- Germany

- /

- Aerospace & Defense

- /

- XTRA:TKMS

TKMS & Co KGaA (XTRA:TKMS): Evaluating Valuation After MDAX Inclusion and Record Defence Contract Wins

Reviewed by Simply Wall St

TKMS & Co KGaA (XTRA:TKMS) has been drawing fresh investor attention after its spin off from Thyssenkrupp, its rapid MDAX inclusion, a record order backlog and a string of big submarine contracts that have reshaped its growth story.

See our latest analysis for TKMS & Co KGaA.

Despite a cautious 2026 outlook, investors have leaned into the defence demand story, with a 7.79% 1 day share price return and 18.18% 7 day share price return hinting that momentum is building after a softer year to date.

If TKMS has you rethinking defence exposure, it could be worth scanning aerospace and defense stocks to see what other names are riding the same structural spending tailwind.

With TKMS trading only slightly below analyst targets but at a hefty intrinsic discount, investors face a key question: is today’s price a genuine entry point into long term defence growth, or has the market already looked ahead?

Most Popular Narrative Narrative: 37.2% Undervalued

With TKMS shares last closing at €75.40 against a narrative fair value of €120, the spread points to a substantial upside in the rearmament cycle.

However, it is also necessary to bear in mind several limitations of this company: low margins, TKMS wants to reach an 8% margin in 2028, while, for example, the Rheinmetall arms manufacturer already has a 15% margin in 2025. Unlike arms manufacturers, which can produce ammunition relatively flexibly, the production of ships and submarines takes many months. It is a large project, risky and dependent on ongoing payments. Production is also difficult to expand because submarines must be built in docks and not just anywhere.

According to Marek_Trnka, this fair value leans on rising margins, accelerating earnings and a punchy future profit multiple more often reserved for high growth names.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower margin progress, or delays and cost overruns on complex submarine programs, could quickly challenge the current undervalued, high growth narrative.

Find out about the key risks to this TKMS & Co KGaA narrative.

Another View Multiples Versus Peers

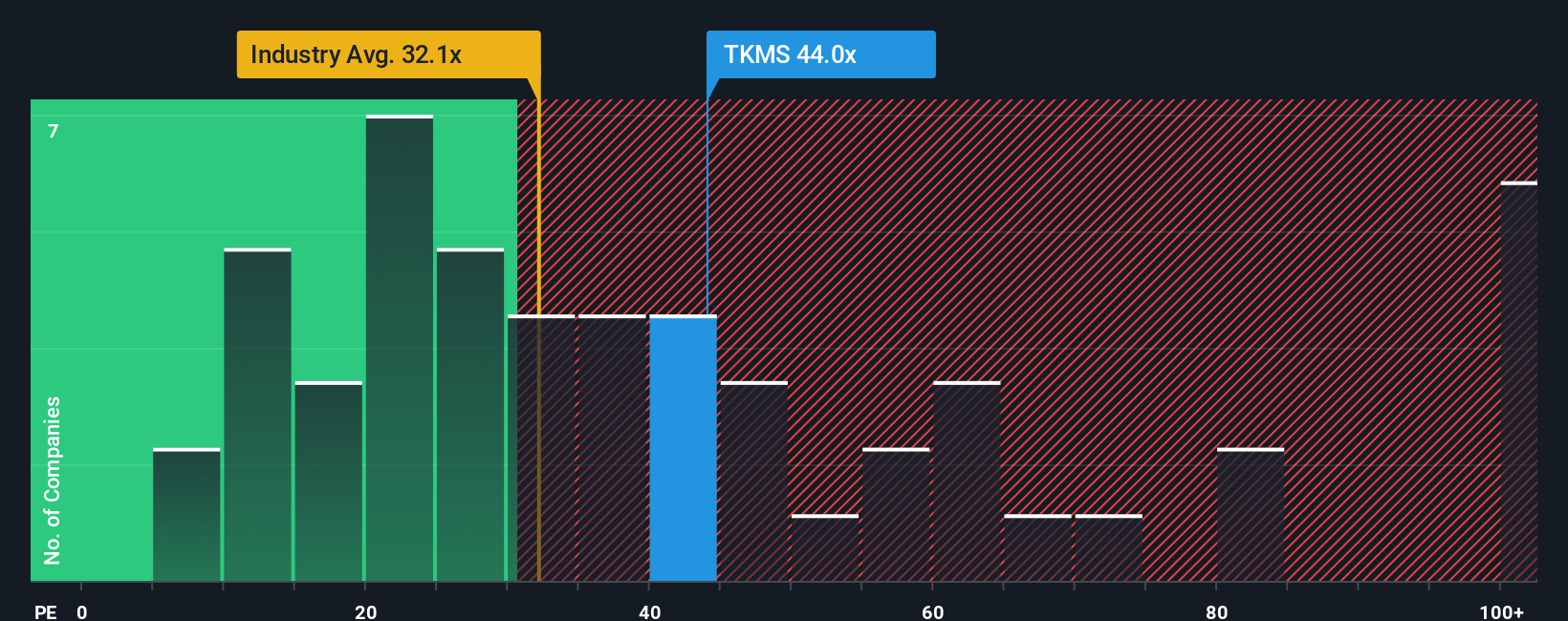

While our fair value work suggests upside, the price tag looks rich on earnings, with TKMS trading at about 49.6 times profits versus roughly 30.9 times for the wider European defence group and 56.5 times for closer peers. That premium gap cuts both ways. Is the story strong enough to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TKMS & Co KGaA Narrative

If you see things differently or want to dig into the numbers yourself, you can easily build a custom view in just minutes. Do it your way.

A great starting point for your TKMS & Co KGaA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at TKMS when there are other compelling opportunities waiting. Use the Simply Wall Street Screener now so you do not miss your next winner.

- Capture potential mispricings by using these 904 undervalued stocks based on cash flows that spotlight companies trading below their intrinsic worth based on cash flow strength.

- Harness structural tailwinds in healthcare innovation with these 30 healthcare AI stocks that pinpoint businesses applying artificial intelligence to improve patient outcomes and efficiency.

- Navigate market volatility through these 80 cryptocurrency and blockchain stocks that focus on companies involved in cryptocurrency adoption and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKMS & Co KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKMS

TKMS & Co KGaA

Provides naval platforms and equipment in Germany, Brazil, Norway, and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026