Positive earnings growth hasn't been enough to get Stabilus (ETR:STM) shareholders a favorable return over the last year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Stabilus S.A. (ETR:STM) share price is down 33% in the last year. That's well below the market decline of 6.0%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 13% in three years. It's down 34% in about a quarter.

The recent uptick of 6.7% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

View our latest analysis for Stabilus

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Stabilus share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

Stabilus' revenue is actually up 14% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

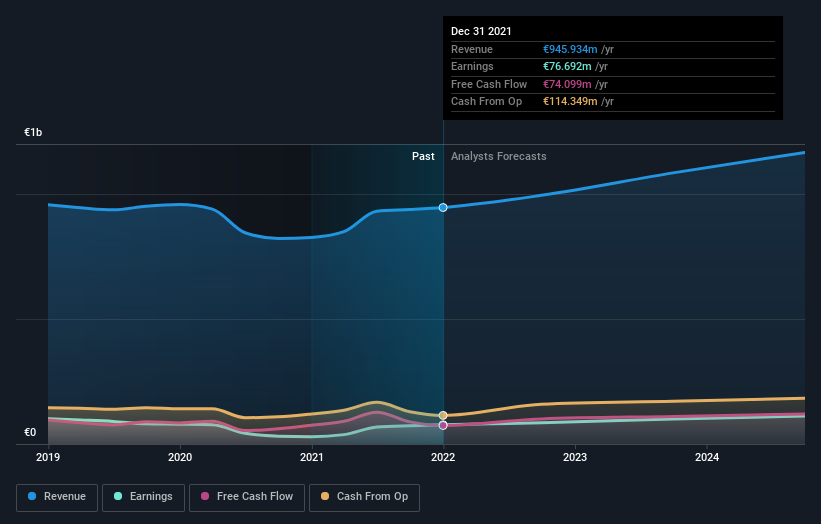

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Stabilus has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Stabilus

A Different Perspective

We regret to report that Stabilus shareholders are down 32% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 6.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Stabilus you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:STM

Stabilus

Manufactures and sells gas springs, dampers, electromechanical damper opening systems, vibration isolation products, and industrial components in Europe, the Middle East, Africa, North and South America, the Asia-Pacific, and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives