- Germany

- /

- Commercial Services

- /

- XTRA:GBF

Investors Still Waiting For A Pull Back In Bilfinger SE (ETR:GBF)

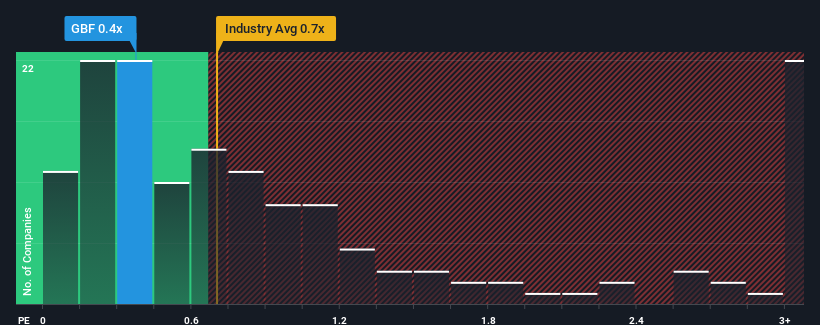

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Commercial Services industry in Germany, you could be forgiven for feeling indifferent about Bilfinger SE's (ETR:GBF) P/S ratio of 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Bilfinger

What Does Bilfinger's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Bilfinger has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Bilfinger will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Bilfinger?

Bilfinger's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 4.0% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 30% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 5.8% per annum as estimated by the four analysts watching the company. With the industry predicted to deliver 5.6% growth per annum, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Bilfinger's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Bilfinger's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Bilfinger's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Commercial Services industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It is also worth noting that we have found 1 warning sign for Bilfinger that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bilfinger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:GBF

Bilfinger

Provides industrial services to customers in the process industry primarily in Europe, North America, and the Middle East.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives