- Germany

- /

- Commercial Services

- /

- XTRA:WAH

Wolftank-Adisa Holding AG (ETR:WAH) Soars 26% But It's A Story Of Risk Vs Reward

Wolftank-Adisa Holding AG (ETR:WAH) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.6% in the last twelve months.

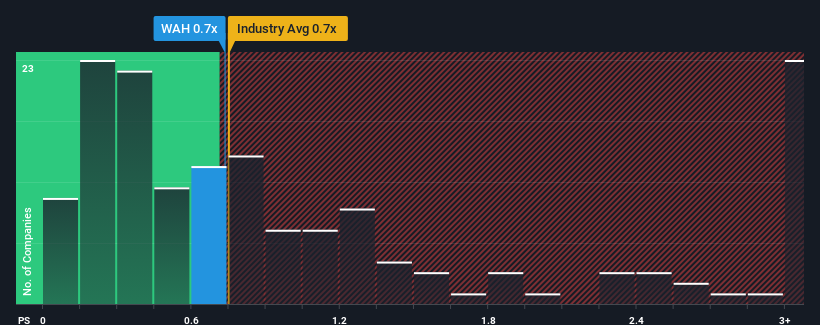

Although its price has surged higher, you could still be forgiven for feeling indifferent about Wolftank-Adisa Holding's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Germany is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Wolftank-Adisa Holding

What Does Wolftank-Adisa Holding's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Wolftank-Adisa Holding has been doing quite well of late. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Wolftank-Adisa Holding will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Wolftank-Adisa Holding's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. The latest three year period has also seen an excellent 151% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 21% per year as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.9% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Wolftank-Adisa Holding's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Wolftank-Adisa Holding's P/S?

Wolftank-Adisa Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Wolftank-Adisa Holding's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Wolftank-Adisa Holding (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wolftank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WAH

Wolftank Group

Provides environmental remediation and refueling solutions for renewable energies worldwide.

Reasonable growth potential and fair value.

Market Insights

Community Narratives