Loss-making Koenig & Bauer (ETR:SKB) has seen earnings and shareholder returns follow the same downward trajectory over past -57%

Koenig & Bauer AG (ETR:SKB) shareholders will doubtless be very grateful to see the share price up 44% in the last month. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 57% in that period. Some might say the recent bounce is to be expected after such a bad drop. The rise has some hopeful, but turnarounds are often precarious.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Koenig & Bauer

Because Koenig & Bauer made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Koenig & Bauer grew revenue at 6.8% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 16% for the last three years. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

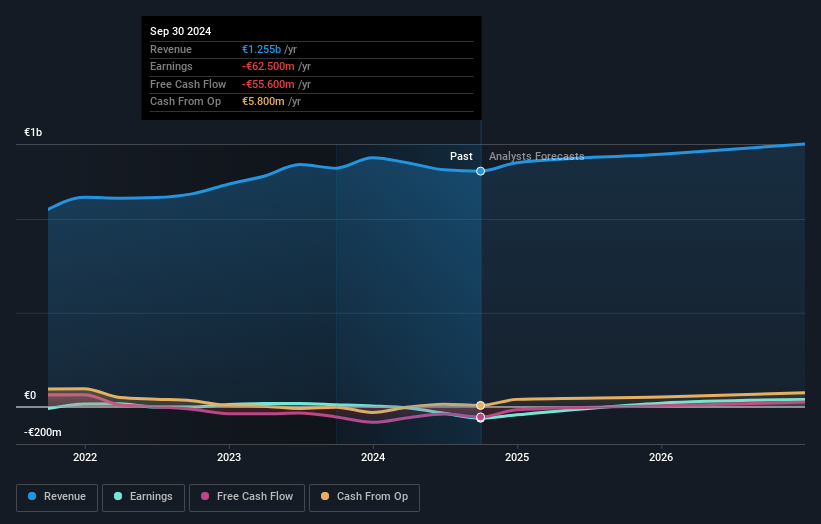

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Koenig & Bauer stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Koenig & Bauer has rewarded shareholders with a total shareholder return of 21% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Koenig & Bauer has 1 warning sign we think you should be aware of.

But note: Koenig & Bauer may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Koenig & Bauer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SKB

Koenig & Bauer

Develops and manufactures printing and postprint systems worldwide.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives