Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that HMS Bergbau AG (FRA:HMU) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for HMS Bergbau

What Is HMS Bergbau's Debt?

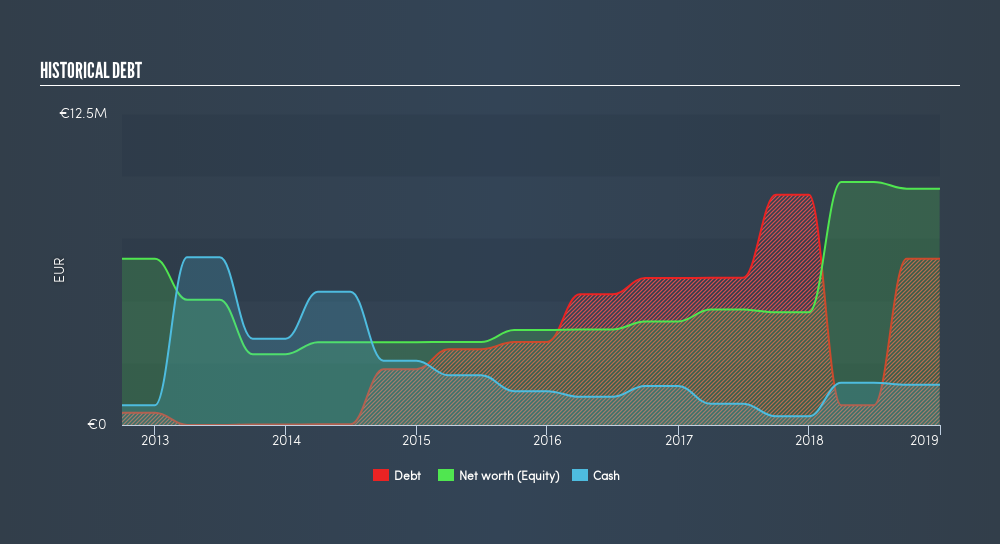

As you can see below, HMS Bergbau had €6.68m of debt at December 2018, down from €9.25m a year prior. On the flip side, it has €1.61m in cash leading to net debt of about €5.07m.

How Strong Is HMS Bergbau's Balance Sheet?

We can see from the most recent balance sheet that HMS Bergbau had liabilities of €42.4m falling due within a year, and liabilities of €7.22m due beyond that. Offsetting these obligations, it had cash of €1.61m as well as receivables valued at €39.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €8.72m.

Since publicly traded HMS Bergbau shares are worth a total of €76.1m, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Since HMS Bergbau does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Strangely HMS Bergbau has a sky high EBITDA ratio of 16.5, implying high debt, but a strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! Shareholders should be aware that HMS Bergbau's EBIT was down 76% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. When analysing debt levels, the balance sheet is the obvious place to start. But it is HMS Bergbau's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, HMS Bergbau burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both HMS Bergbau's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Overall, we think it's fair to say that HMS Bergbau has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. Over time, share prices tend to follow earnings per share, so if you're interested in HMS Bergbau, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:HMU

HMS Bergbau

Engages in trading and distributing coal and other energy raw materials to energy producers, cement manufacturers, and industrial consumers worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives