- Germany

- /

- Commercial Services

- /

- XTRA:WAH

A Piece Of The Puzzle Missing From Wolftank-Adisa Holding AG's (ETR:WAH) 25% Share Price Climb

Wolftank-Adisa Holding AG (ETR:WAH) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.4% over the last year.

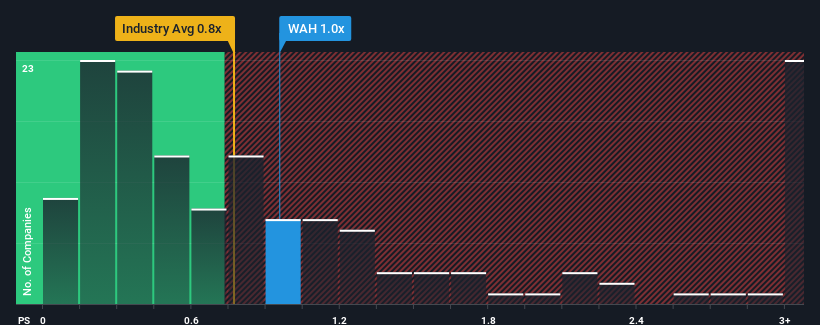

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Wolftank-Adisa Holding's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Germany is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Wolftank-Adisa Holding

What Does Wolftank-Adisa Holding's P/S Mean For Shareholders?

Recent times have been advantageous for Wolftank-Adisa Holding as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wolftank-Adisa Holding.Is There Some Revenue Growth Forecasted For Wolftank-Adisa Holding?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Wolftank-Adisa Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Pleasingly, revenue has also lifted 66% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 32% each year over the next three years. With the industry only predicted to deliver 5.2% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Wolftank-Adisa Holding's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Wolftank-Adisa Holding's P/S

Wolftank-Adisa Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Wolftank-Adisa Holding's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Wolftank-Adisa Holding that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wolftank Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WAH

Wolftank Group

Provides environmental remediation and refueling solutions for renewable energies worldwide.

Good value with reasonable growth potential.

Market Insights

Community Narratives