Wacker Neuson's (ETR:WAC) Dividend Is Being Reduced To €0.60

Wacker Neuson SE (ETR:WAC) is reducing its dividend from last year's comparable payment to €0.60 on the 28th of May. The dividend yield will be in the average range for the industry at 2.5%.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Wacker Neuson's stock price has increased by 38% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

We've discovered 2 warning signs about Wacker Neuson. View them for free.Wacker Neuson's Projected Earnings Seem Likely To Cover Future Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, Wacker Neuson's dividend made up quite a large proportion of earnings but only 17% of free cash flows. This leaves plenty of cash for reinvestment into the business.

According to analysts, EPS should be several times higher next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 25% which is fairly sustainable.

View our latest analysis for Wacker Neuson

Dividend Volatility

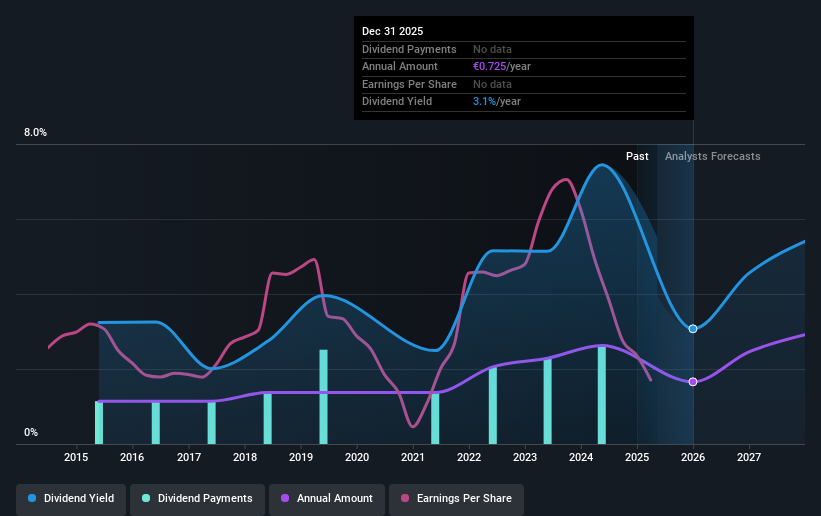

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2015, the dividend has gone from €0.40 total annually to €0.60. This implies that the company grew its distributions at a yearly rate of about 4.1% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Dividend Growth Is Doubtful

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's not great to see that Wacker Neuson's earnings per share has fallen at approximately 7.6% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Wacker Neuson's Dividend

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 2 warning signs for Wacker Neuson that investors should take into consideration. Is Wacker Neuson not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wacker Neuson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WAC

Wacker Neuson

Manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion