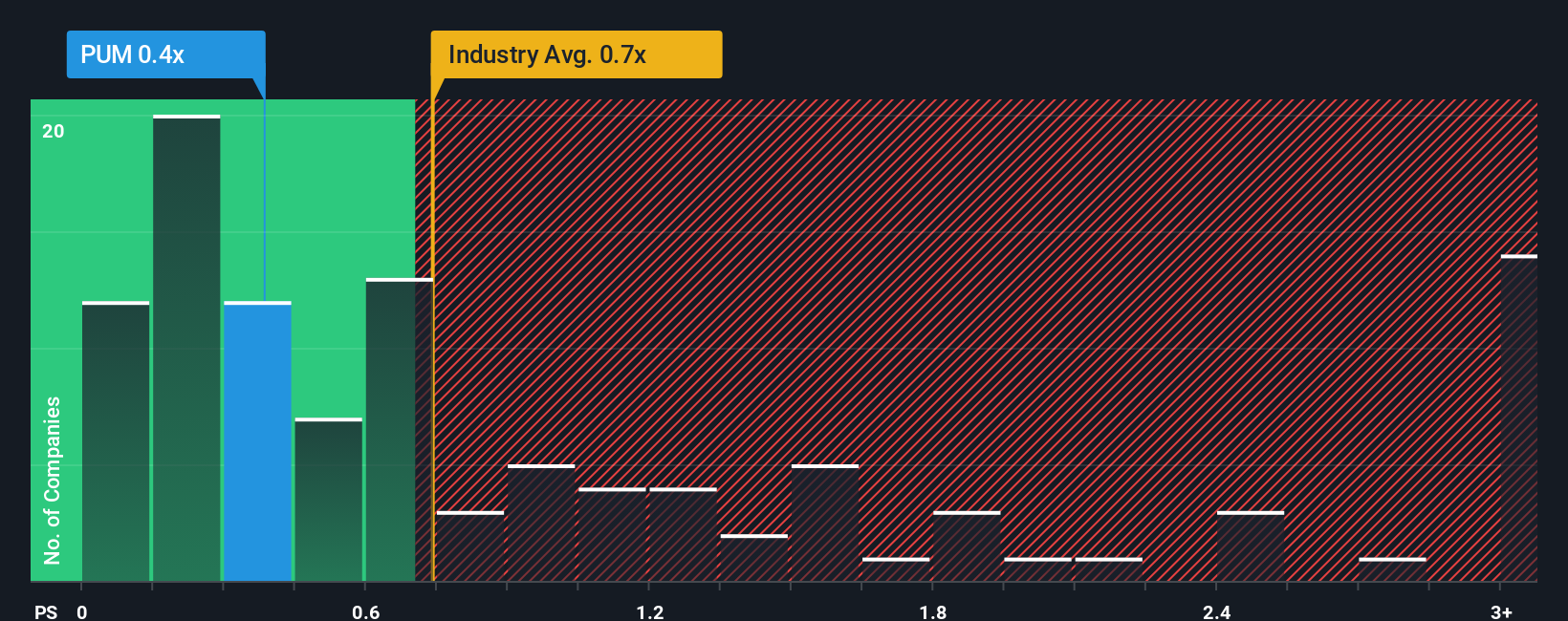

For companies like PUMA, which are currently experiencing losses or break-even results, the Price-to-Sales (P/S) multiple is often the preferred valuation metric. This is because P/S allows investors to value the company based on its revenue, which remains meaningful even in periods where earnings are negative or volatile.

When using sales multiples, factors like future growth expectations and risks come into play. A higher expected growth rate or lower risk profile usually justifies a higher sales multiple. In contrast, stagnant growth or elevated risks result in a lower “fair” level.

At the moment, PUMA trades at a P/S ratio of 0.30x. This is significantly below both the Luxury industry average of 0.83x and the peer group average of 1.08x. This indicates the stock is noticeably discounted relative to headline benchmarks.

To improve upon simple industry or peer comparisons, Simply Wall St’s proprietary Fair Ratio adjusts for the company’s unique growth prospects, margins, market cap, industry category, and risk factors. This Fair Ratio gives a more tailored benchmark and, in PUMA’s case, is calculated to be 0.65x.

Comparing PUMA’s actual P/S multiple of 0.30x to the Fair Ratio of 0.65x, the stock appears undervalued on this basis. This suggests investors may be underestimating its sales potential or are pricing in outsized risks.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PUMA Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your perspective or story about PUMA, connecting the company’s future prospects to your own assumptions about its fair value, as well as expectations around revenue, earnings, and profit margins. With Narratives, you link what’s happening behind the scenes at the company to your financial forecast and ultimately to what you believe is a reasonable price for the stock.

Narratives are easy to create and update right within the Simply Wall St Community page, making powerful analysis more accessible, whether you’re a seasoned investor or new to the market. Millions of investors use these tools as a flexible way to decide when to buy or sell by comparing their own Fair Value to the current share price.

Best of all, Narratives keep pace with the news, dynamically updating forecasts, valuations, and discussions whenever fresh information like earnings or company announcements break. For example, some PUMA Narratives see a swift recovery and strong growth, while others remain cautious, setting significantly lower estimates for the months ahead.

Do you think there's more to the story for PUMA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PUM

PUMA

Engages in the development and sale of sports and sports lifestyle products in Germany, rest of Europe, the United States, North America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success