Why We're Not Concerned About Stabilus SE's (ETR:STM) Share Price

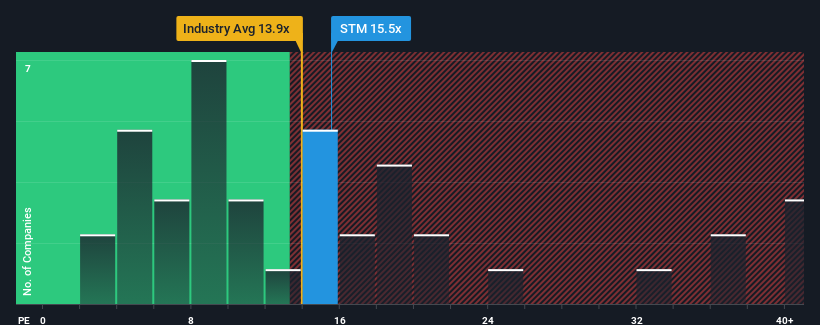

With a median price-to-earnings (or "P/E") ratio of close to 16x in Germany, you could be forgiven for feeling indifferent about Stabilus SE's (ETR:STM) P/E ratio of 15.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Stabilus' negative earnings growth of late has neither been better nor worse than most other companies. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't accelerate downwards if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Stabilus

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Stabilus' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.1%. Still, the latest three year period has seen an excellent 224% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is not materially different.

In light of this, it's understandable that Stabilus' P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Stabilus' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 1 warning sign for Stabilus that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:STM

Stabilus

Manufactures and sells gas springs, dampers, electromechanical damper opening systems, vibration isolation products, and industrial components in Europe, the Middle East, Africa, North and South America, the Asia-Pacific, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives