Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that SBF AG (FRA:CY1K) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for SBF

What Is SBF's Debt?

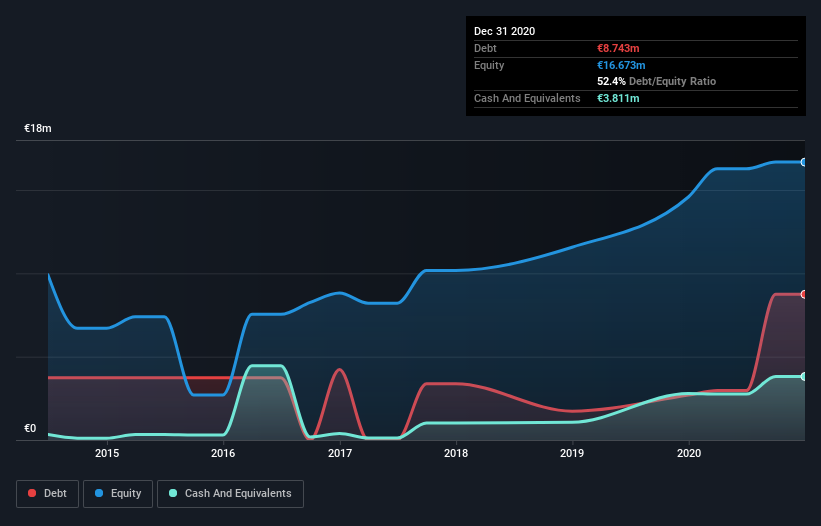

You can click the graphic below for the historical numbers, but it shows that as of December 2020 SBF had €8.67m of debt, an increase on €2.70m, over one year. However, it also had €3.81m in cash, and so its net debt is €4.86m.

A Look At SBF's Liabilities

According to the last reported balance sheet, SBF had liabilities of €5.95m due within 12 months, and liabilities of €7.43m due beyond 12 months. Offsetting these obligations, it had cash of €3.81m as well as receivables valued at €2.06m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €7.51m.

Given SBF has a market capitalization of €66.7m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

SBF has a low net debt to EBITDA ratio of only 1.5. And its EBIT easily covers its interest expense, being 18.5 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. It is just as well that SBF's load is not too heavy, because its EBIT was down 28% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if SBF can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, SBF actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Neither SBF's ability to grow its EBIT nor its conversion of EBIT to free cash flow gave us confidence in its ability to take on more debt. But its interest cover tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that SBF is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for SBF you should be aware of, and 2 of them shouldn't be ignored.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DB:CY1K

SBF

Through its subsidiary, SBF Spezialleuchten GmbH, engages in the development, manufacture, and distribution of ceiling and lighting systems for indoor and outdoor rail vehicles.

Good value with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success