Neway Valve Suzhou And Two More Dividend Stocks For Income Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape of cautious Federal Reserve commentary, rate cuts, and political uncertainties, investors are increasingly seeking stability and growth through dividend stocks. With U.S. stocks experiencing broad-based declines and economic indicators showing mixed signals, identifying robust dividend-paying companies like Neway Valve Suzhou becomes crucial for those aiming to enhance income growth in their portfolios amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Neway Valve (Suzhou) (SHSE:603699)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Neway Valve (Suzhou) Co., Ltd. is engaged in the research, development, production, sale, and servicing of industrial valves both in China and internationally, with a market cap of CN¥17.39 billion.

Operations: Neway Valve (Suzhou) Co., Ltd. generates its revenue primarily from the valve industry, amounting to CN¥5.76 billion.

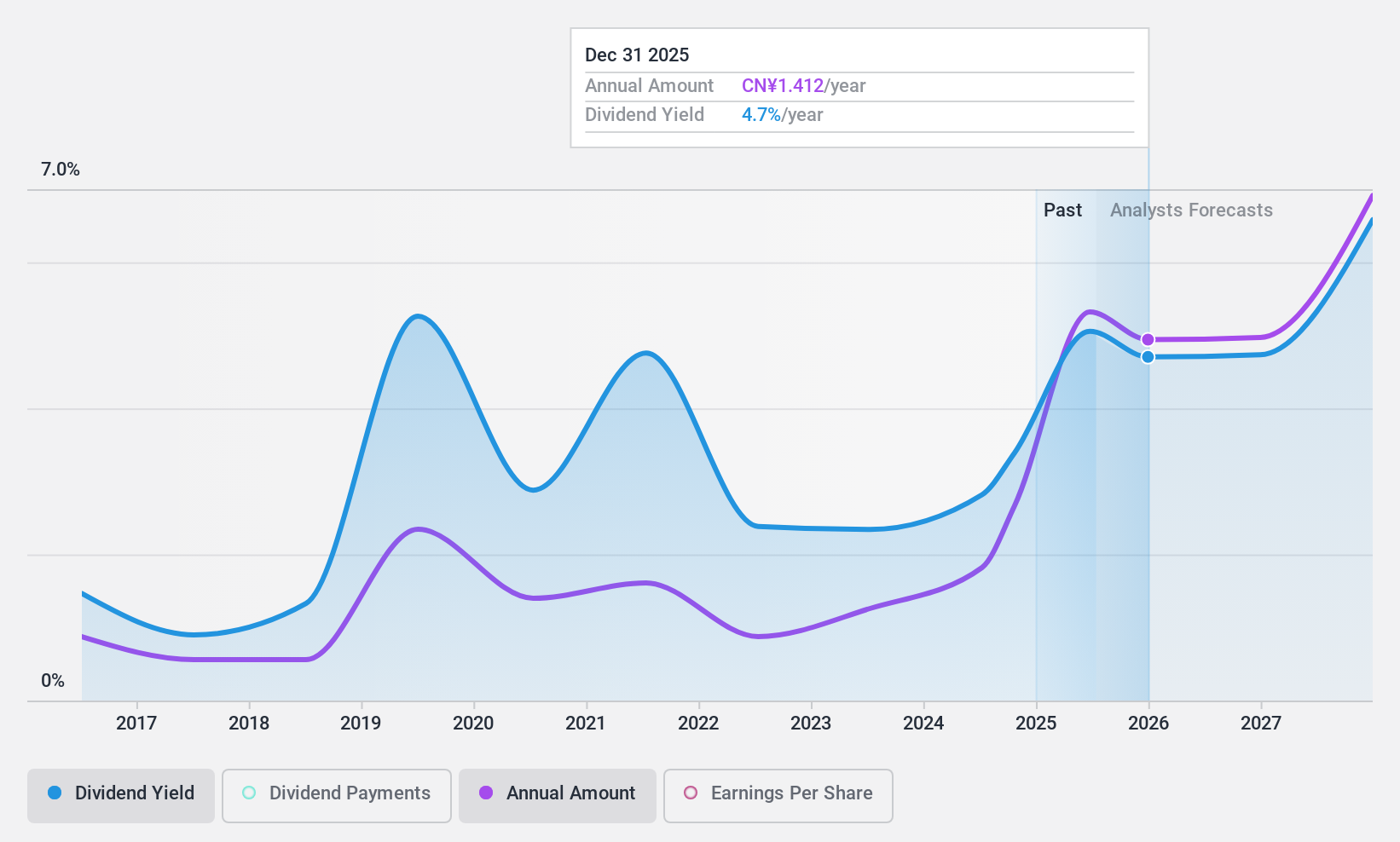

Dividend Yield: 3.3%

Neway Valve (Suzhou) offers a dividend yield of 3.32%, placing it in the top 25% of CN market payers. However, its dividends have been volatile over the past decade, with a high cash payout ratio of 91.2%, indicating coverage issues by free cash flow. Despite this, earnings are covered by a reasonable payout ratio of 71.4%. Recent earnings show growth with net income rising to ¥827.84 million for the first nine months of 2024 from ¥588.42 million last year.

- Get an in-depth perspective on Neway Valve (Suzhou)'s performance by reading our dividend report here.

- According our valuation report, there's an indication that Neway Valve (Suzhou)'s share price might be on the expensive side.

Powertech Technology (TWSE:6239)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Powertech Technology Inc. is engaged in the research, design, development, assembly, manufacturing, packaging, testing, and sales of various integrated circuit products across Taiwan and internationally with a market cap of NT$93.42 billion.

Operations: Powertech Technology Inc. generates revenue primarily from its Semiconductors segment, amounting to NT$75.25 billion.

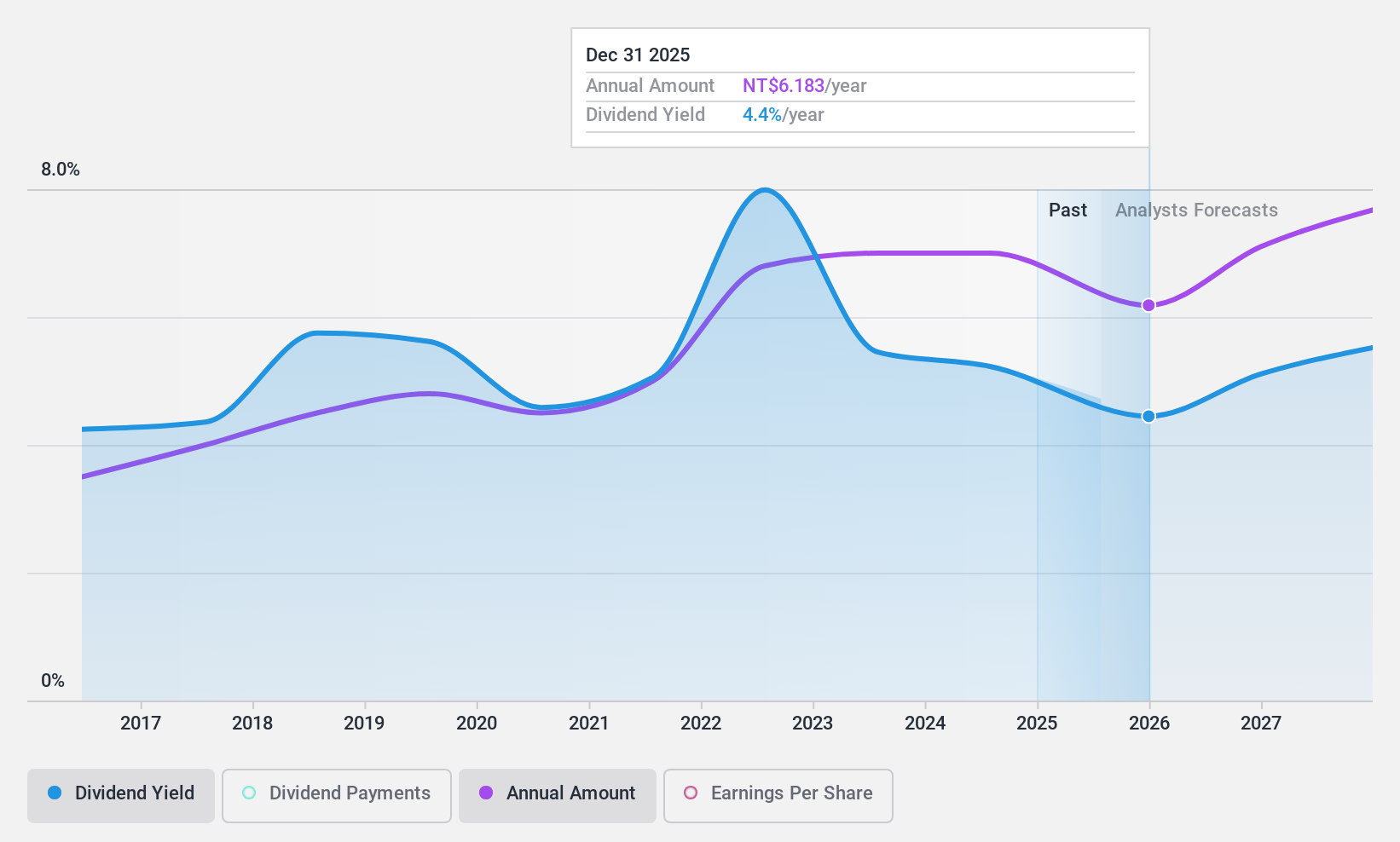

Dividend Yield: 5.6%

Powertech Technology provides a strong dividend yield of 5.6%, ranking in the top 25% of Taiwan's market payers, with stable and growing dividends over the past decade. Its payout ratio of 56.7% ensures dividends are well-covered by earnings and cash flows, evidenced by a cash payout ratio of 43.1%. Recent earnings reveal growth, with net income for nine months reaching TWD 5.27 billion from TWD 4.04 billion last year, supporting dividend sustainability.

- Navigate through the intricacies of Powertech Technology with our comprehensive dividend report here.

- The analysis detailed in our Powertech Technology valuation report hints at an deflated share price compared to its estimated value.

technotrans (XTRA:TTR1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: technotrans SE is a global technology and services company with a market capitalization of €123.30 million.

Operations: technotrans SE generates its revenue from two primary segments: Technology, contributing €177.05 million, and Services, contributing €62.84 million.

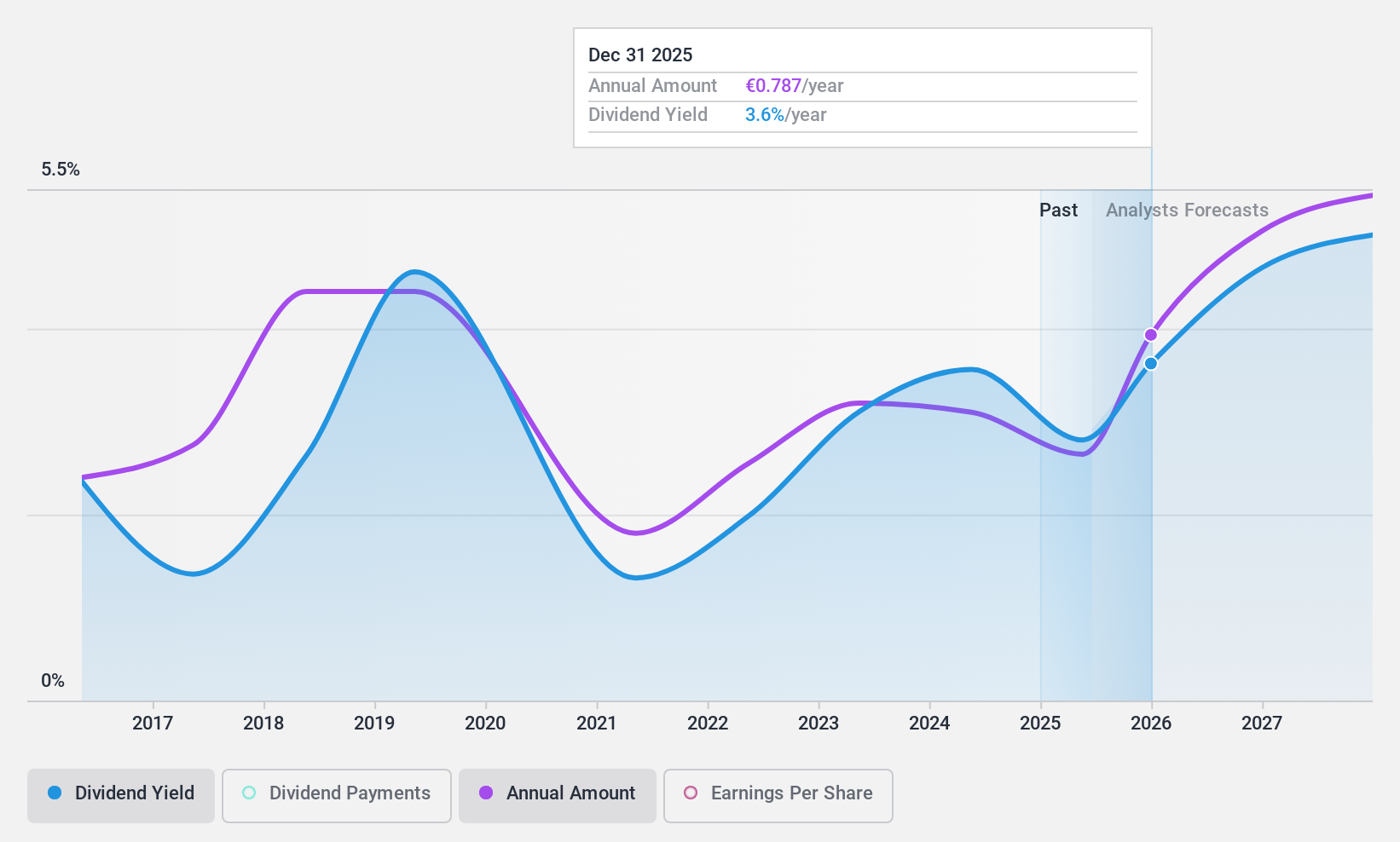

Dividend Yield: 3.5%

Technotrans SE's dividend payments have been volatile and unreliable over the past decade, despite being covered by earnings with a payout ratio of 57.1% and cash flows at 42.9%. The dividend yield is relatively low compared to top payers in Germany. Recent earnings reported a decline in revenue to €175.53 million and net income to €4.55 million for the nine months ending September 2024, potentially impacting future dividend stability.

- Click here to discover the nuances of technotrans with our detailed analytical dividend report.

- According our valuation report, there's an indication that technotrans' share price might be on the cheaper side.

Make It Happen

- Access the full spectrum of 1951 Top Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TTR1

Flawless balance sheet, good value and pays a dividend.