Insider-Owned European Growth Companies To Watch In October 2025

Reviewed by Simply Wall St

As European markets continue to show resilience with the pan-European STOXX Europe 600 Index rising by 1.68%, and major indices like Germany’s DAX and the UK’s FTSE 100 seeing considerable gains, investor confidence is bolstered by strong business activity and consumer confidence. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate management's commitment to long-term success, making them noteworthy considerations for those watching market trends closely.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.4% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Here we highlight a subset of our preferred stocks from the screener.

Plejd (DB:3CA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that develops smart lighting control products and services, operating in Sweden, Norway, Finland, the Netherlands, Germany, and internationally with a market cap of €9.80 billion.

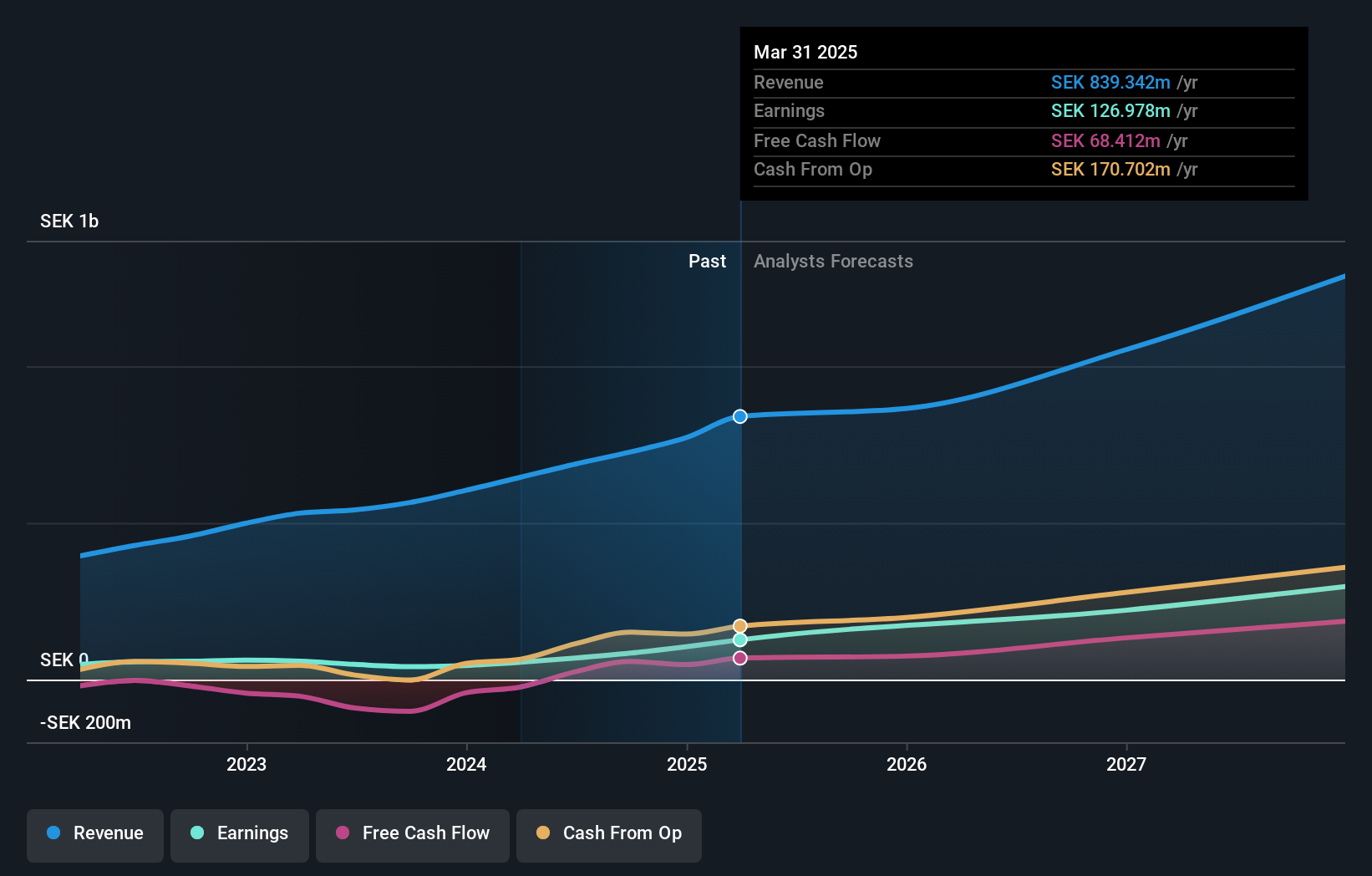

Operations: The company's revenue primarily comes from its Electronic Security Devices segment, which generated SEK 978.99 million.

Insider Ownership: 39.1%

Revenue Growth Forecast: 20.7% p.a.

Plejd AB demonstrates significant growth potential, with its earnings forecasted to increase by 31.9% annually, outpacing the German market's expected growth. Recent financial results show robust performance, with Q3 revenue rising to SEK 248.97 million from SEK 179.58 million a year ago and net income increasing to SEK 35.24 million from SEK 20.32 million. However, substantial insider selling in recent months may warrant caution despite the company's strong growth trajectory and high insider ownership levels.

- Take a closer look at Plejd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Plejd's share price might be on the expensive side.

EnergyVision (ENXTBR:ENRGY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EnergyVision NV is a Belgian company offering solar energy and mobility-as-a-service solutions to corporate and residential clients, with a market cap of €627.93 million.

Operations: EnergyVision NV generates revenue from its EPC Activity (€75.84 million), Asset-Based Energy (€16.25 million), Asset-Based Mobility (€5.07 million), and Non-Asset-Based Energy (€23.49 million) segments, serving both business and individual customers in Belgium.

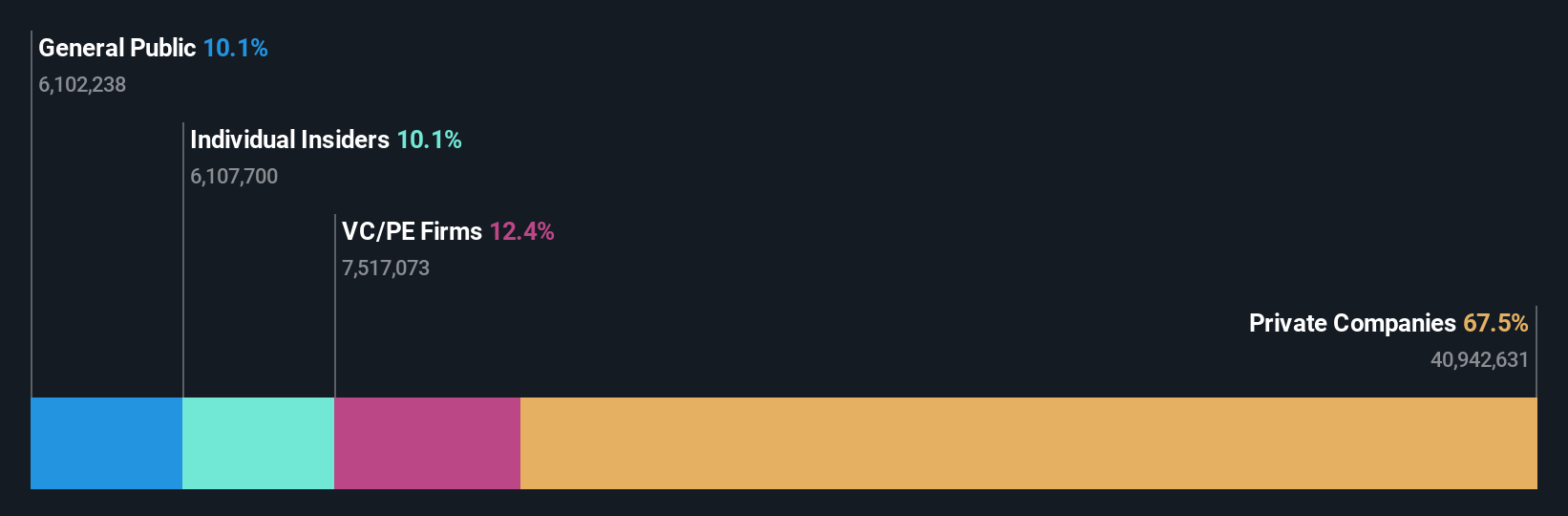

Insider Ownership: 10.1%

Revenue Growth Forecast: 20.5% p.a.

EnergyVision is poised for robust growth, with revenue expected to increase by 20.5% annually, surpassing the Belgian market's 8.4% growth rate. Earnings are forecasted to grow significantly at 40.7% per year, although the company's high debt level may pose a risk. Analysts agree on a potential stock price rise of 30.4%. Despite limited recent insider trading activity, EnergyVision's substantial insider ownership aligns with its strong growth prospects in Europe’s energy sector.

- Get an in-depth perspective on EnergyVision's performance by reading our analyst estimates report here.

- Our valuation report here indicates EnergyVision may be overvalued.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €472.72 million.

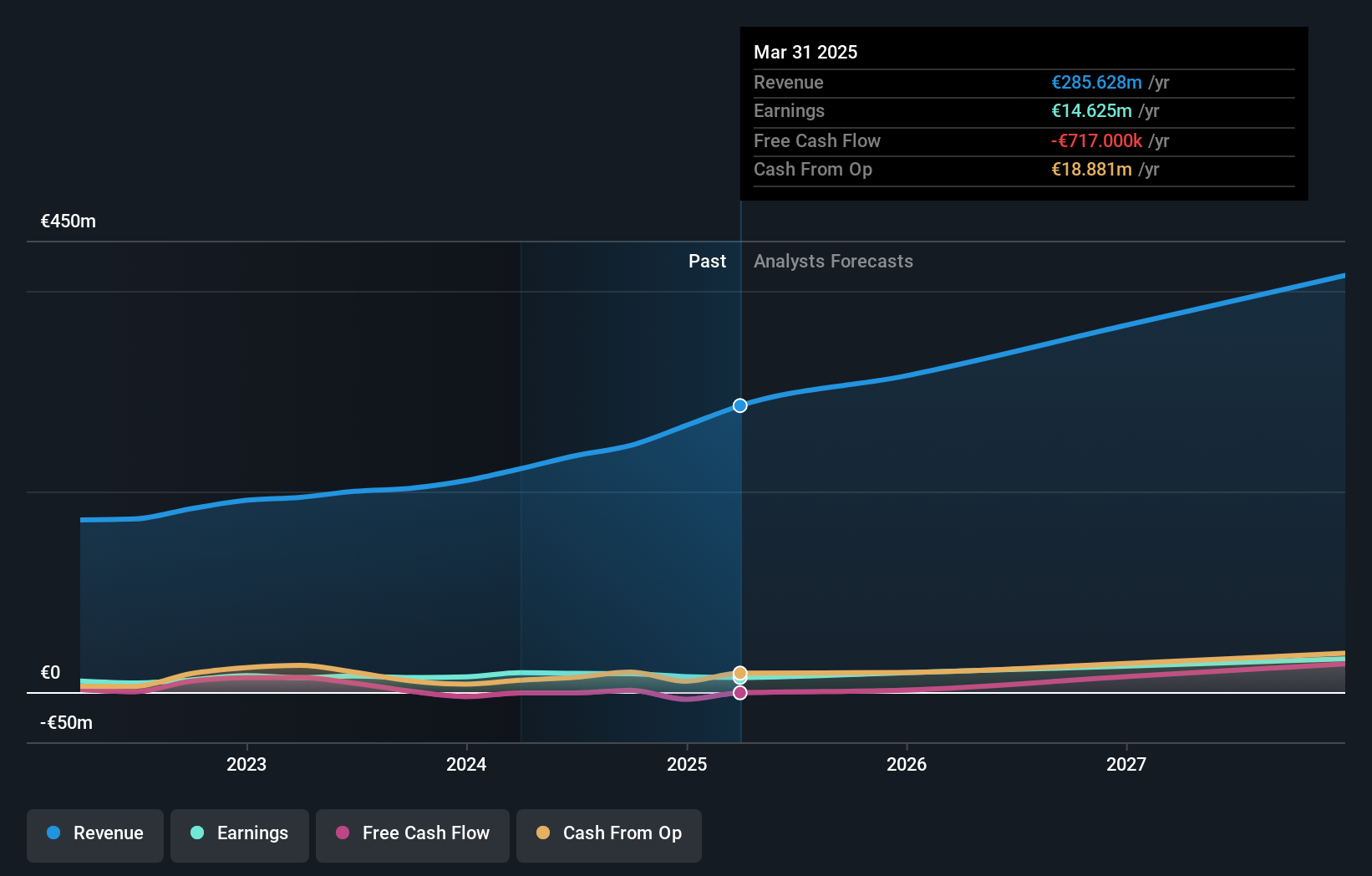

Operations: The company's revenue segment includes Wireless Communications Equipment, generating €292.95 million.

Insider Ownership: 40%

Revenue Growth Forecast: 11.7% p.a.

init innovation in traffic systems is positioned for growth, with earnings projected to expand significantly at 31.2% annually, outpacing the German market's 16.7%. Despite lower profit margins this year (5%) compared to last year's (7.9%), revenue growth forecasts remain strong at 11.7%, exceeding the market average of 6%. Recent earnings reports show increased sales but slightly decreased net income, highlighting potential challenges amidst its high insider ownership and future profitability expectations.

- Click to explore a detailed breakdown of our findings in init innovation in traffic systems' earnings growth report.

- Our valuation report unveils the possibility init innovation in traffic systems' shares may be trading at a premium.

Taking Advantage

- Get an in-depth perspective on all 189 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Ready To Venture Into Other Investment Styles? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives