Is adidas (XTRA:ADS) Using Experiential Branding To Deepen Its Long-Term Sports Lifestyle Moat?

Reviewed by Sasha Jovanovic

- Earlier this month, Adidas Terrex ran a creative campaign that included opening a cozy yurt in Kazakhstan as an experiential marketing hub for the brand.

- The yurt activation highlights adidas’s push into immersive, outdoors-focused storytelling that reinforces its sports lifestyle positioning and attracts social media attention.

- We’ll now explore how this Kazakhstan yurt experience, as an example of experiential branding, could influence adidas’s broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

adidas Investment Narrative Recap

To own adidas, you generally need to believe in its ability to convert global sports and lifestyle demand into profitable, brand‑led growth. The Terrex yurt in Kazakhstan is an inventive branding moment, but it is unlikely to materially change the near term earnings catalyst or the key risks around tariffs, input costs and intense competition in North America.

The most relevant recent announcement here is adidas’s raised 2025 guidance, targeting around 9% currency neutral revenue growth for the core brand and about €2.0 billion in operating profit. Immersive campaigns like Terrex’s yurt sit alongside performance, e commerce and product innovation efforts that will need to work together if adidas is to support that higher earnings ambition against pricing pressure and fashion cycle risk.

Yet beneath the engaging branding stories, investors should be aware of growing cost pressures and fashion cycle risk that could...

Read the full narrative on adidas (it's free!)

adidas’ narrative projects €31.1 billion revenue and €2.5 billion earnings by 2028.

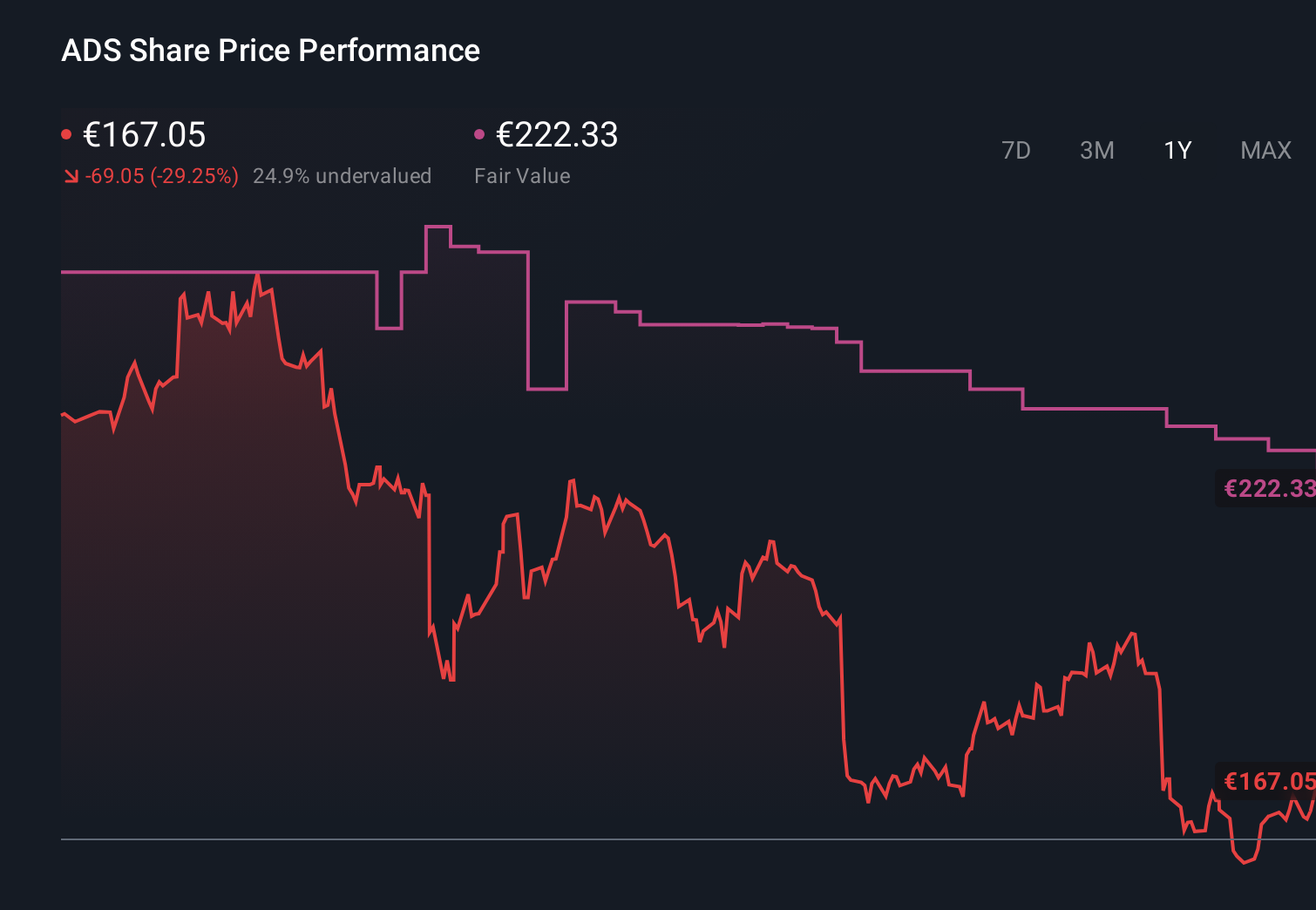

Uncover how adidas' forecasts yield a €222.33 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently estimate adidas’s fair value between €194.37 and €277.40, highlighting a wide band of personal forecasts. Against this, rising U.S. import tariffs and limited pricing power could become a real test of how those differing views play out in the company’s future profitability and resilience.

Explore 9 other fair value estimates on adidas - why the stock might be worth as much as 68% more than the current price!

Build Your Own adidas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your adidas research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free adidas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate adidas' overall financial health at a glance.

No Opportunity In adidas?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets a range of athletic and sports lifestyle products in Europe, Greater China, Japan, South Korea, Latin America, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion