- Germany

- /

- Industrials

- /

- XTRA:SIE

Should Investors Reconsider Siemens Shares After 29.9% Surge and Digitalization Moves?

Reviewed by Bailey Pemberton

- Ever wondered if Siemens is a bargain or if the stock’s rapid rise means buyers should be cautious? You are not alone. Let's dig deeper.

- After climbing 1.5% in the past week, 8.6% over the last month, and an impressive 29.9% year-to-date, Siemens shares are catching more attention than ever before.

- Recent headlines have highlighted Siemens’ strategic investments in digitalization and ambitious sustainability targets. These moves have added momentum to the share price, suggesting renewed optimism around the company’s long-term prospects and global relevance.

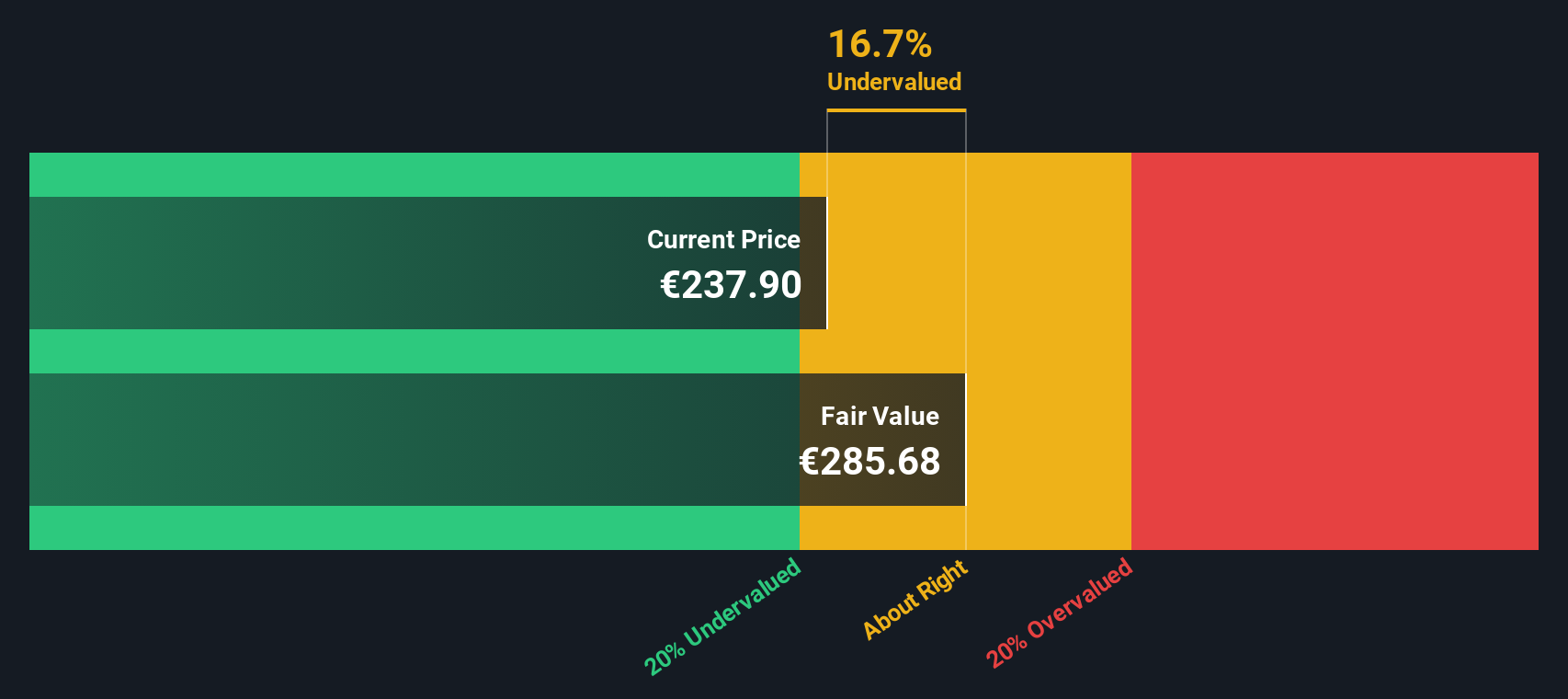

- Based on our framework, Siemens scores 3 out of 6 on undervaluation checks, putting its valuation in a grey zone. Up next, we’ll break down what this means and explore mainstream approaches to valuing the company. Stick around to discover an alternative way to assess Siemens’ true worth at the end.

Approach 1: Siemens Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by forecasting its future cash flows and discounting them back to today’s value. This helps investors determine whether the current share price accurately reflects the company’s intrinsic worth.

For Siemens, the most recent twelve months’ Free Cash Flow stands at €10.58 billion. Based on analyst forecasts and conservative projections by Simply Wall St for the years beyond the next five, Siemens’ Free Cash Flow is expected to reach €11.12 billion in 2030. Over the coming decade, cash flow estimates are projected to gradually increase. Analysts provide consensus figures through 2028, and further years are extrapolated from existing trends.

Applying the DCF method results in an estimated intrinsic value per share of €283.98. Compared to the company’s current market price, this implies Siemens shares are trading at a 13.5% discount, indicating they are undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Siemens is undervalued by 13.5%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Siemens Price vs Earnings

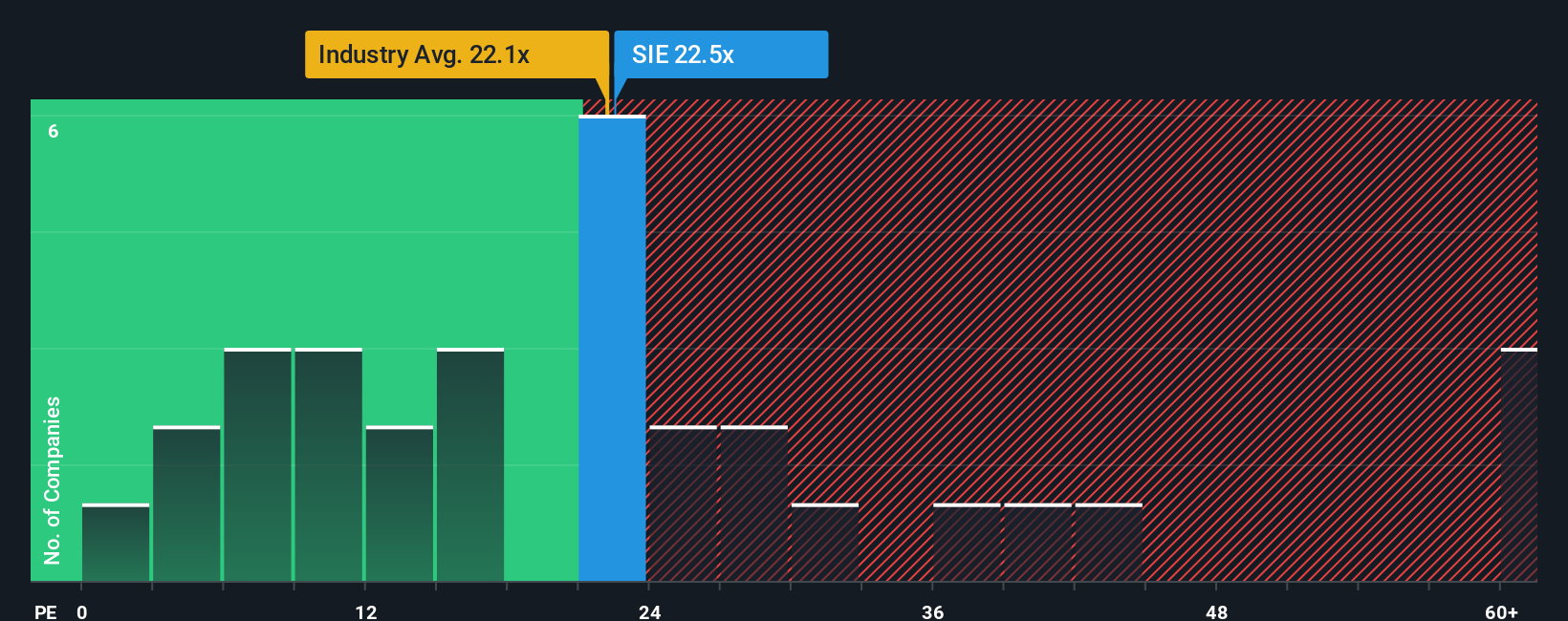

The Price-to-Earnings (PE) ratio is widely used to value established, profitable companies like Siemens, as it directly relates a company’s share price to its per-share earnings. Investors rely on the PE ratio to gauge how much they are paying for current and future profitability.

A "normal" or "fair" PE ratio depends on how quickly a company is expected to grow compared to its risks. Higher growth prospects usually justify a loftier PE, while increased risks can reduce what investors are willing to pay.

As of now, Siemens trades at a PE ratio of 24.2x. For context, the Industrials industry has an average PE of 12.8x, and Siemens’ peer group comes in considerably higher at 56.8x. According to Simply Wall St’s Fair Ratio model, which factors in Siemens’ earnings growth, profit margins, industry, market cap, and key risks, a fair PE ratio for Siemens is calculated at 27.0x.

The Fair Ratio goes deeper than simple peer or sector comparisons. It accounts for qualitative and quantitative factors unique to Siemens, like its growth outlook, risk profile, and profitability, providing a more precise gauge of valuation.

Because Siemens’ actual PE ratio of 24.2x is slightly below the Fair Ratio of 27.0x, the stock appears modestly undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Siemens Narrative

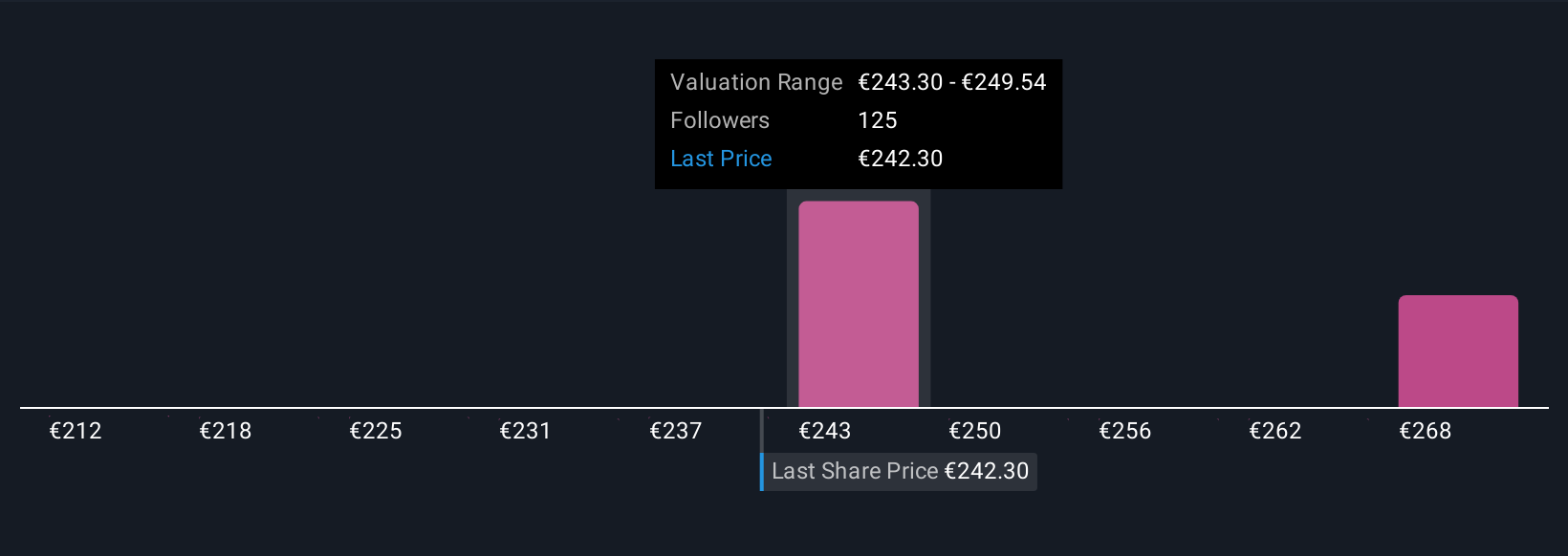

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative gives you the power to define your own story for Siemens by connecting what you believe about its future, including growth, risks, and industry trends, directly to financial forecasts and a fair value estimate, all in one place.

Narratives help cut through the noise by framing your perspective on Siemens and updating your fair value dynamically as news or earnings break. Using Simply Wall St's Community page, millions of investors create, share, and compare Narratives, making the process easy and highly accessible.

With Narratives, you can decide whether Siemens is a buy or sell today by seeing if your fair value is above or below the current share price. You can also see how your view compares to others. For example, on Siemens, current investor Narratives range from a high target price of €300 based on sustained digital growth and margin expansion, to a low of €185 reflecting integration risks and global competition.

Try building your own Narrative to express your outlook, stress-test your assumptions, and make more confident decisions whenever new information arrives.

Do you think there's more to the story for Siemens? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives