- Germany

- /

- Commercial Services

- /

- XTRA:TGT

What 11880 Solutions AG's (ETR:TGT) 26% Share Price Gain Is Not Telling You

11880 Solutions AG (ETR:TGT) shareholders have had their patience rewarded with a 26% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.4% over the last year.

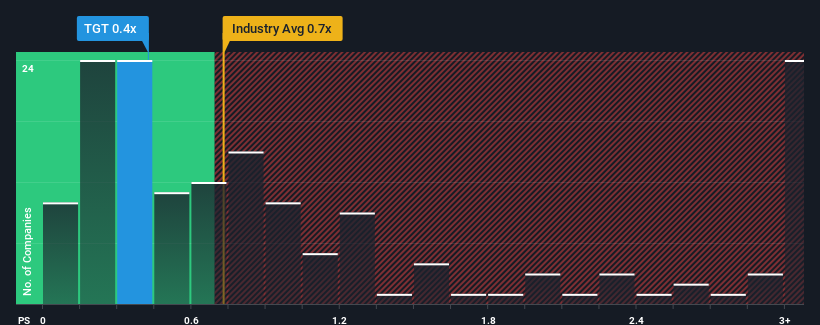

Even after such a large jump in price, there still wouldn't be many who think 11880 Solutions' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Germany's Commercial Services industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for 11880 Solutions

How Has 11880 Solutions Performed Recently?

For example, consider that 11880 Solutions' financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for 11880 Solutions, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is 11880 Solutions' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like 11880 Solutions' to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. Regardless, revenue has managed to lift by a handy 6.6% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 8.8% shows it's noticeably less attractive.

With this in mind, we find it intriguing that 11880 Solutions' P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From 11880 Solutions' P/S?

11880 Solutions' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that 11880 Solutions' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Having said that, be aware 11880 Solutions is showing 4 warning signs in our investment analysis, and 2 of those are significant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TGT

11880 Solutions

Offers telephone directory assistance services to private and business customers in Germany.

Mediocre balance sheet low.

Market Insights

Community Narratives